What just happened? Amazon for the third quarter reported net sales of $70 billion, an increase of 24 percent over the $56.6 billion it brought in during the same period a year ago. Wall Street was expecting just $68.8 billion so it's a win on that front but Amazon is still taking a beating in after-hours trading due to its earnings per share miss.

As CNBC highlights, analysts were expecting $4.62 per diluted share but Amazon was only able to deliver $4.23 per share. Net income, meanwhile, slid to $2.1 billion from $2.9 billion a year ago. Earnings per diluted share in the third quarter of 2018 were $5.75. Operating income dipped to $3.2 billion from $3.7 billion a year ago.

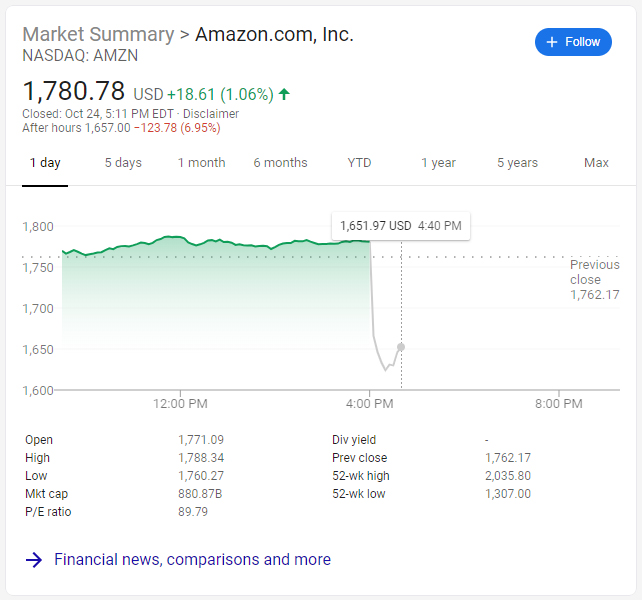

Amazon's share value is down 6.95 percent as of writing in after-hours trading.

The third quarter included sales from Prime Day 2019, the company's annual sales event in mid-July. This year's shopping extravaganza was bigger than Black Friday and Cyber Monday combined, Amazon said.

Amazon is in the midst of transitioning its Prime delivery service from two days to one day. "It's a big investment," CEO Jeff Bezos said, but "it's the right long-term decision for customers." Bezos added that they are prepping to make their 25th holiday season the best ever for Prime customers.

For the all-important fourth quarter holiday season, Amazon forecasted net sales of between $80 billion and $86.5 billion, below analysts' expectations of $87.4 billion.

Masthead credit: Amazon package by Hadrian