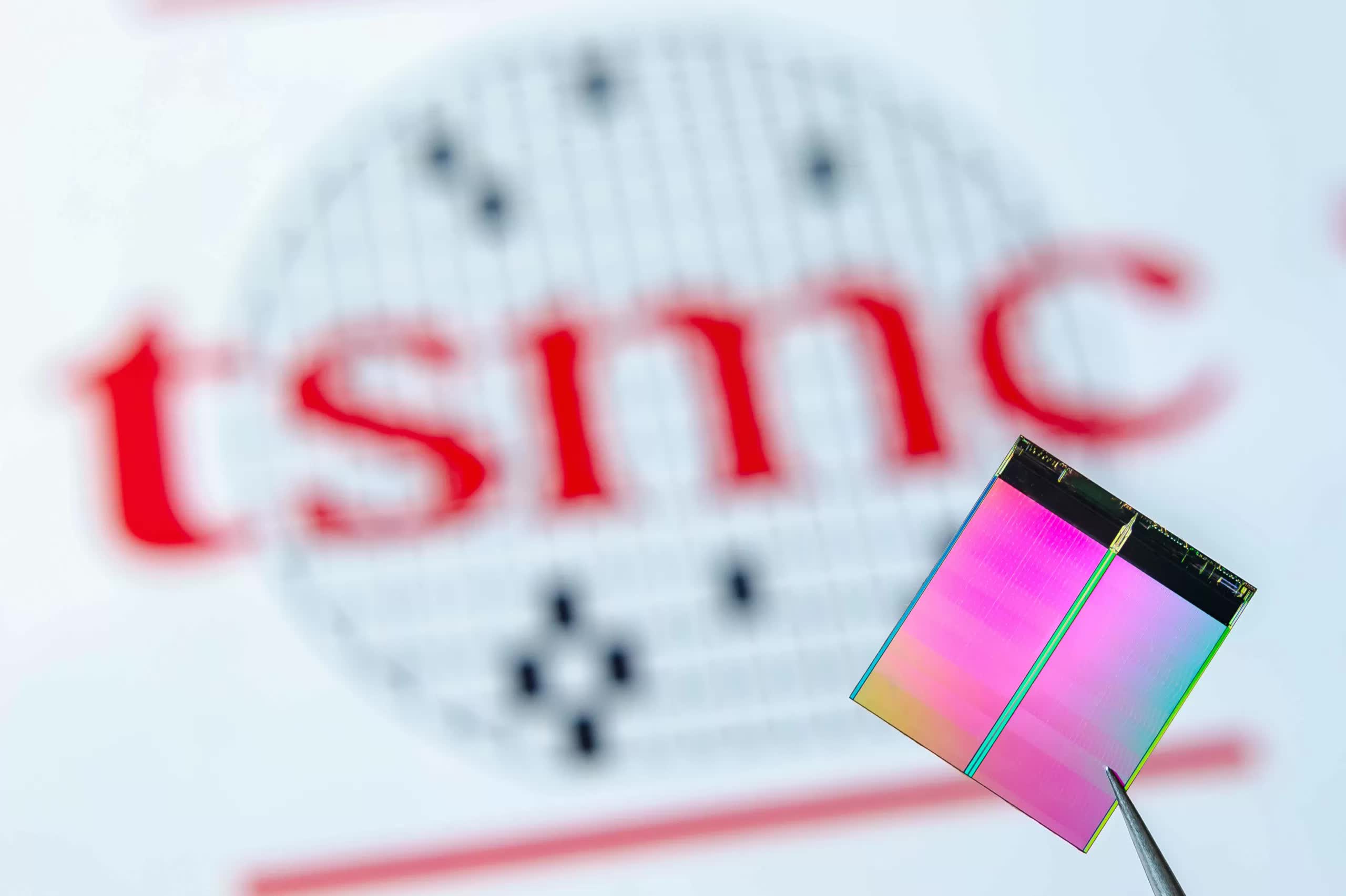

In brief: We're in the middle of a global economic slowdown that has hit tech companies especially hard, but it seems nobody told TSMC. The world's largest contract chipmaker saw its November revenue increase 50.2% year-on-year to reach $7.27 billion, and a lot of it was thanks to Apple.

Falling demand, China's Covid Zero policies, the rising cost of living, and recession fears have made 2022 a bad year for tech giants. Demand for everything from smartphones to PCs has fallen, and mass layoffs have become a regular sight.

TSMC has bucked the trend by more than doubling its sales in November---compared to a year earlier---reaching $7.27 billion. That puts the company on track to hit its fourth-quarter estimate of between $19.9 billion and $20.7 billion.

Much of TSMC's good quarter came from supplying the A16 SoC used in the iPhone 14 Pro and 14 Pro Max. Apple, already TSMC's biggest customer, said last month that it would purchase chips from the supplier's US facilities, lessening Cupertino's reliance on Asia. We also heard that the Taiwanese giant will begin manufacturing on a 4nm process in its Arizona fabs in 2024---an upgrade from the previously planned 5nm wafers---following a decision that was reportedly encouraged by Apple.

Some analysts wonder whether TSMC will be able to keep its run of good fortune going next year when orders could decline. However, the company reportedly plans to raise 3nm wafer prices by 25 percent over 5nm to $20,000, which should boost its bottom line. The 2023 iPhone 15's A17 Bionic chip will be manufactured on the 3nm process, and Apple has already agreed, albeit reluctantly, to TSMC's price hike.

At an event attended by Joe Biden earlier this week, TSMC confirmed it would expand its building and manufacturing efforts within the US. The expansion will see $40 billion spent on two fabs in Arizona, an increase from the previously planned $12 billion investment. The site will create tens of thousands of jobs and have a total manufacturing output of 600,000 wafers per year.