In brief: Despite the well-documented global chip shortages and the graphics card supply issues, 2020 was a boom time for Nvidia and AMD. The firms experienced the largest YoY revenue increases among the top fabless tech companies last year, totaling a combined $25+ billion.

A TrendForce report (via PC Gamer) notes that while the pandemic initially looked set to devastate the IC design industry, the resulting increase in remote working/learning and more people gaming led to unprecedented demand.

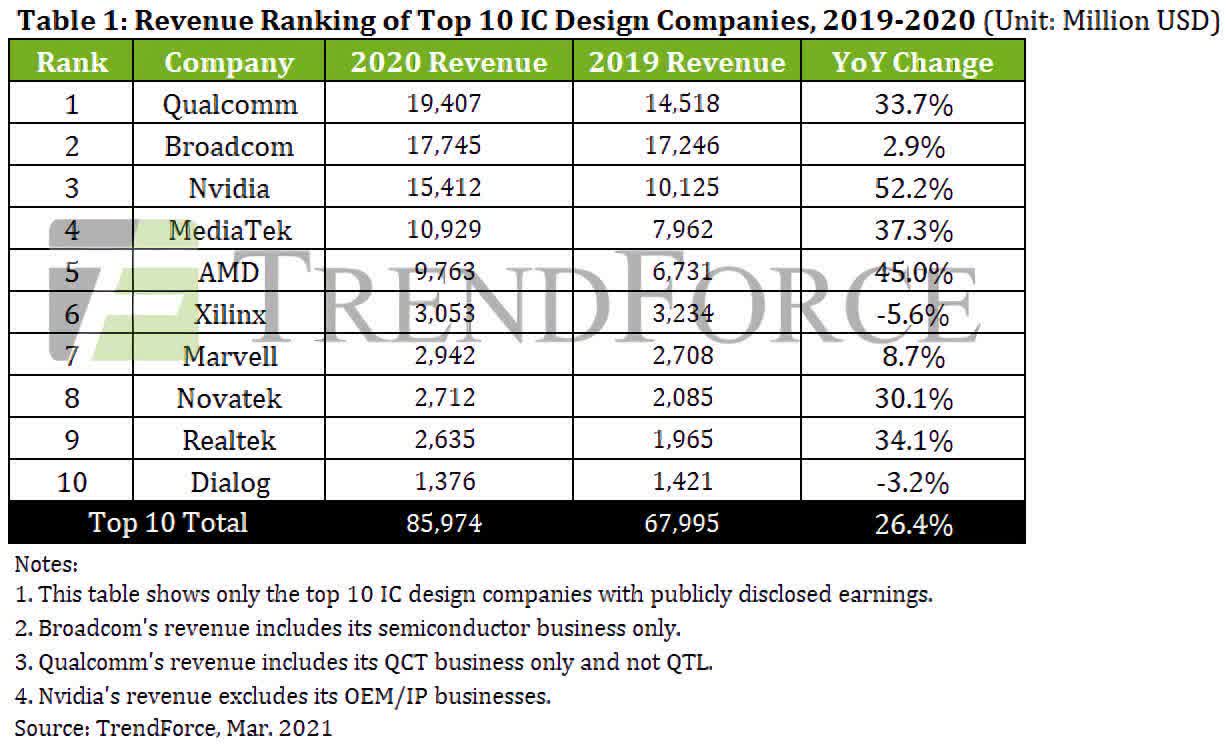

While Qualcomm and Broadcom took the first and second spots, respectively, when it came to the Top 10 IC design companies in 2020, third place Nvidia was the leader in terms of year-on-year growth. Team green generated $15.4 billion last year, a massive 52.2% increase compared to 2019. It’s noted that the company’s acquisition of Mellanox boosted its data center solutions, which generated nearly $6.4 billion in revenue.

It was a good year for fifth place AMD, too. The company’s $9.7 billion of revenue marked a 45% jump over the previous year. Its 7nm CPUs for both consumers and enterprise use continued to erode Intel’s market share. Chipzilla recently said it plans to open up both its current and planned manufacturing capacity to other firms, including AMD and Nvidia, through the launch of Intel Foundry Services.

Broadcom was top dog in 2019, but according to TrendForce, the sudden demand for network devices, along with Apple’s decision to adopt Qualcomm’s baseband processors once again, helped the Snapdragon maker take the number one position with a revenue of $19.4 billion, up 33.7% YoY.

When it comes to the global chip shortage, there are fears the situation could be exacerbated by the ongoing drought in Taiwan, which will soon introduce further water restrictions.

https://www.techspot.com/news/89086-nvidia-amd-generated-over-25-billion-combined-revenue.html