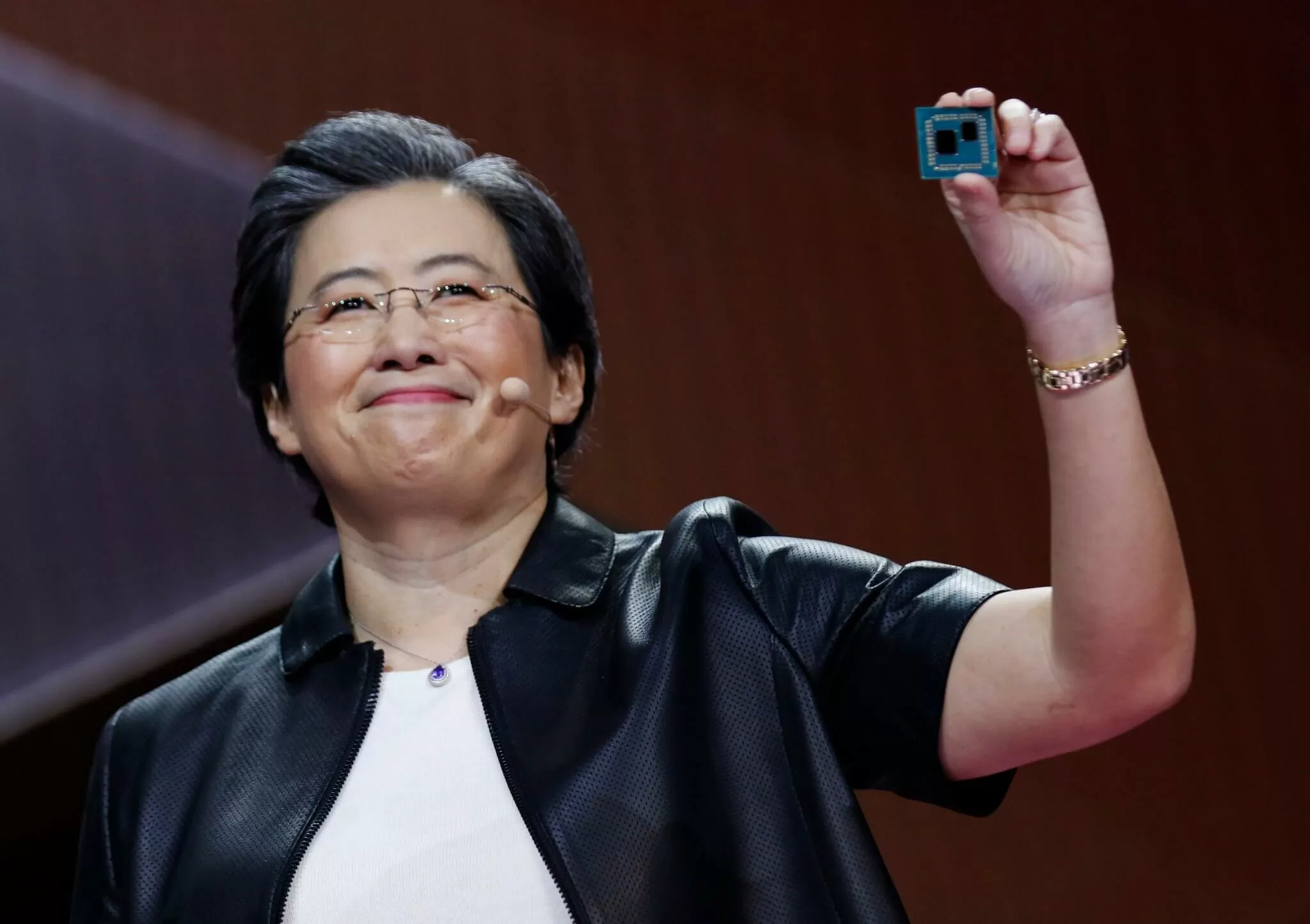

In context: What Lisa Su has achieved since taking over as AMD CEO in 2014 cannot be understated, from chipping away at Intel’s once-dominant position as market leader in the consumer CPU space to increasing the company’s value from $2 billion to $90 billion. But the boss insists now isn’t the time to sit back and admire her work.

