What just happened? Good news for Hodlers who held onto their Bitcoin throughout the digital currency's rough couple of years: BTC has passed the $51,000 milestone, pushing its market cap past $1 trillion for the first time since 2021. The strong performance is being felt in the rest of the crypto market, too.

Bitcoin had a horrific 2022. With the collapse of TerraUSD and FTX, the crypto winter wiped $1 trillion off the value of the crypto market. Bitcoin was under $17,000 in December 2022, a far cry from its $69,000 high just a year earlier.

But Bitcoin's price made a slow and steady recovery across 2023, rallying by more than 150%. It hit a 21-month peak of over $45,000 last month and has been mostly trending upwards ever since.

At the time of writing, Bitcoin's price is $51,807. The last time it was this high was in November 2021. Its market cap – the value of all Bitcoin in circulation – is now above $1 trillion for the first time in over two years.

Bitcoin's price dipped after the SEC approved Bitcoin exchange-traded funds (ETFs) in January, but there has been high demand for the ETFs since then; they allow investors to buy a product that tracks the price of Bitcoin without having to hold the currency directly.

Moreover, anticipation for April's halving, an event that happens every four years in which the amount of bitcoin awarded to miners is cut in half, has further pushed up the price of Bitcoin. Based on previous halvings, BTC's price is expected to rise following the event.

Bitcoin's performance is pushing the other big cryptocurrencies to their highest prices in years. It's seen the total value of the crypto market edge close to $2 trillion.

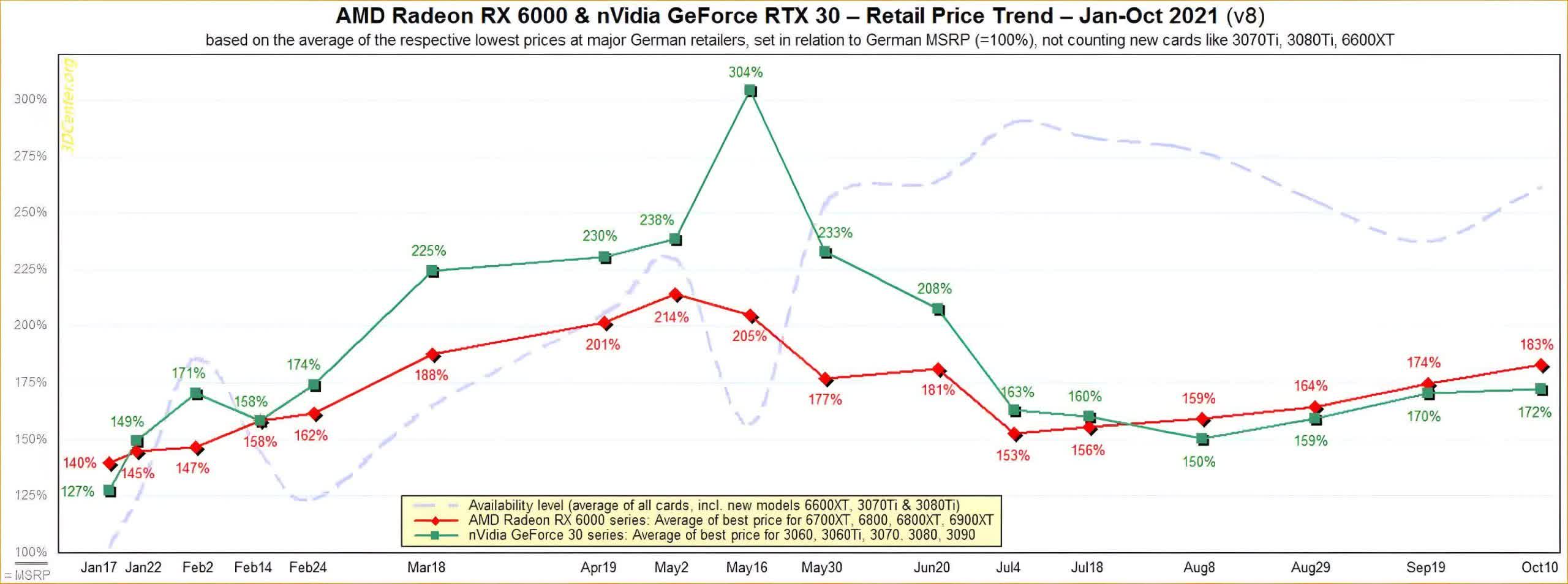

While this is all welcome news for crypto holders, a resurging market is always going to concern PC gamers for whom the memory of graphics cards selling at three times their MSRP (where available) still lingers. Surging crypto prices were a major part of the problem back in 2021, but it's worth remembering that massive demand from stay-at-home gamers and pandemic-related chip shortages exacerbated the situation.