The big picture: The global transition to 5G is accelerating, and that's where Qualcomm still dominates. As the company lost some of its grip on the LTE side and Huawei lost the ability to make its own chips, MediaTek was quick to step in and scoop up some of their business. It's not yet clear if this trend will continue past the current chip shortage, but the landscape of application processors, systems-on-a-chip, and baseband modems is certainly changing.

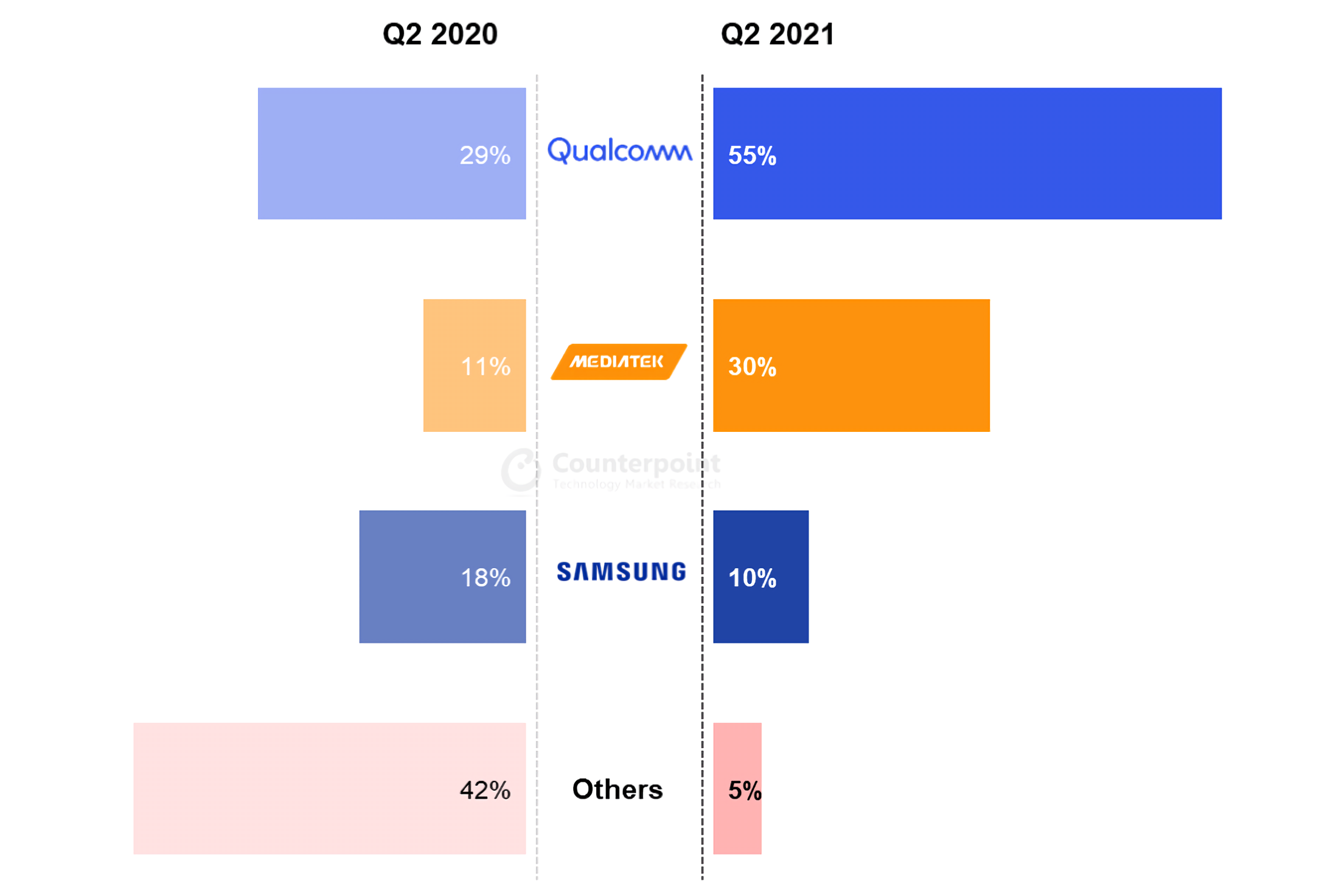

Back in December 2020, MediaTek surpassed Qualcomm in terms of market share for the first time, with over 100 million smartphones sold in Q3 2020 being powered by its Dimensity and Helio chipsets. The latter company is still the king of 5G chipsets for now with a 55 percent share of total volume, but it looks like its dominance is now being challenged more than ever before.

According to new data for Counterpoint Research, MediaTek's share of the global smartphone SoC and baseband modem market has grown to 43 percent in the second quarter of this year, which is a healthy increase from the 35 percent share recorded in the previous quarter. By comparison, Qualcomm had a 29 percent share of the market in Q1, but only a 24 percent share in the second quarter.

A major driver of MediaTek's growth over the three months ending in June was a relentless focus on low-end and mid-range 5G-ready chipsets in addition to aggressive pricing on LTE chipsets. This allowed the Taiwanese company to capture 30 percent of the 5G modem market, while Qualcomm currently leads with a 55 percent share. Both companies are up year-over-year at the expense of Samsung, Huawei, and others – Qualcomm's share grew 90 percent while MediaTek's share almost tripled over the same period.

Qualcomm has been struggling as a result of the ongoing chip shortage, and the company has been hit particularly hard in the high-end segment, where it hasn't been able to mitigate supply chain bottlenecks. Meanwhile, Apple seems to be the only company that has seen little impact, but that situation could change in the coming months. Either way, a big reason why Qualcomm dominates the 5G space is Apple's iPhone 12, but that will go away in 2023 when the Cupertino giant will transition to in-house 5G modems.

Samsung's share of the mobile chipset market slipped this year to just seven percent, but the company recently started selling its Exynos chips to Chinese ODMs as well as Google, so it won't be long before its market share bounces back. Additionally, the Korean giant is preparing an Exynos 2200 chipset with "Voyager" Radeon graphics, increasing the pressure on Qualcomm even further.

MediaTek's strength has traditionally been in the low-end and mid-range segments, but the company has big plans for the high-end arena and is slowly making its way into the lucrative US market. The rumor mill says MediaTek's upcoming Dimensity 2000 chipset will be built on TSMC's 4nm node and will be able to compete with Qualcomm and Samsung's greatest in terms of performance and energy efficiency. If true, we're definitely looking at exciting times ahead.