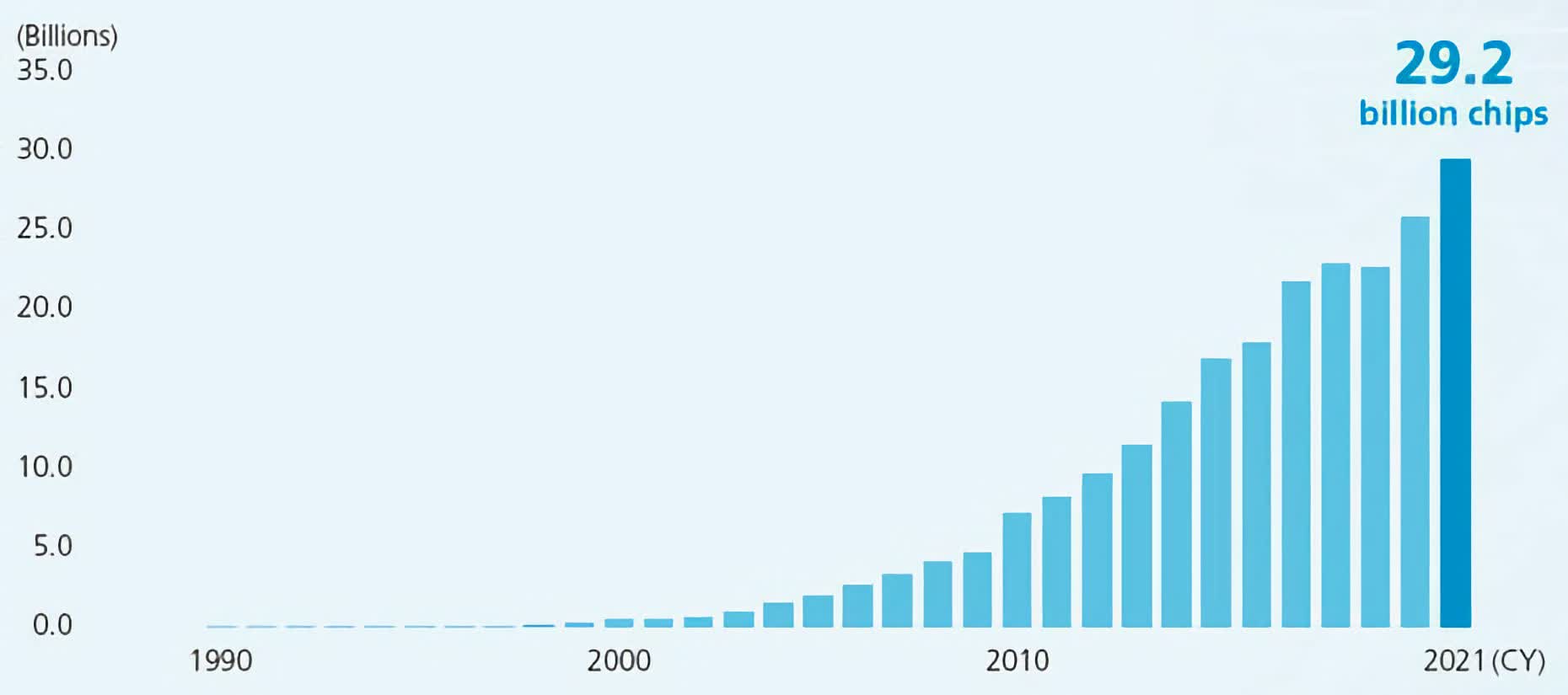

In context: Arm's owner Softbank has been facing financial woes for a while and are looking to increase profits from their most valuable asset, the Arm instruction set. Chips based on the Arm architecture are found in nearly all mobile computing devices, also making their way into servers more recently. With a new proposed pricing model, Arm is looking to change how their chip licensing model works.

British chip designer Arm has put forth a proposal that modifies how they charge for chip licensing, according to a report by Financial Times. With their current model, Arm charges royalties of 1-2% based on the value of the chip, says Sravan Kundojjala, an analyst at TechInsights.

This currently means that when chipmakers like Qualcomm use an Arm design in one of their SoCs like the Snapdragon, they pay Arm royalties based on the value of the chip.

The new proposed model would implement a big change, where Arm would charge royalties based on the average selling price of the devices. This would mean that instead of charging Qualcomm, Arm would now charge manufacturers like Motorola and Samsung.

The average price for a smartphone chip from Qualcomm is $24, while the average price for a smartphone sold in the US was $299 for 2022. Based on this, Arm means to boost their profits, granted if they keep the royalties inline of where they are today.

In their Q3 FY22 earnings, Arm reported total revenue of $746 million, up 28% year on year with all of that stemming from licensing and royalties. Some readers might remember Nvidia's attempt of taking over Arm for the sum of no less than $40 billion, a deal that ultimately fell through after failing to overcome regulatory issues.

A few people have already pointed out that this move by Arm might give an opportunity to RISC-V, an open source instruction set architecture that launched in 2015, but has only seen limited use outside of IoT devices. Seeing as Arm basically has a monopoly on the mobile market, and Apple having almost completed their switch to Arm across all platforms, this latest move may open the door for competitors if manufacturers find Arm's new model too pricey.