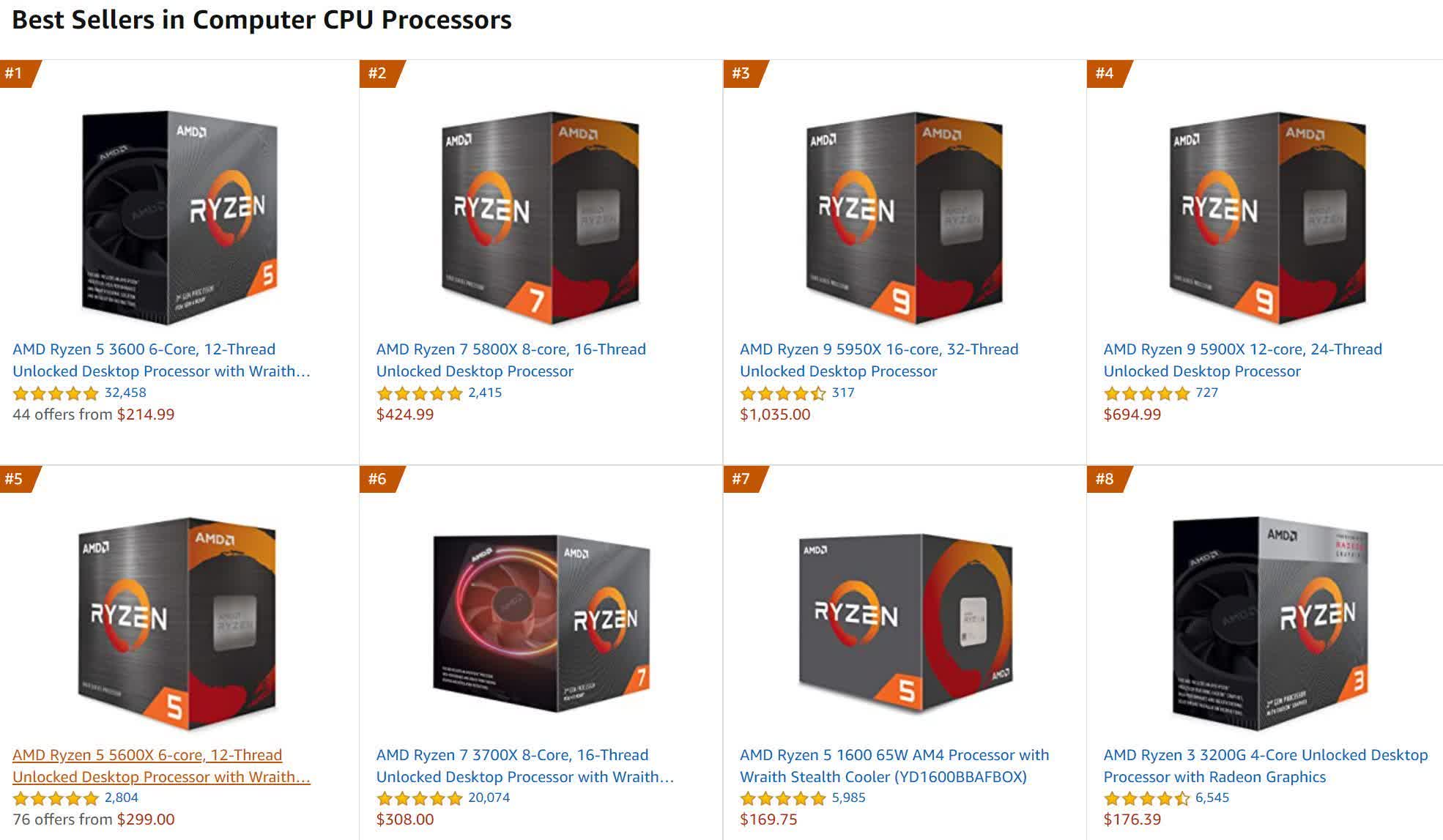

AMD’s processors had long been considered the lesser alternative to Intel’s CPUs, but that started changing with the launch of its Ryzen series in 2017. Team red keeps eroding its rival’s market share, as seen in numerous reports, Amazon’s top-selling CPU lists, and Steam surveys. In the latter case, AMD is expected to pass the 30% user share milestone this month.

Su’s work has not gone unnoticed. AMD’s 90% stock price rise two years ago put her on Bloomberg’s 50 “people who defined 2019” list. The same year saw Su take the title of the first woman to become the highest-paid CEO at an S&P 500 company after her total compensation reached $58.5 million.

Amazon's latest top-selling CPU chart. Notice a pattern?

Illustrating AMD’s new financial clout was yesterday’s unveiling of a $4 billion stock-repurchase plan, its first buy-back since 2001. But Su said the company is not about to rest on its laurels. “Without a doubt it does not get easier,” the CEO said in an interview with Bloomberg. “We’re in a very competitive market. We have big ambitions about what we want to be able to do.”

Su also addressed the global chip shortage that’s been the bane of consumers' lives for so many months. While we’ve heard the problems could last well into 2022, Su is more optimistic, defining them as "not a disaster – these are just another example of the periodic imbalances between supply and demand in the semiconductor market," writes Bloomberg. She added that the situation does mean customers are now open to longer-term commitments, which is a bonus.

"Normally everybody sort of plans their worlds separately, and now we’re really having to plan our worlds together," Su said.

The good news for those still clamoring for a new Ryzen 5000-series CPU is that Su believes supply of the TSMC-built chips will improve later this year.

https://www.techspot.com/news/89755-amd-rise-continues-but-ceo-lisa-su-there.html