What just happened? One reason more people don't own crypto such as Bitcoin is the small number of companies currently accepting it as payment, but that's starting to change. United Wholesale Mortgage (UWM), the second-largest mortgage lender in the United States, has announced that customers will be able to pay their mortgage using BTC later this year.

In the company's second-quarter earnings last week, CEO Mat Ishbia said, "We've evaluated the feasibility, and we're looking forward to being the first mortgage company in America to accept cryptocurrency to satisfy mortgage payments."

UWM doesn't plan to accept just Bitcoin; it is also considering supporting other cryptocurrencies, including Ethereum. "We're going to walk before we run, but at the same time, we are definitely a leader in technology and innovation and we are always trying to be the best and the leader in everything we do," Ishbia told The Detroit Free Press. "That's the plan. Obliviously there's no guarantees — we're still working through some details. But absolutely."

“We are evaluating the feasibility and requirements in order to accept cryptocurrency to satisfy mortgage payments.” – @Mishbia15

— United Wholesale Mortgage (@UWMlending) August 16, 2021

UWM's decision will be a welcome one for crypto proponents. A recent study found that most cryptocurrency holders and non-holders would be interested in using it to make online purchases, especially if doing so offered benefits such as more security, privacy, or discounts. But the second most common reason why people had not bought any crypto was it not being mainstream enough/accepted enough—the first was their lack of knowledge.

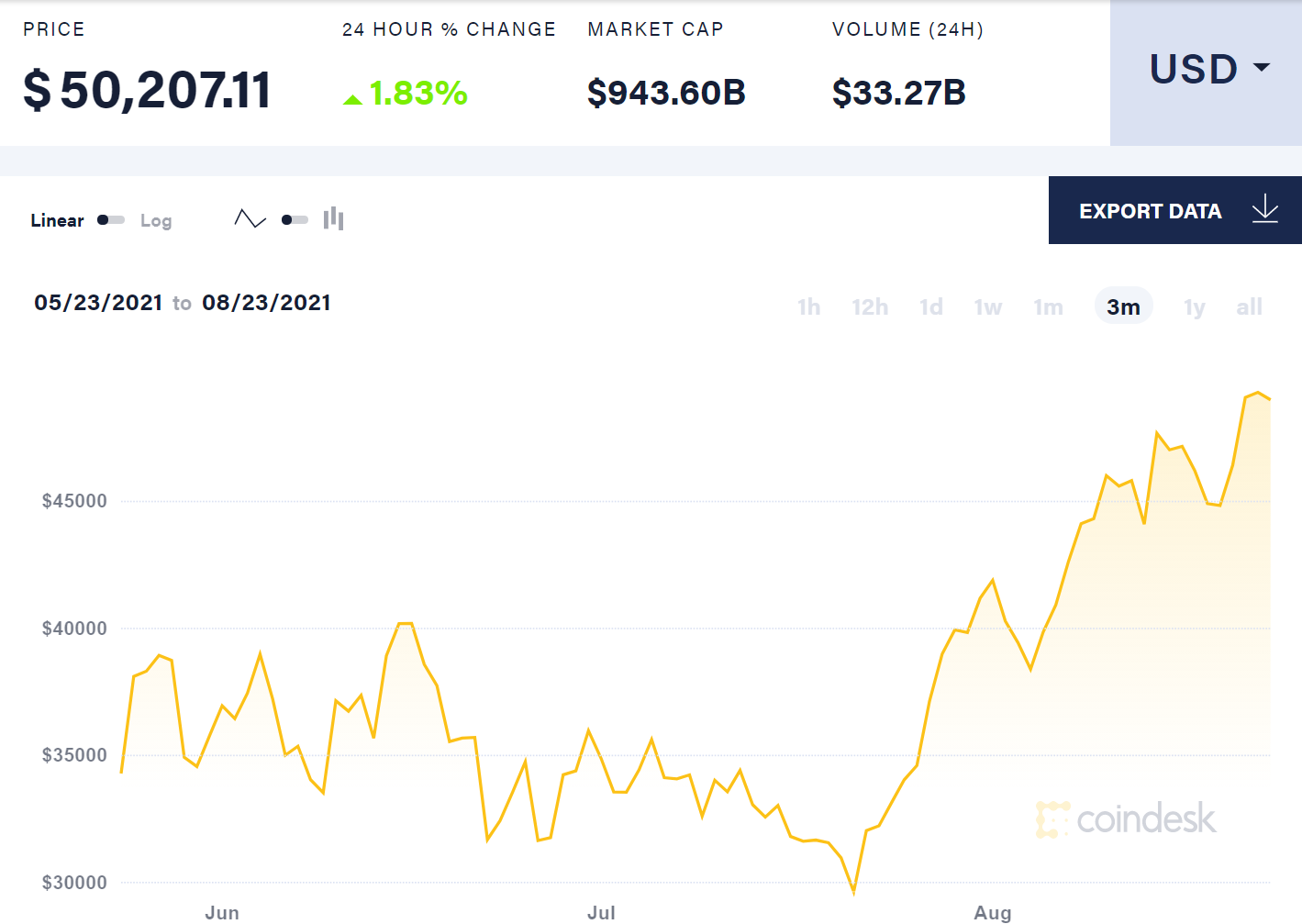

Bitcoin's price over the last 3 months. Courtesy of Coinbase.

July saw Bitcoin slump to its lowest price since the start of the year, but BTC has rebounded recently, helping push the crypto market's total value over $2 trillion. It reached $50,000 a few hours ago, doubtlessly aided by UWM's announcement, marking its highest point since May.

https://www.techspot.com/news/90898-bitcoin-passes-50000-after-second-largest-mortgage-lender.html

:max_bytes(150000):strip_icc()/GettyImages-1256500712-f300d52bba964f0c99551aa3a12d81a3.jpg)