The big picture: AMD's efforts in the x86 CPU space continue to bear fruit by slowly eroding Intel's dominance in every market category. Intel should be particularly worried about AMD's continued gains in the server space, where companies are slowly warming up to the idea of using the latter company's Epyc processors. Meanwhile, the desktop CPU market is having a bad moment, and Arm chipsets grow in importance in both the desktop and notebook markets.

AMD's GPU efforts have not been enough to pose a significant challenge to rival Nvidia, whose graphics cards dominate the Steam charts and are also among the best sellers on Amazon and Newegg. Things are unlikely to change in the short term despite Team Red's RDNA 2 refresh, as a cautious third player in this market is planning to eat away its appeal in the low-end and mainstream segments.

When it comes to CPUs, AMD keeps humming along as Intel delivered a strong Alder Lake lineup for consumers and even went to great lengths to make its Xeon Scalable processors more appealing when compared to Epyc offerings for the data center. According to the latest market report from Mercury Research, AMD continued to erode Intel's dominance in the x86 CPU space throughout the first quarter of this year.

Mercury president Dean McCarron says that almost all processor market segments experienced a decline during the quarter, with shipments of desktop processors seeing the largest quarterly drop ever --- 30 percent. This is the cumulative effect of a slowdown in demand for PCs, factory lockdowns, and an extended shortage of chips, passive components, and various materials and gases.

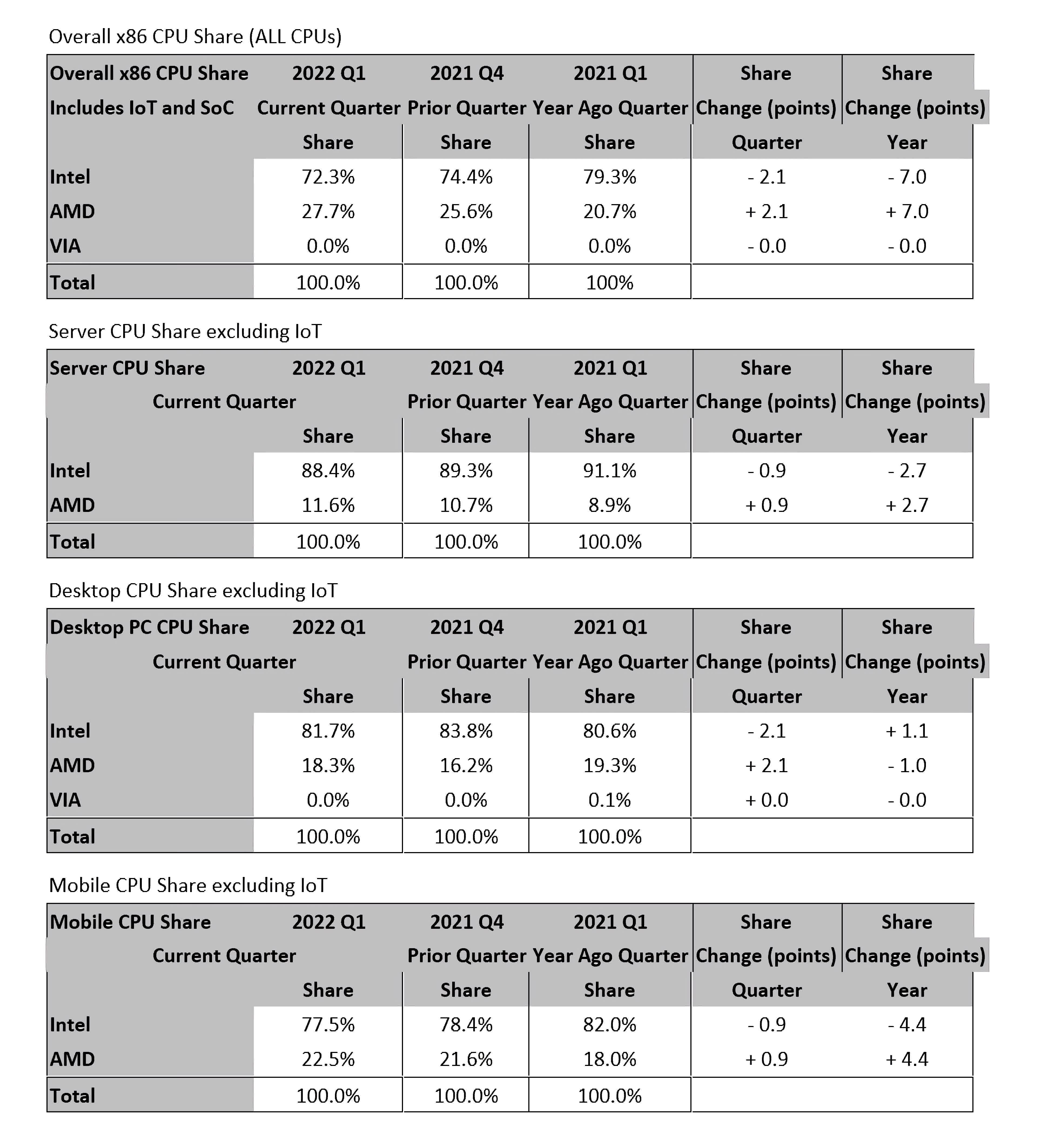

AMD hit a record 27.7 percent share of the overall x86 market, topping the previous milestone of 25.6 percent achieved in the last quarter of 2021. As Via is just a ghost at this point, Intel took the rest, which looks like a quarter-on-quarter decline of 2.1 percentage points. Still, McCarron notes that Intel likely experienced some year-over-year growth in the desktop segment where the Q1 2022 decline was partly caused by excess inventory buildup at OEMs.

Intel did experience some pressure from AMD in the server market, where the latter has seen great success with its Epyc offerings and now holds an 11.6 percent share. And it looks like the battle is set to intensify with the arrival of Zen 4 Epyc later this year. Companies like Netflix are increasingly turning to AMD's server CPUs to solve their hyperscale headaches, but grabbing customers away from a deeply entrenched Intel will be a long-term fight for Team Red.

Mobile CPUs are a different story, and here both Intel and AMD took a hit due to a notebook shipment downturn. However, AMD has been prioritizing the production of Ryzen processors (as well as Epyc CPUs for servers). This translated into a small quarterly growth as well as a healthy 4.4 percent year-over-year increase in market share in the laptop CPU segment for AMD.

The Mercury Research analysts also note that Arm chipset sales have continued to climb over the same period, mostly thanks to Chromebooks and Apple's M1 Macs. The Cupertino giant has migrated most of its hardware lineups to Apple Silicon, and now one in 10 PCs shipped is powered by an Arm chipset. Meanwhile, the average selling price for mobile and desktop processors is now a record $138, a clear sign that the market has matured and consumers are increasingly opting for higher-end products.