In brief: Makers of AI PCs and processors will be happy with the news that people are buying these products, which feature NPUs designed to accelerate AI tasks. The less welcome caveat is that according to a new report, many people are purchasing them simply because they want or need a new PC – not because of the AI features.

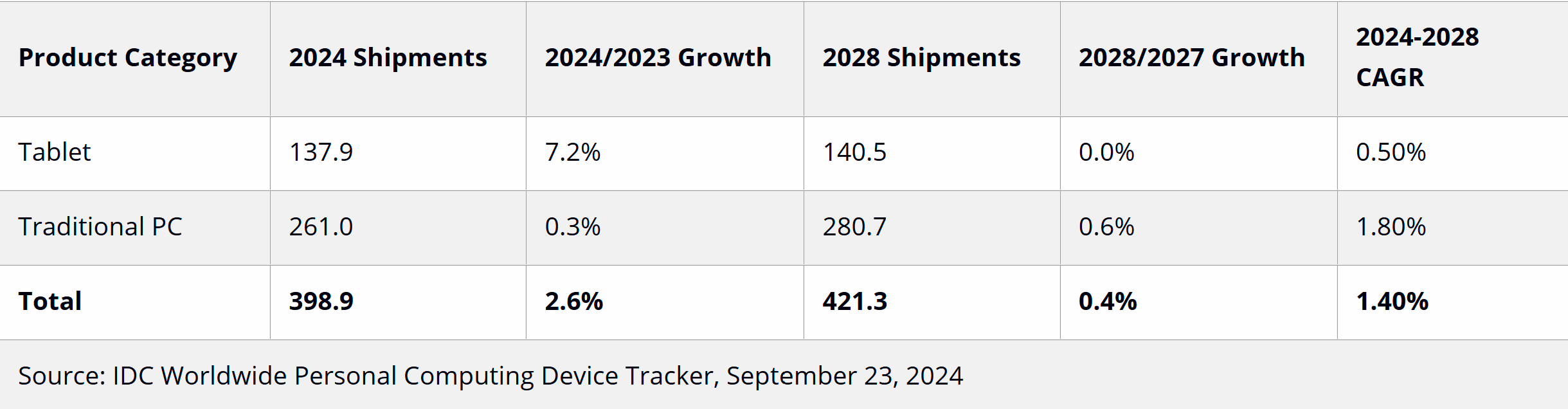

The latest IDC Research report shows that shipments of personal computing devices are expected to grow 2.6% year over year in 2024 to 398.9 million units.

The report notes how pretty much every PC company these days pushes the benefits of their machines' NPUs and AI smarts, but most people buy them because they want a new or upgraded PC, as opposed to specifically requiring an AI PC.

"While AI has been a buzzword of late, it has yet to be a purchase driver among PC buyers," said Jitesh Ubrani, research manager, Worldwide Mobile Device Trackers. "Businesses certainly recognize the importance of AI though many struggle to see the immediate use case and instead are opting for AI PCs as a means to futureproofing."

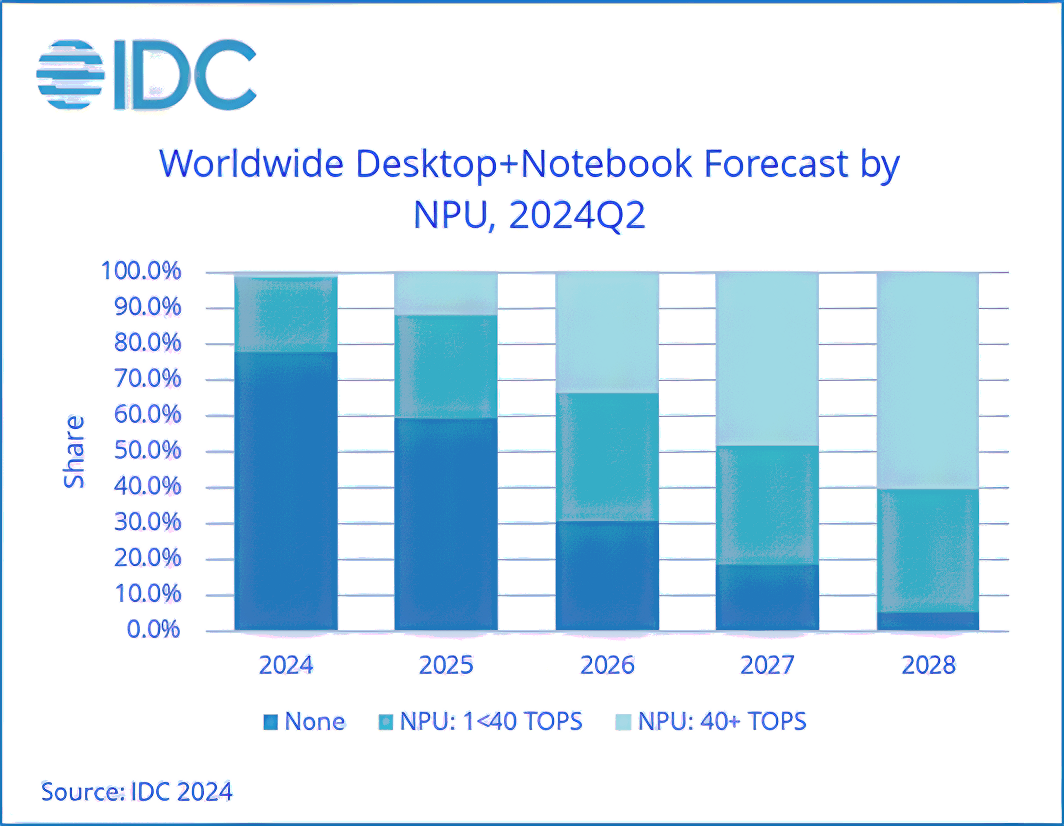

Ubrani adds that manufacturers should explain better to consumers what an NPU is, why it's important, and why they might need one. The fact that all new processors have built-in NPUs means AI PC sales will continue to grow, even if people don't care about their headline capabilities.

Ubrani also points out that the inclusion of an NPU and the early hardware requirements for AI tasks mean premium laptops are coming with more storage and memory, which is increasing the average selling price.

In July, a survey of 22,000 people found that 84% were not willing to pay extra for a PC or hardware just because it offered enhanced AI capabilities.

Looking at PCs overall (excluding tablets), IDC writes that the traditional PC market will remain flat in 2024 with 261 million units shipped as growth stagnates at just 0.3%. That figure would be 2.8% when excluding China, which is experiencing several economic challenges that are impacting the PC market. Next year should be better, though, as the end of Windows 10 support is expected to spur commercial buyers to upgrade, pushing growth to 4.3%.

The tablet industry is a bright spot in the report. Slate sales are up 7.2% compared to last year as shipments reach 137.9 million, as manufacturers release more powerful models with larger screens. We're used to seeing Apple dominate this area, but growth has been driven by Android tablets in emerging regions. Unfortunately for OEMs, tablet growth is expected to hit 0% by 2028 as smartphones become larger and more powerful (and more foldables arrive) and tablets struggle in the face of touch-capable laptops.