The big picture: The crypto winter spells terrible news for everyone who has built racks upon racks of mining rigs. For gamers, it creates the right conditions for a price war between retailers and miners. At least in China, GPU prices are dropping below MSRP across the board, and it's only a matter of time before this becomes a global trend.

Used graphics card prices fell 50 percent recently, primarily thanks to a sharp decline in cryptomining profitability. Companies like Asus have seen demand for GPUs used to mine Ethereum and other tokens diminish to the point where the impact on their bottom line is non-existent.

Analysts estimate that Ethereum miners spent around $15 billion over the past 18 months, grabbing more than a third of all available GPUs from Nvidia's RTX 3000 series and AMD's RX 6000 series. Now they're trying to sell them as fast as they can before prices reach a floor.

As one would expect, this has caused a flood of used Ampere and RDNA 2 cards on the second-hand market when retailers are sitting on healthy inventories of new cards. With next-gen graphics card launches on the horizon, gamers aren't rushing to buy current models, some of which are almost two years old.

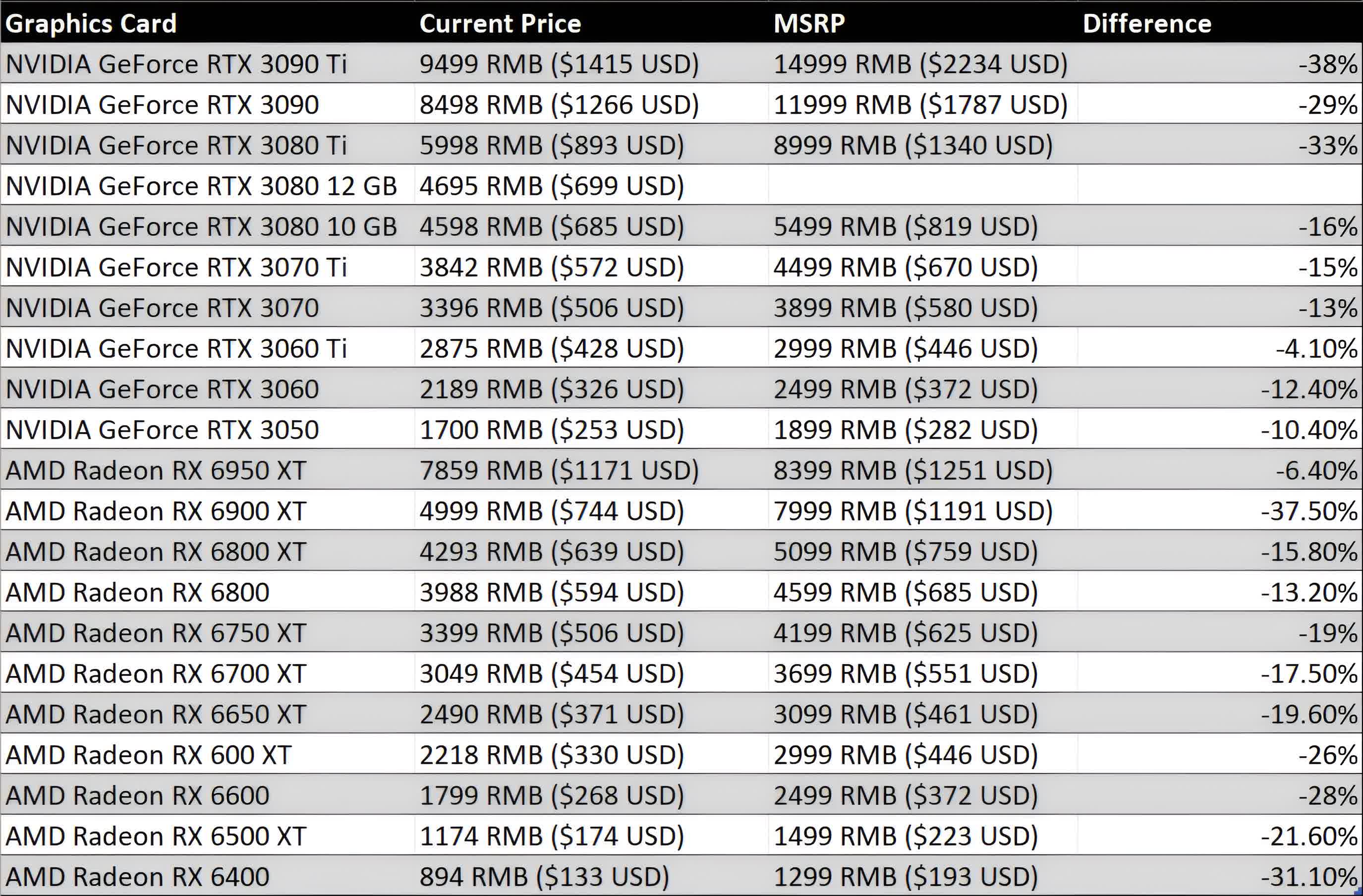

In China, this is causing a price war between retailers and miners. Both have gradually lowered their prices over the past few weeks. According to a Baidu forum post, the average selling price of GPUs in the region has dropped to around 20 percent below MSRP.

Nvidia's RTX 3090 and RTX 3090 Ti now cost 29 percent and 38 percent below their manufacturer-suggested prices, respectively. That means the RTX 3090 Ti is going for around $1,415, which is still high but much more affordable than a month ago. A Founder's Edition model is now $1,600 at Best Buy — another sign that the crypto winter is putting enormous downward pressure on GPU pricing, especially for the higher-end models.

The same trend has been observed somewhat on AMD cards. Team Red typically prices its GPUs lower, but even the mighty RX 6900 XT is now priced 37.5 percent below MSRP.

Overall, choosing the best value GeForce or Radeon GPU is still highly dependent on your region and whether or not you have an urgent need for a GPU upgrade or replacement. If you can wait, prices will likely deflate even more in the coming months.