In brief: The semiconductor industry can't keep up with demand for advanced chips even as foundries have continued to optimize their output. Now even that's off the table, so companies like TSMC are simply raising prices to make the most out of the current situation.

On Tuesday, Taiwan Economy Minister Wang Mei-Hua sought to reassure the US that chip shortages would ameliorate towards the end of the year as the Taiwanese government has been taking steps to increase the country's output. For a brief moment, industry watchers were actually optimistic about the possibility that supply could finally catch up with demand in the coming months.

However, a new report from Nikkei suggests the industry will have to brace for yet another blow, as TSMC has notified its clients that it will increase contract pricing by up to 20 percent, which is higher than any previous price hike. Taiwanese chipmakers collectively increased contract pricing by 10 percent over the past 12 months.

The good news is the price increases vary from client to client, so not all industries will see the same impact. For some of the notified clients, however, the price hike is immediate and will no doubt result in higher prices for end customers. Unfortunately for tech enthusiasts, this means that processors, GPUs, PC motherboards, phones, and consoles will see little improvement in availability but perhaps a substantial increase in their retail price.

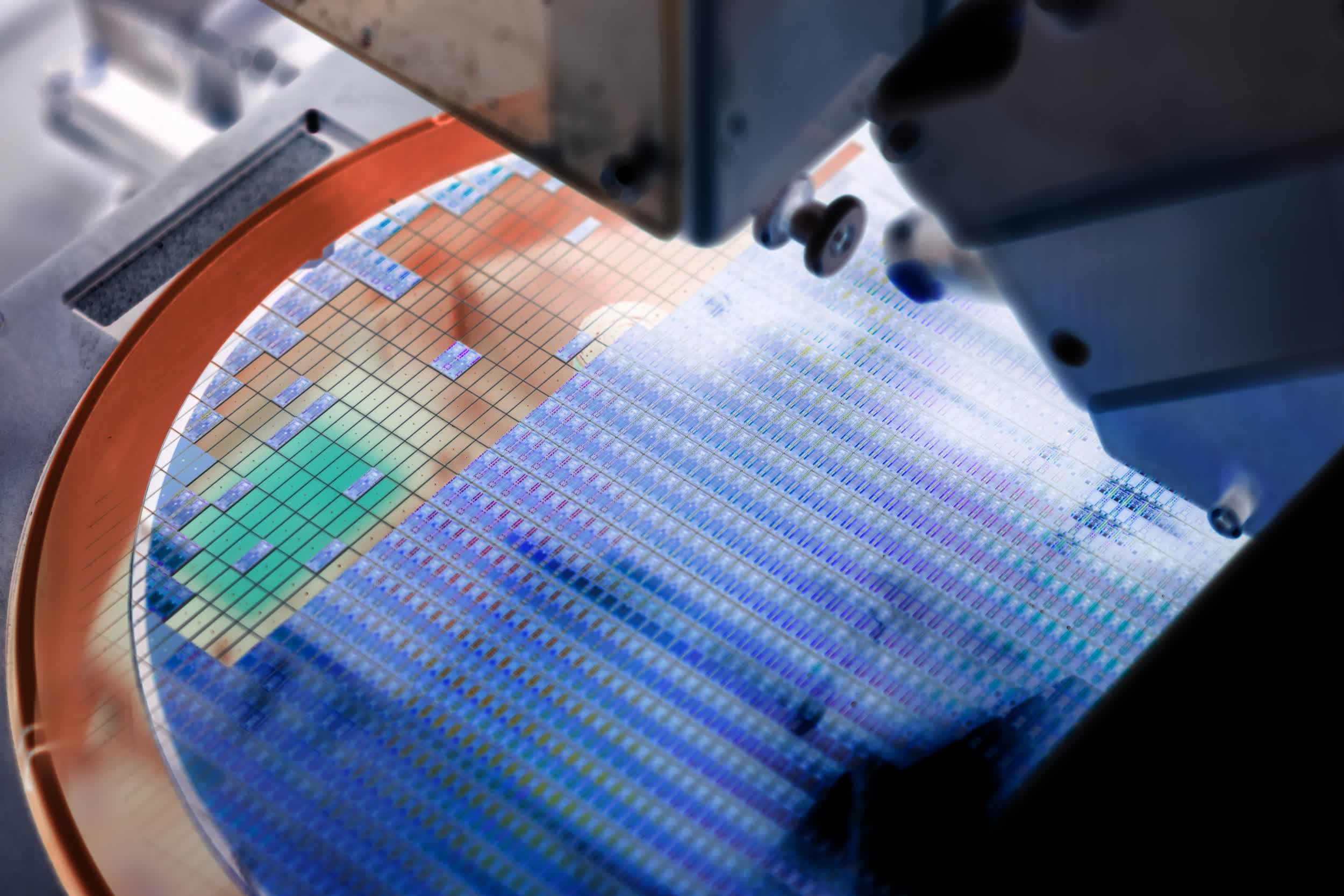

Anything made using TSMC's 7nm and 5nm process nodes will cost up to 10 percent more per wafer, while chips made using 16nm and older process nodes will see higher price hikes.

Recently, other foundries have also increased prices for their clients, and that includes GlobalFoundries, United Microelectronics, Semiconductor Manufacturing International Corp., and Powerchip Semiconductor.

Last month, Samsung announced a similar price hike in order to finance new foundries and expansions on current production facilities. It wouldn't be surprising if there's a similar motivation behind TSMC's price hike, not to mention that improved margins can offset the costs and risks of pushing chip manufacturing equipment to the limit.

Otherwise, TSMC's decision to increase prices for its most advanced process nodes is grounded in more pressing realities, such as unrelenting demand for anything with a chip inside, the higher cost of raw materials, freight shipping costs, and keeping investors happy by making sure the gross margin doesn't fall under the industry standard, which is 50 percent.