In brief: Intel's first ASIC mining solution isn't quite as powerful or as efficient as existing offerings from companies like Bitmain, MicroBT, and Canaan. However, the company seems determined to develop increasingly energy-efficient solutions that it believes would help reduce the environmental impact of mining Bitcoin and other proof-of-work cryptocurrencies.

Earlier this month, Intel revealed it had been investing in blockchain technology as part of its renewed strategy to develop “the most energy-efficient computing technologies at scale.” These investments have mostly gone into developing specialized chips for hashing cryptocurrency transactions, also known as mining ASICs.

During this year’s IEEE International Solid-State Circuits Conference (ISSCC), Intel revealed more details about its first-generation “Bonanza Mine” (BMZ1) blockchain acceleration solution. The company has already started taking orders, and among its first clients are Jack Dorsey’s Block (formerly known as Square) and Bitcoin mining company GRIID.

The silicon giant also unveiled a 3,600-watt mining rig based on no less than 300 BMZ1 chips with a total system hash rate of 40 terahashes per second. For reference, Bitmain’s Antminer S19j can deliver up to 90 terahashes per second using around 3,100 watts. The latter company even claims its upcoming liquid-cooled miner will deliver up to 198 terahashes per second with a power consumption of 5,445 watts.

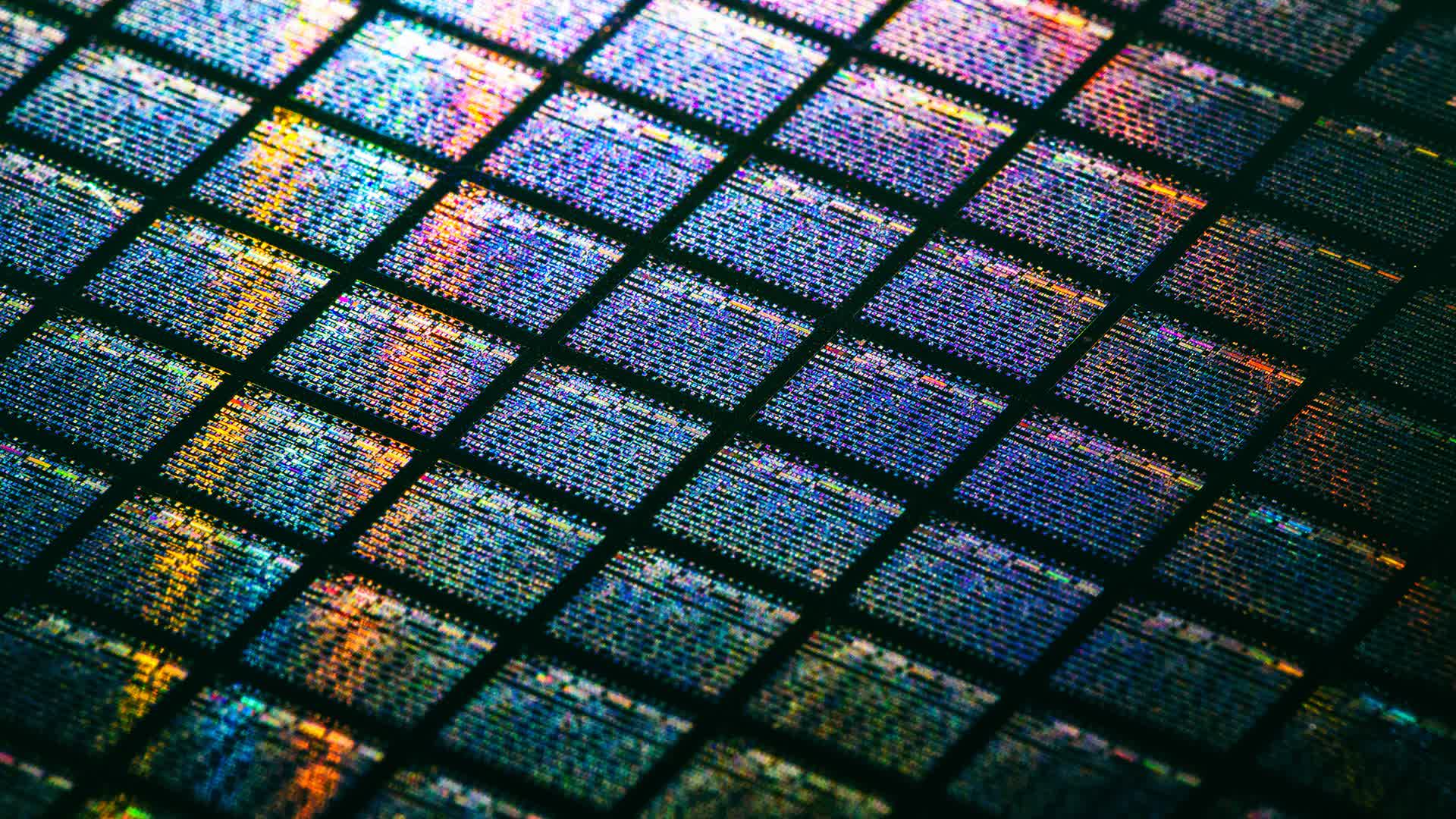

On the one hand, the current Bonanza Mine system doesn’t compare too favorably with existing solutions from competitors, at least in terms of mining efficiency. On the other hand, the small die size of the BMZ1 chip (7 by 7.5mm) allows for a density of up to 4,000 per wafer, possibly making this a more cost-effective alternative. Intel is also working on a second-generation blockchain accelerator chip, offering better performance-per-watt.

Cryptocurrency mining energy consumption has been a hot topic for a while now, and leading Bitcoin mining outfits have been trying to reduce the stigma around it. It's not yet clear how Intel's mining rig can help that cause, but perhaps time will tell.

https://www.techspot.com/news/93483-intel-unveils-3600-watt-asic-bitcoin-mining-rig.html