In brief: The chip boom of the past two years that spurred a global shortage is coming to an end, and that shouldn't surprise anyone. Chipmakers, consumer tech companies, and retailers are expecting rockier months ahead, but consumers can finally hope for good availability and pricing on both current-gen and next-gen products.

This year, the smartphone market experienced one of its worst first quarters of the past several years. Global shipments fell more than 11 percent compared to 2021, and the European market saw its most significant decline in a decade.

Some of that decline was expected due to seasonality, so phone makers like Samsung started reducing their production accordingly. That said, market analysts at Counterpoint estimate that mobile chipset revenues grew around 23 percent in the first three months of 2022 thanks to a shift in consumer demand toward more expensive 5G handsets.

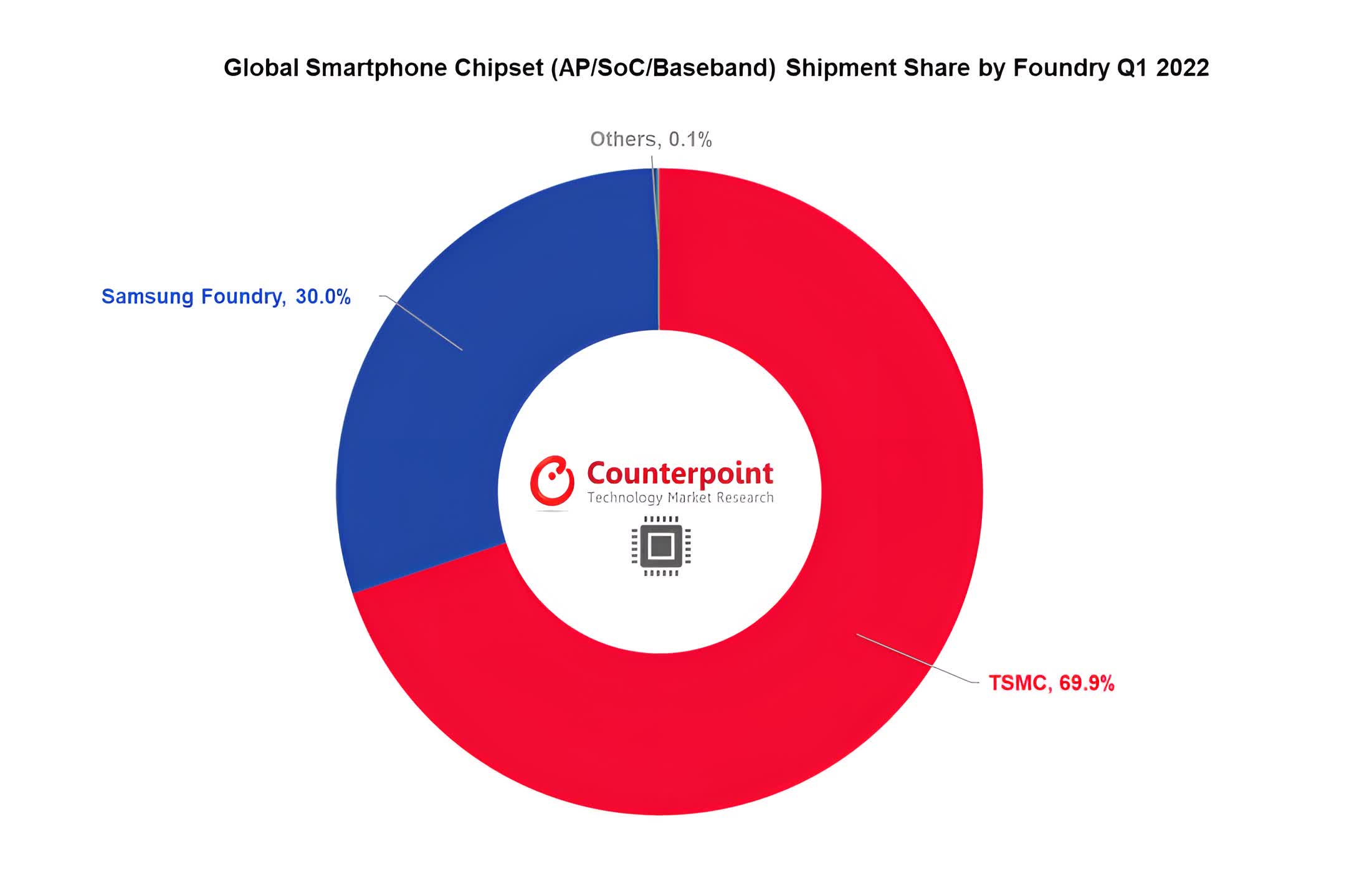

TSMC took the lion's share of contract manufacturing for these chipsets --- an estimated 70 percent of SoCs and cellular modems were made using the Taiwanese company's latest process nodes (7nm, 6nm, 5nm, and 4nm). Samsung took most of the remaining chip orders and is currently looking to woo more customers with its cutting-edge 3nm process node, which is the first to use gate-all-around field-effect transistors.

When zooming in on TSMC, analysts found that chipset sales had declined nine percent year-over-year for the three months ending in March. That situation is expected to change in the coming months as Qualcomm will shift more of its chip orders to TSMC instead of Samsung. Notably, this decision was made after the Korean giant experienced yield problems on its 4nm process node.

