In a nutshell: Intel wants to step in and help the automotive industry by creating chips for vehicles. CEO Pat Gelsinger said the company aims to produce the silicon within six to nine months.

We heard last week that Gelsinger was one of several executives from top chipmakers and auto manufacturers set to meet with high-level officials within the Biden administration to discuss the semiconductor supply chain issues. Execs from Dell, Samsung, Ford, HP, AT&T, Alphabet, General Motors, and others attended the April 12 meeting.

Following yesterday’s gathering, Gelsinger said Intel was talking to companies that design chips for automakers about manufacturing them in its fabs. The CEO last month unveiled plans to open up the company’s current and planned manufacturing capacity to other chipmakers through the launch of Intel Foundry Services.

Intel is spending $20 billion on two new state-of-the-art fabs focused on EUV-based (extreme ultraviolet) process technologies at 7nm and below in Arizona to help address the current chip shortages.

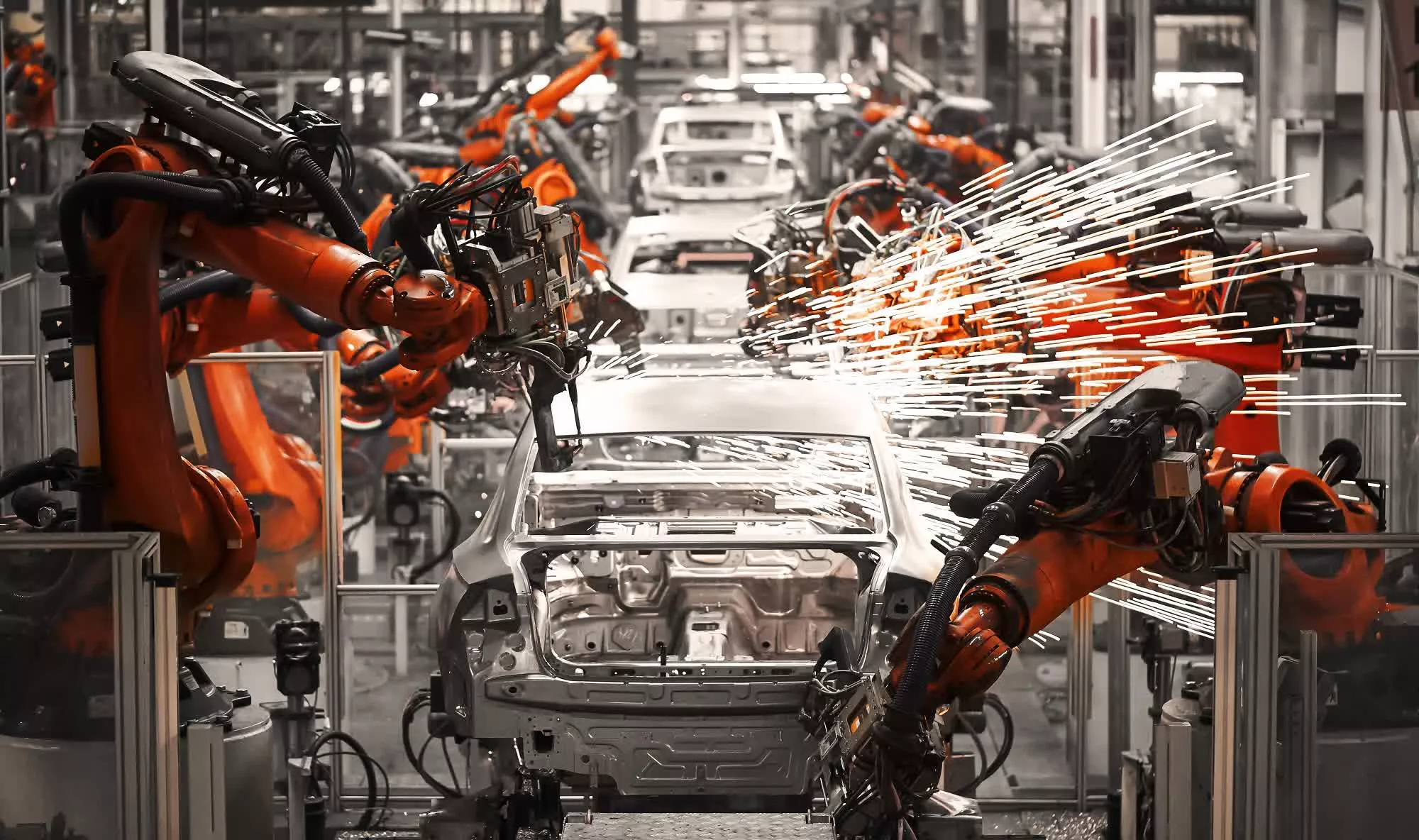

We all know how the chip crisis affects everything from PC hardware to consoles and home electronics, but one of the areas hit hardest has been the auto industry. Ford, GM, Audi, Honda, VW, Subaru, Toyota, Mazda, Nissan, and Stellantis (formed from the Fiat Chrysler/Peugeot merger) have all reduced or say they may reduce their output, with several plants shutting down entirely.

Every vehicle manufactured these days comes with a microchip controlling a range of entertainment, navigation, and vehicular systems. Thanks to Intel possessing its own fabs, which has helped keep its CPUs available (and discounted, in some cases), it can get to work on easing the supply problems relatively quickly.

“We’re hoping that some of these things can be alleviated, not requiring a three- or four-year factory build, but maybe six months of new products being certified on some of our existing processes,” Gelsinger said. “We’ve begun those engagements already with some of the key components suppliers.”

https://www.techspot.com/news/89282-intel-talks-automakers-produce-vehicle-chips-shortages-bite.html