The big picture: Intel has ambitions to create a foundry business by manufacturing chips for other companies. This is an important strategic initiative that the company will need to recoup the massive investment it is now making in fabs around the world.

Most analysts agree that this proposition is a non-starter until Intel can catch up with its manufacturing process. And rightly so, without that, Intel Foundry Services (IFS) would lack serious competitive differentiation (yes, packaging, but that is not enough). And we have also cautioned that the company lacks customer service muscles after an entire history of the fabs team running the show.

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

But beyond that there are even more concerns.

When we talk about semis fabrication, we tend to treat the different foundries nodes as fungible, as if a customer could easily trade Samsung for Intel for TSMC. This is not accurate. In reality, each fab has a different way of doing manufacturing. Intel's process was designed to make CPUs, and those processes are not the same as what is needed for other types of chips. For instance, mixed signal chips which need to process digital versions of analog signals (like cell phone signals) while also doing pure digital logic, require a very different set of steps for manufacture – different machines, calibrated differently, in a different order. To put it politely, Intel does not have a great track record for producing their own mixed signal parts.

And then there are the tools. A major part of the foundry customer experience is the software tools used to handle communications between the fabless customer and the foundry. This is not as simple as emailing a couple files over. The big foundries have all invested heavily in integrating the tools they use to handle production with the software tools used by their customers.

This is a big part of the competitive stranglehold that the EDA vendors like Cadence and Synopsys hold over the industry. To be clear, Intel has its own set of tools to handle production of their own chips, but these are to a surprising degree proprietary to Intel. From what we hear, even Intel employees do not love the experience. Will IFS expect customers to learn these tools? More likely, Intel is going to need to invest heavily in software to build a whole new set of tools that customers will be comfortable with.

All of this leads to the question, if Intel can get its manufacturing back on track (a big if), what customer is going to want to switch to Intel? Even if Intel can overtake TSMC's process by 2025 as they claim (or is it 2026?), it is going to take fabless customers a considerable period of time (measured in years) before they are going to feel comfortable sending real production orders to IFS.

The industry is littered with horror stories about companies getting stranded because their foundry's process does not go to plan.

