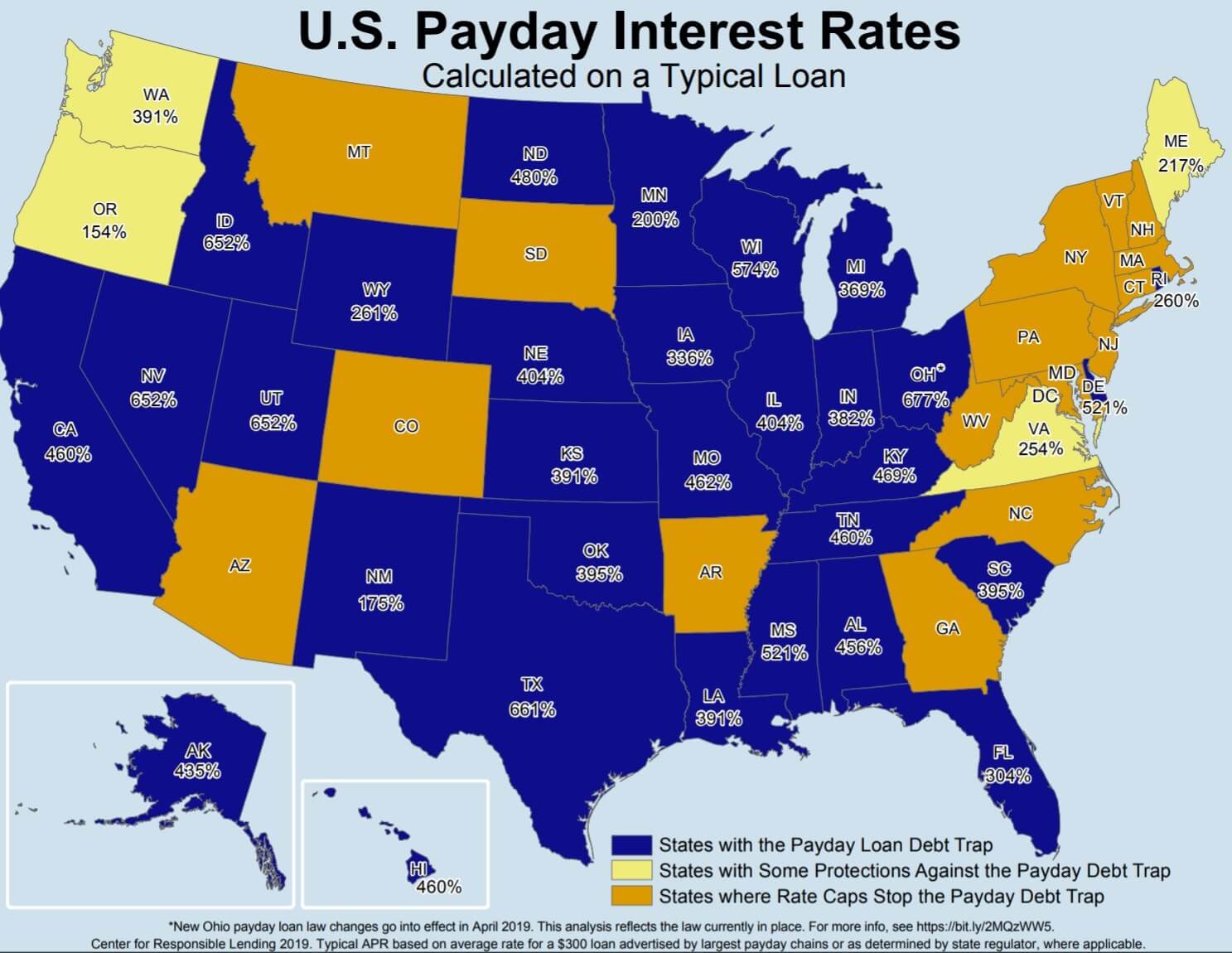

In brief: Need a small, short-term loan quickly? There’s always payday lenders, but their average annual percentage rate is almost 400 percent. A better option could soon come from Cash App, the mobile payment app from Square.

