Crowdfunding sites such as Kickstarter and Indiegogo have done wonders for independent game developers, allowing small studios that are passionate about a particular project to get the funding necessary to bring it to life.

Yet as Fortune correctly points out, those backing games through crowdfunding don’t receive any equity. A heartfelt “thank you,” a small discount on the price of the game and perhaps some neat rewards are all that’s offered to backers in exchange for their up-front investment.

A new startup by the name of Fig is aiming to change that.

Fig is a crowdfunding site dedicated entirely to gaming. An advisory board will comb over each submission, permitting only the most promising of campaigns to move forward. This means that the site will only feature a handful of campaigns to back at any given time, allowing each to receive as much exposure as possible. As many that have tried to launch a crowdfunding campaign can attest to, it’s easy to get lost in a sea of hundreds or thousands of concurrent campaigns if you don't have brand recognition or get lucky with media coverage.

The most interesting aspect of Fig is the fact that it combines reward-based crowdfunding with traditional equity investing.

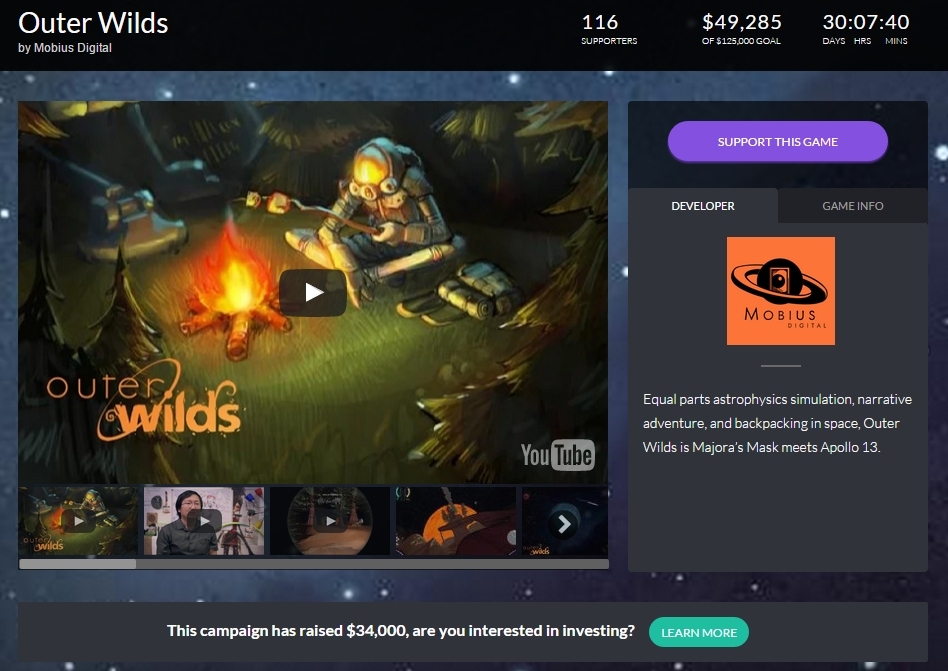

Fig’s first campaign, a space exploration game called Outer Wilds, is open for backing by accredited investors as well as game fans. Fig CEO Justin Bailey, who served as COO at Double Fine Productions, said equity investing will eventually be open to all.

Bailey cites Oculus VR, a company that found loads of success on Kickstarter and was eventually sold to Facebook for $2 billion, as a perfect example of a campaign in which backers didn’t receive any return on their “investment.”

For investors (and gamers that will be able to invest at a later date), Fig offers another benefit that can’t be found elsewhere: the ability to invest in an individual game rather than a studio like Activision or Electronic Arts. Traditional investors may not have the wherewithal to recognize whether or not a particular game will be successful which is where the standard reward-based aspect comes into play. If investors see that fans are really pumped about any given project, they’ll likely be more inclined to put their money on the line.

With Outer Wilds, investors must invest a minimum of $1,000 to get some skin in the game. What’s unclear is how much “stock” is available for investors to purchase and how much each “share” is worth. I could perhaps find this information if I logged in but since I’m not an accredited investor, that doesn't appear to be an option.

It’ll also be interesting to see what impact equity investing has on a budding studio. Giving out too much equity could hamper a studio’s financial ability to create its next project and may force them to rely on crowdfunding the second time around. There’s nothing inherently wrong with that as others have done so but at some point, I imagine a studio would like to have the ability to fund a project without requiring outside assistance.

Outer Wilds has generated more than $49,000 of its $125,000 goal as of writing. That’s not bad for its first day of funding although being the first campaign on the docket has no doubt helped matters. If you’re interested in backing the project, a pledge of just $20 is all that’s required to guarantee a digital copy upon completion.

https://www.techspot.com/news/61800-fig-gaming-only-crowdfunding-site-twist-equity-investing.html