In brief: It's a case of another day, another gloomy report on the state of the PC market. This time, it's research giant IDC that has produced a bleak summary of the industry. The first quarter saw global shipments crater, and the biggest victim was the world's largest company, Apple.

The International Data Corporation's (IDC) latest report on the PC market reiterates the problems that the industry has been facing for around a year now: weak demand, excess inventory, and a worsening macroeconomic climate.

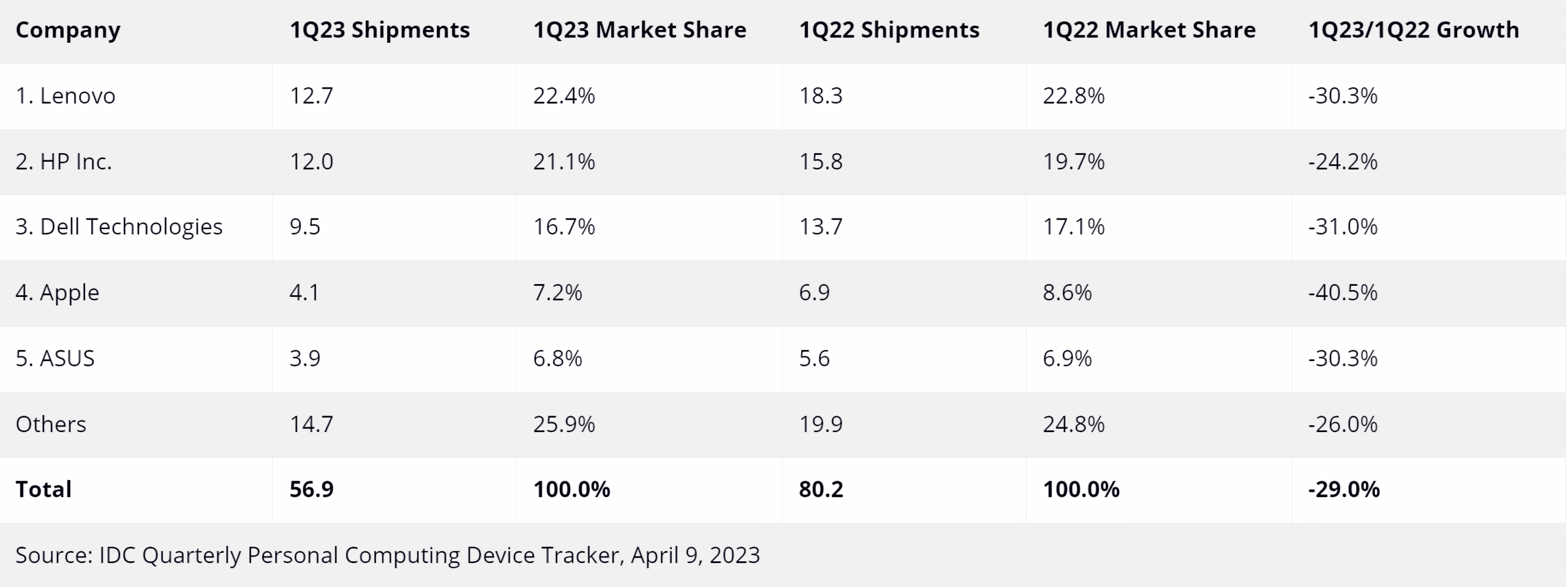

The first quarter saw shipments of traditional PCs crash to 56.9 million, marking a -29% decline compared to the 80.2 million units shipped in the same period last year. IDC notes that the figures illustrate how shipments have, at least for now, returned to levels experienced before the pandemic-induced boom. Shipment volume in the first quarter was noticeably lower than the 59.2 million units shipped in Q1 2019 and 60.6 million in the first quarter of 2018.

While all five of the top PC manufacturers saw declines in year-on-year growth in Q1 2023, it was Apple that took the biggest hit. Cupertino's shipments fell by a massive -40.5% during the quarter.

Click to expand

Apple's misfortune doesn't come as too much of a surprise. The refreshed MacBook Pros with M2 Pro and M2 Max chips arrived back in January to rave reviews - they won some categories in our recent Best Laptops feature - but the company reportedly froze production of its M2 series of SoCs in January and February due to lower than anticipated MacBook demand. Apple is said to have resumed production in March, but at a 50% slower rate compared to before the shutdown.

Lenovo remains the top company in terms of total shipments in Q1 (12.7 million). It's followed by HP, Dell, Apple, and Asus. HP saw the lowest yearly decline in shipments, falling -24.2%.

The report comes just days after Samsung, the world's largest manufacturer of DRAM and NAND chips, said it would be scaling back chip production to what it calls a "meaningful level" after reporting its lowest quarterly profits since the 2009 financial crisis.

There was some good news in the report. IDC writes that the slowing demands are giving manufacturers time "to make changes as many factories begin to explore production options outside China." Apple started manufacturing some iPhone 13 handsets in India last April as it looks to lessen its reliance on the East Asian nation.

The other bright spot is that IDC believes the industry will see a return to growth toward the end of year as the global economy is predicted to improve. It's also expected that more people and businesses will upgrade to Windows 11.

"By 2024, an aging installed base will start coming up for refresh," said Linn Huang, research vice president, Devices and Displays at IDC. "If the economy is trending upwards by then, we expect significant market upside as consumers look to refresh, schools seek to replace worn down Chromebooks, and businesses move to Windows 11. If recession in key markets drags on into next year, recovery could be a slog."