The big picture: Intel may be scrambling to regain its leadership crown for advanced process technology, but older, mature nodes are still too important to ignore. By acquiring Tower Semiconductor, the company can serve automakers and specialized equipment companies that still have plenty of use for nodes ranging from 1000nm to 65nm.

By now it's no secret that Intel wants to grow its manufacturing business into one that can rival those of TSMC and Samsung. With its IDM 2.0 initiative, the company wants to make strategic changes on many different levels, from improving its process technology to building additional capacity, and using some of that capacity to serve various organizations who want to make their own custom silicon.

Today, Intel announced yet another step in that direction. The silicon giant is buying Tower Semiconductor, a specialty foundry based in Israel, for $5.4 billion. The acquisition will give Intel a larger presence in a space that has been dominated for years by TSMC, its Taiwanese rival that specializes in serving fabless companies.

Tower Semiconductor currently has seven manufacturing facilities --- one 300mm fab, five 200mm fabs, and one 150mm fab. Two facilities producing 150mm and 200mm wafers are located in Migdal Haemek, Israel, two 200mm fabs are located in Newport Beach, California and San Antonio, Texas, and the remaining facilities (one 300mm fab and two 200mm fabs) are located in Japan and are co-owned by Tower and Nuvoton, with the former having a controlling stake (51 percent).

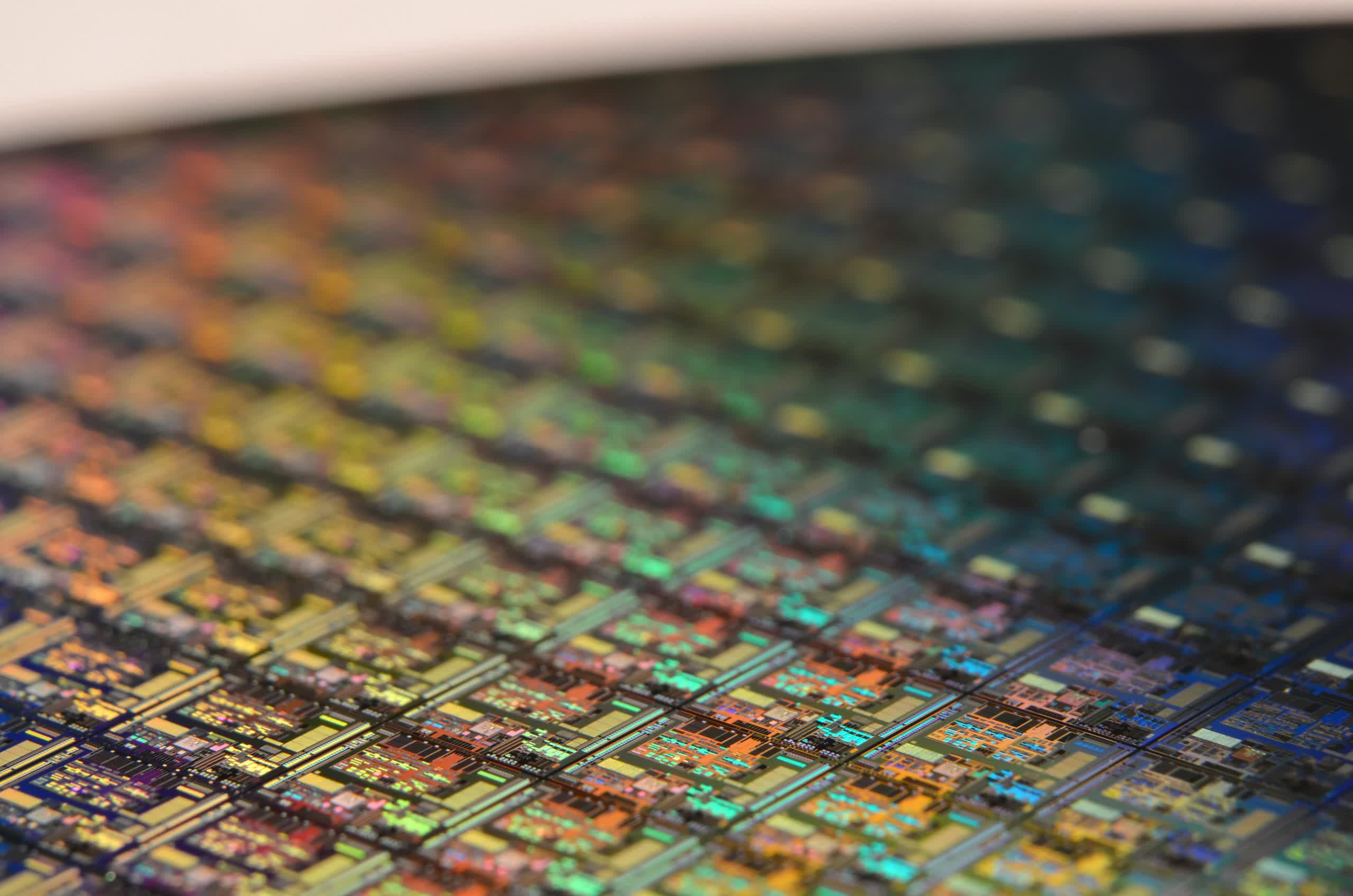

Typical customers for Tower Semiconductor are companies that design MEMS, RF CMOS, and BiCMOS chips, CMOS image sensors, power management ICs (PMICs), and silicon-germanium transistors (SiGe). In terms of overall manufacturing capacity, the foundry is capable of more than two million wafer starts per year. It's also the sixth largest contract chip manufacturer by revenue, and operates in an industry with long product lifecycles, which means Intel will have an easy time managing the operating and research and development costs.

Intel is heavily invested in Israel, and currently has five sites in the region where it employs over 14,000 people. Back in 2017, it acquired autonomous vehicle technology firm Mobileye for a whopping $15.3 billion.

Masthead credit: Laura Ockel