What just happened? After experiencing two straight quarters of losses, including the largest in the company's history, Intel has returned to profitability in the second quarter as the PC market started to show signs of recovery. Chipzilla recorded $1.5 billion in profit from $12.9 billion in revenues during the three months to July 1, pushing its share price up 8% in after-hours trading.

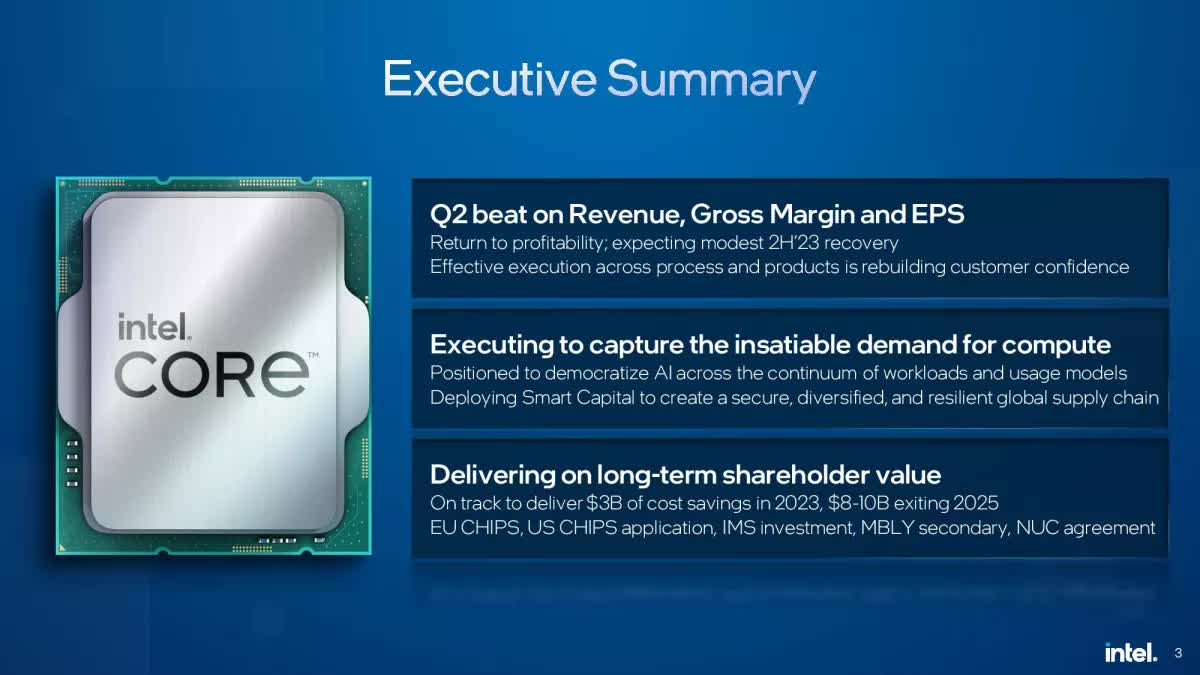

Team Blue saw its revenue fall 15% compared to the same period a year earlier, but it's still a huge improvement over the first quarter when the company's $2.8 billion loss – a 30% YoY decline - represented the worst in its entire history. Q1 was the second consecutive quarter Intel had seen a loss after hemorrhaging $700 million during the previous three months.

Intel's chip sales were down 12% in Q2 to $6.8 billion, but that was still better than the 21% analysts had been expecting, and a big improvement over the 38% decline in Q1.

Helping Intel were Global PC shipments. They've been in freefall for a while now, but while they still declined around 11.5% in the June quarter, it was better than the previous two quarters' 30% drop.

"It was a very good quarter, we exceeded expectations on top line, on bottom line, we raised guidance, and we look forward to the continued opportunities that we have of accelerating our business and seeing the margin improvement that comes in the second half of the year," said CEO Pat Gelsinger, on an earnings call with analysts.

Gelsinger pointed to cost-saving measures, confidence in the company's roadmap, and the strength of its client and datacenter groups for the return to profitability.

Intel recently announced that it was ceasing development of its NUCs, passing the baton onto partners to carry on the business; Asus was named as the first company to continue producing the tiny PCs. The move came soon after Intel sold its server-building business to Taiwanese company Mitac in April. The cost-cutting measures are part of Intel's plan to slash $3 billion off its annual spending this year and $8 billion to $10 billion by 2025.

Despite the positive news, CFO David Zinsner urged some caution, noting a "moderate" recovery of global macroeconomic conditions and a "modest" recovery for Intel across the rest of 2023. There was also a warning that excess inventory in server CPUs will continue into the second half of the year.

Almost all of Intel's business units experienced YoY revenue declines, including sales in its data center and artificial intelligence business, which were down 15% to $4 billion from $4.7 billion in the year-ago quarter. Gelsinger did say, however, that the company has enough customers to sell at least $1 billion worth of its AI chips through 2024.

The only segment not to experience a yearly decline was Intel Foundry Services (IFS), which saw revenue increase to $232 million, up from $57 million a year ago. Gelsinger said some of the IFS sales increase came from advanced packaging, which involves placing multiple chip components from another company into a single "package" to lower costs and increase performance.

"There's a lot of interest in the industry for advanced packaging, because it is essential to deliver high-performance computing and AI," Gelsinger said. "So we expect a lot more business coming our way in that area."

https://www.techspot.com/news/99580-intel-back-profitability-after-successive-quarters-losses.html