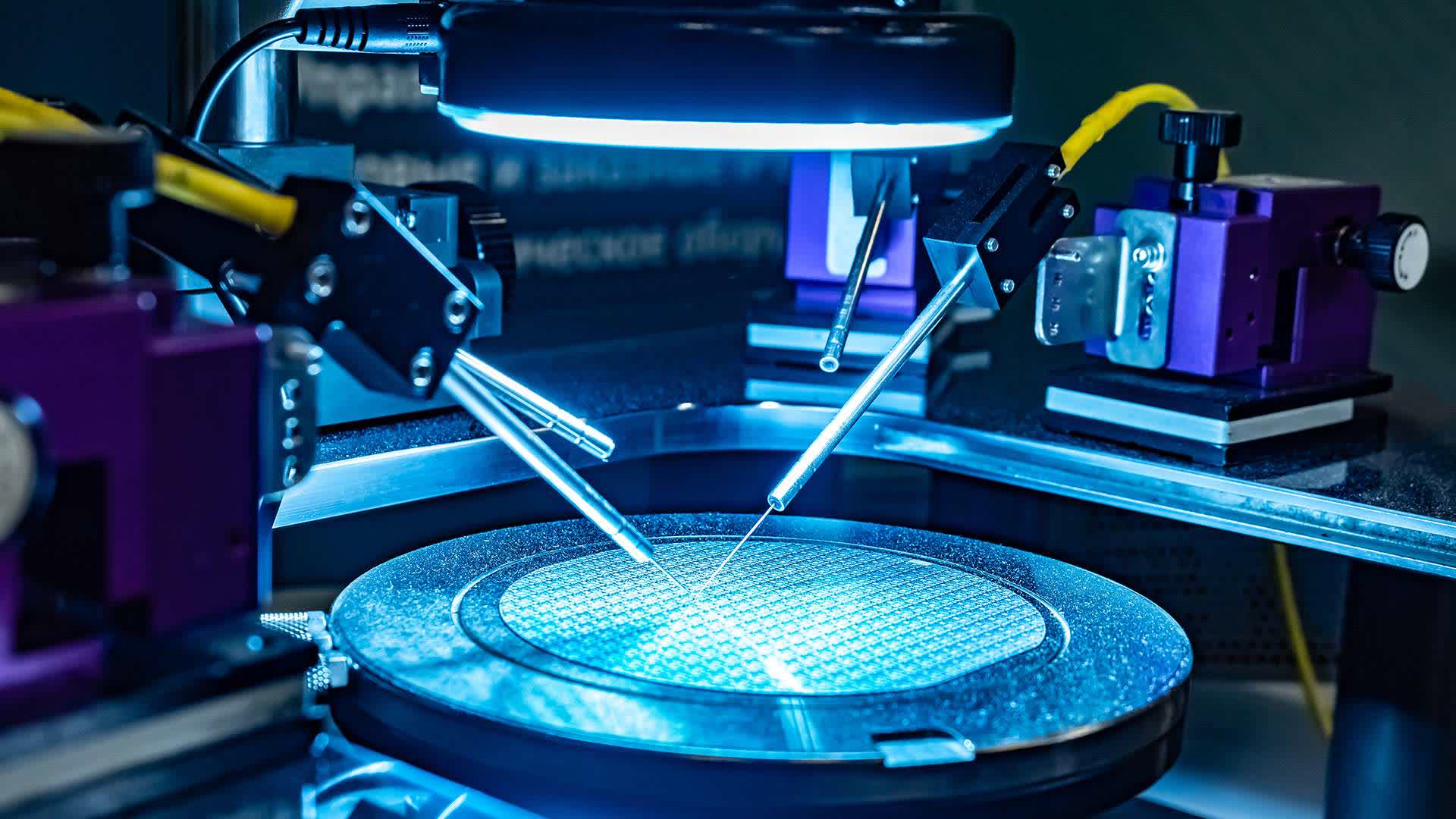

It is important to keep in mind that every time a company sends a chip to the foundry for production that company is taking a risk. There is a reason they call them "Risk Starts." For established foundries, that risk is measured in terms of yield, the percentage of chips produced on each wafer. But for a new process, let alone a new foundry, there is real risk that the process may not work. The industry is littered with horror stories about companies getting stranded because their foundry's process does not go to plan.

Given all this, it seems very unlikely that any of the biggest chip companies are going to be a in a big hurry to sign up for IFS. Would Apple risk an iPhone cycle failing because its foundry was not ready? Just moving from TSMC 5nm to TSMC 3nm is scary enough. If Intel can fix its process (again, a big if), the big customers will absolutely take a serious look at IFS, but that serious look will entail years of meetings and deep diligence.

That being said, there is one group of customers who might be very interested in rolling the dice on IFS – designers of RISC V chips. Today, these companies don't have a lot of good options. They can get access to TSMC, but they are generally very small and so do not get "A Team" service or pricing.

RISC V chips also have the benefit of being a fairly greenfield opportunity, they are so new that no one has deep experience in fine-tuning foundry processes for their manufacture. Remember back in February when Intel announced they were making big RISC V investments? At the time, we noted that Intel was not going to switch its CPUs from x86 to RISC V, but they were interested in the broader ecosystem.

The investment they talked about was largely around building the tools and processes needed to attract RISC V fabless designers. It is worth pointing out that Intel's RISC V team appears to be largely sitting inside the IFS organization.

This is not a bad strategy. Under normal circumstances we would be complimenting Intel's wisdom. RISC V companies could easily be a stepping stone for IFS, a whole bunch of fairly captive guinea pigs customers upon whom they can experiment hone their customer service capabilities. The trouble is that all of this is still very far away. We recently commented to a friend that we did not expect to see IFS truly operational until 2030, and he responded "Oh, so you are an optimist."

Intel is on the right path, it is just a very long road.

Editor's note: Shortly after this column was written, Intel Foundry Services president Randhir Thakur told EE Times that the U.S. Department of Defense is IFS' "# 1 customer" as part of the DoD's SHIP program. There may be some obvious political implications in choosing Intel, but that still means Intel has yet to execute and proof itself as a foundry taking on client's projects.