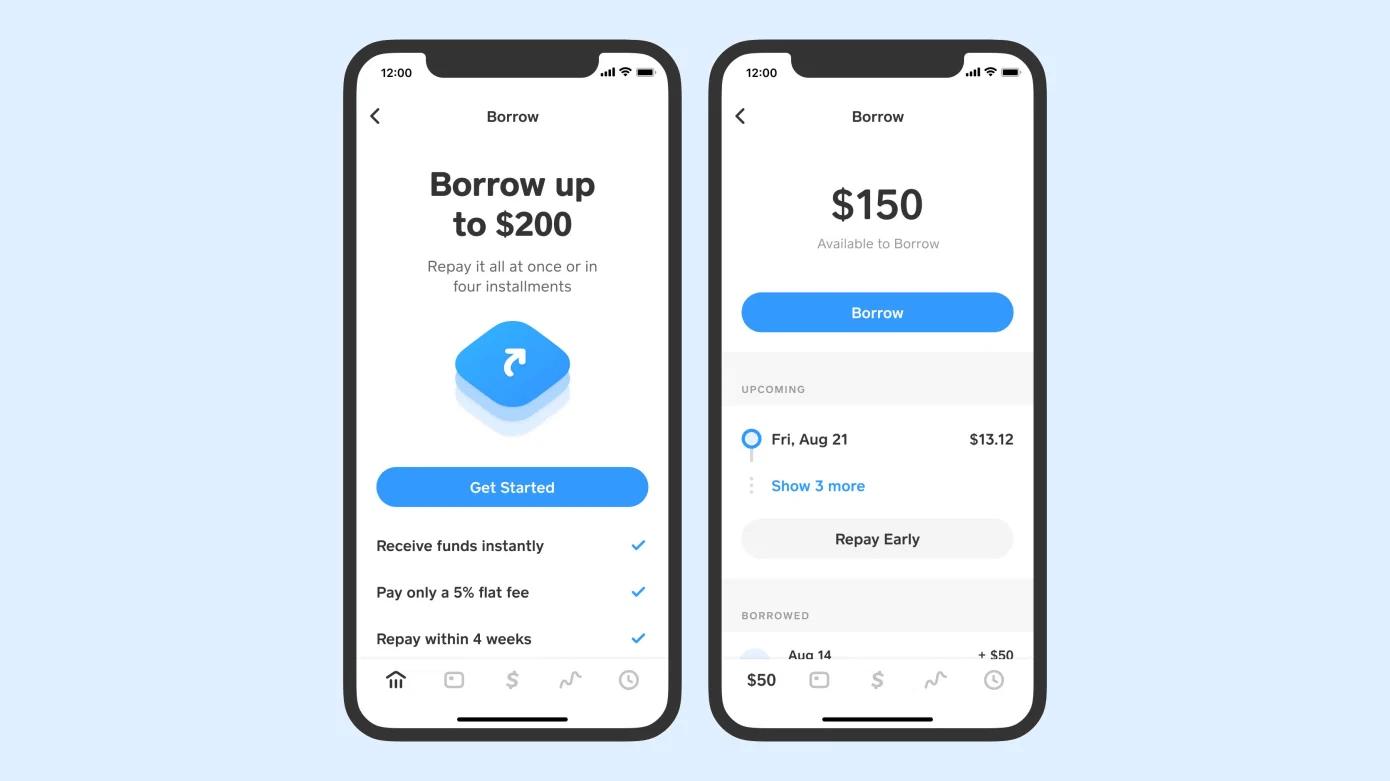

The company is currently testing the feature with around 1,000 users, but if Square deems it to be successful, expect a wider rollout. The pandemic has brought economic hardship around the world, and a short-term cash infusion could help a lot of people—provided they pay it back on time.

Cash App is limiting its loan amounts to between $20 and $200 right now, though that would likely increase if availability is expanded. You’ve got four weeks to pay back the loan, and there’s a flat 5 percent interest fee, which means it’s a 60 percent APR. That’s definitely high, but most payday lenders and less-reputable companies charge three- and four-figure average percentage rates.

Image courtesy of Center for Responsible Lending

If, for some reason, you can’t pay the loan back within the four weeks, there’s an additional one-week grace period. After that, an extra 1.25 percent (non-compounding) interest will be added each week. Defaulting means you won’t be able to take out any additional loans.

“We are always testing new features in Cash App, and recently began testing the ability to borrow money with about 1,000 Cash App customers,” a company spokesperson said in a statement to TechCrunch. “We look forward to hearing their feedback and learning from this experiment.”

Last year, Google banned apps from its store that enable personal loans with an APR of 36 percent or higher. It doesn’t allow apps that require loan repayments in full within 61 days, either, so it’ll be interesting to see how Cash App deals with those rules.

https://www.techspot.com/news/86360-square-cash-app-testing-short-term-loan-feature.html