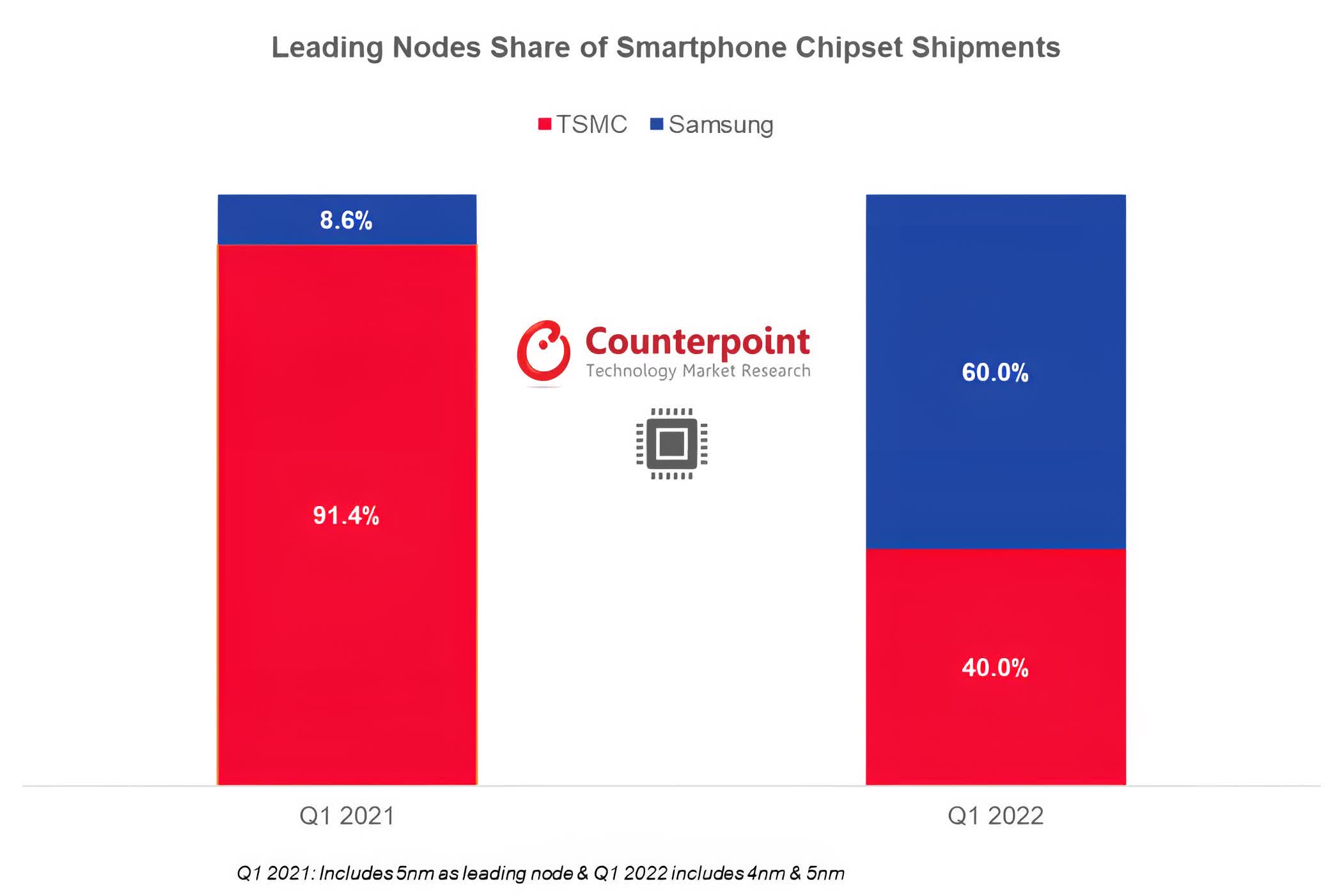

Despite those issues, Samsung holds a strong position when it comes to 5nm and 4nm nodes. The company went from shipping less than nine percent of all advanced mobile chips in Q1 2021 to no less than 60 percent in the first quarter of this year.

Overall, consumer demand for smartphones is expected to drop in the coming months due to inflation and growing fears of an imminent global recession. That said, there are signs the tech supply chain may finally be healing after suffering several shocks over the past two years.

A TrendForce report suggests the chip shortage as we know it may be coming to an end sooner than previously expected. Foundries have seen a wave of order cancellations that will result in capacity being underutilized towards the end of this year.

| Wafer Size | Process node | Target products | H2 2022 Capacity Utilization |

|---|---|---|---|

| 200mm | 0.35 – 0.11μm | Display Driver ICs, PMICs, Contact Image Sensors | 90-95% |

| 300mm | 90/55nm | Microcontrollers, PMICs, TDDI, Wi-Fi | 90-99% |

|

300mm |

40/28nm | AMOLED Display Driver ICs, Wi-Fi, 4G modems, TV SoCs, Platform Controller Hubs | 90-99% |

| 300mm | 1Xnm | 4G/5G modems, FPGAs, ASICs, Wi-Fi, TV SoCs, Platform Controller Hubs | 95-100% |

| 300mm | 7nm – 4nm | CPUs, GPUs, ASICs, mobile SoCs, FPGAs, AI Accelerators | 95-100% |

The first of these revisions is for 200mm and 300mm wafers made using mature process nodes like 12 nm and beyond. This means that manufacturers no longer have problems sourcing PMICs, microcontrollers, display driver ICs, and other much-needed components. Analysts believe some foundries will have problems maintaining production capacity at 90 percent, especially as manufacturers are starting to deal with a buildup in inventory.

More advanced chip fabrication lines may still see anywhere between 95 percent to full utilization rates. That means companies that design CPUs, GPUs, ASICs, 5G modems, and mobile chipsets don't see any reason to make fewer of them just yet. At the same time, foundries aren't willing to give up orders and will, at best, offer delays in shipments of up to three months.

For gamers who are waiting for new CPUs and GPUs from Intel, Nvidia, and AMD, this is definitely good news as it means availability won't be a major issue. Add to that a flood of used GPUs on the second-hand market and waning demand for PC motherboards, and we have the right conditions for more affordable system upgrades.