In brief: GlobalFoundries is getting ready for an IPO, and analysts expect it to be valued at around $25 billion. The company is still working out the details behind the upcoming share sale, but it looks like it's in a good position to capitalize on the chip boom, especially when it comes to mature process nodes.

Back in July, the rumor mill was abuzz with reports that Intel was interested in buying semiconductor giant GlobalFoundries for around $30 billion, presumably as a quick way to strengthen its IDM 2.0 initiative that led to the creation of Intel Foundry Services. It could have been one of the largest deals in history, but the rumors were quickly shot down by GlobalFoundries CEO Tom Caulfield.

Caulfield said at the time that his company was instead pursuing a bigger and bolder plan that involved an initial public offering. In a filing this week, the company listed the size of its offering as $1 billion, likely a placeholder for the real value that is to be determined once the terms of the share sale are agreed upon. Analysts expect a valuation as high as $25 billion.

Also revealed in the filing are a couple of interesting details about the company's financial performance. 2020 saw the company record a $1.35 billion net loss on revenue of $4.85 billion. As for the six months ending in June, net revenue was $3.05 billion, which is a 13 percent year-over-year increase compared to the same period a year earlier.

Some of you may remember that GlobalFoundries was founded in 2009 when AMD sold its manufacturing operations to the Abu Dhabi-based Mubadala Investment Company. The AMD spinoff was later merged with Singapore's Chartered Semiconductor Manufacturing Ltd., and since then it has grown into the world's fourth largest chip foundry by revenue, after TSMC, Samsung, and UMC.

GlobalFoundries is in a good position to ride the current wave of demand for chips, particularly when it comes to older, more mature process nodes. Foundries like TSMC and Samsung have prioritized more advanced EUV-based chipmaking technologies, but some companies, most notably automakers, aren't willing to embrace them. The auto industry is expected to close the year with a $210 billion loss due to chip shortages, so GlobalFoundries is one of the few companies that can make automakers an offer they can't refuse.

In related news, TSMC chairman Mark Liu claims some companies have been hoarding chips, which is one of the primary reasons for the ongoing chip shortage.

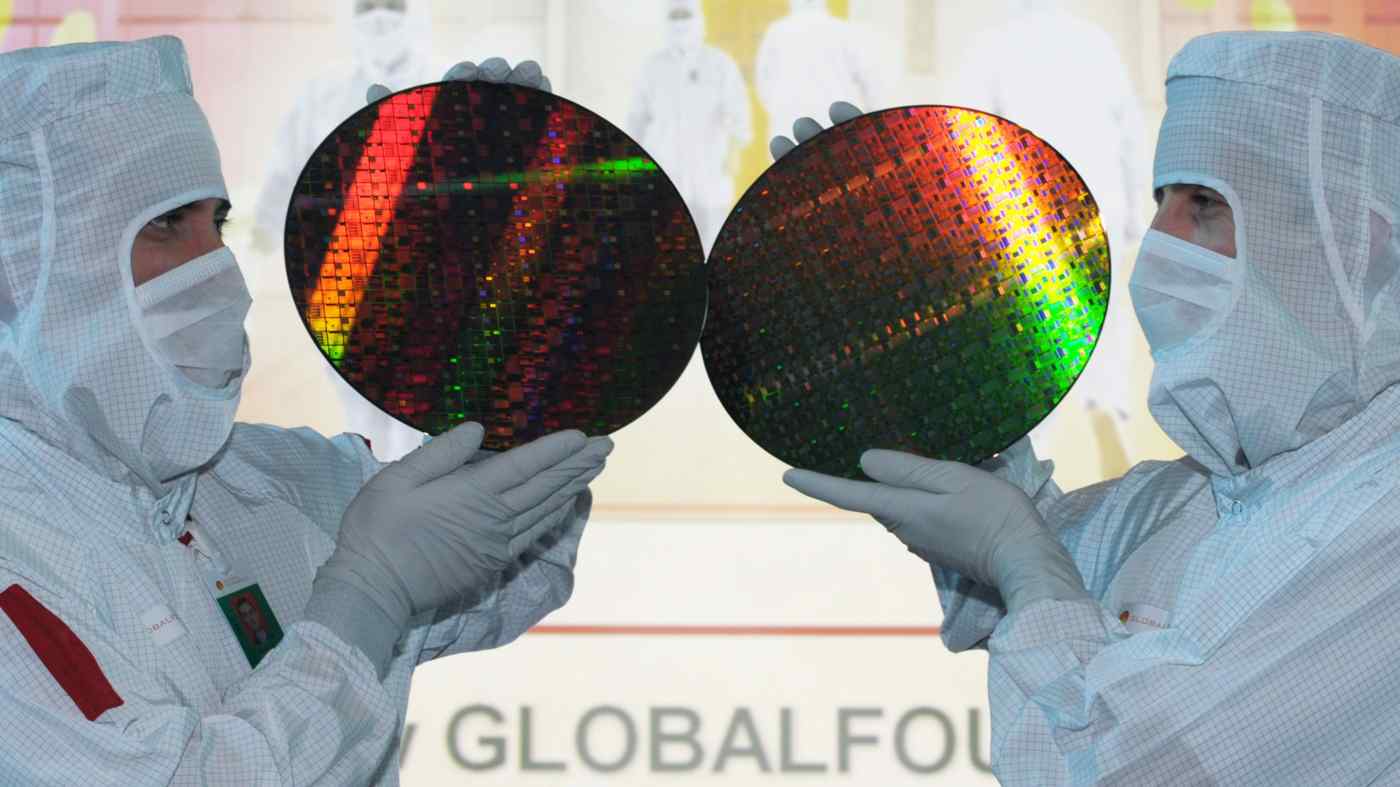

Image credit EPA/Jiji