Highly anticipated: Christmas comes in August this year. Arm filed for Nasdaq listing in what could be the year's biggest IPO. The listing's prospectus is a document that we've been keenly awaiting for a long time. But like so many presents, this was not all that we had hoped for. We have read through the document, and we'll need to go through it a few more to really get into it. Nonetheless, we have have some clear first and second impressions.

First and foremost, Arm did not grow last year, with revenue declining from $2.7 billion to $2.6 billion and change. The document describes this as flat which is fair, but with all the markets and future technology Arm likes to talk about, this is not encouraging. More than anything else, this is likely indicative of a company that remains heavily reliant on the smartphone market, and that market is not doing particularly well right now.

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

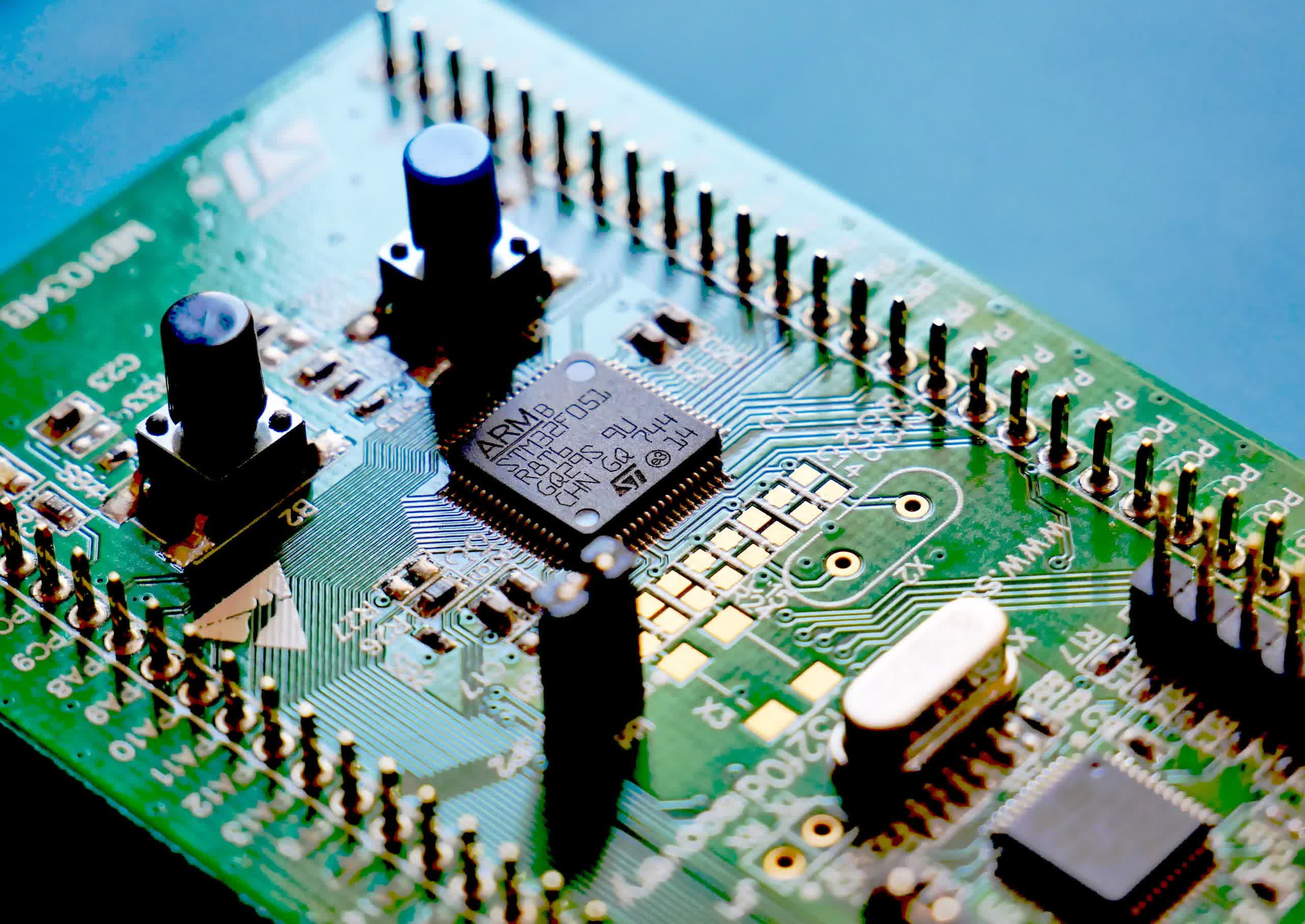

Second, the company continues to extract a small share from the value it contributes. Arm intellectual property (IP) powers all mobile phones, and many other devices. And yet they do not make much money from that.

In the last fiscal year, licensees shipped 30 billion Arm-powered chips, worth $98,9 billion, but Arm generated only $0.11 per chip, a 2.7% royalty rate. This is not per core, but per chip. We have written in the past that Arm's pricing model is broken, its largest customers have massive volume discounts built up over the years, which in addition to leading to financials like this also makes it much harder for new chip companies to adopt Arm and pay full price. Hence the growth of RISC V.

| Units | GBP | USD (@$1.28/GBP) | |

| Chip revenue | 77,265,625,000 | 98,900,000,000 | |

| Arm revenue | 2,679,000,000 | 3,429,120,000 | |

| Chips | 30,000,000,000 | ||

| Arm rev/chip | 0.09 | 0.11 | |

| Chip ASP | 2.58 | 3.30 |

Admittedly, IPO prospectus filings have to conform to tight legal requirements favoring historical over prospective topics. And we have not yet seen the company's roadshow materials.

Arm has publicly and behind the scenes taking steps to change its business model, for instance working directly with end customers as well as what they refer to as "holistic" solutions. These could be very important in shifting the company's prospects, but any mention of them in this filing is oblique.

Perhaps the biggest surprise in the document was the discussion of Arm China, including an attachment to the filing showing the agreement between the two companies (we have just begun to scan the Arm China agreement which is dense legalese).

Arm China, a separate company, is Arm's biggest customer contributing 24% of revenue. The filing presents this as a straightforward relationship, but we know it is actually the result of a long, fascinating drama. The latest material is like a bonus season after the conclusion of a beloved TV show which everyone had thought was long over.

One thing that jumped out at us was some of the detail of the structure of Softbank's ownership of Arm. This is held through an entity named Kronos. Last year, Kronos took out an $8 billion loan against its Arm shares. In theory, Arm is now on the hook to repay that loan in the event Kronos defaults. Given that the loan is collateralized by Arm shares, it is unlikely Arm itself will ever have to assume that debt. However, this is the kind of structure that private equity companies like to use to extract maximum value from their portfolio holdings, and is probably something for everyone to keep in the back of their heads in the event Arm suffers a prolonged period of a weak stock.

Our impression is that Arm resembles a low-growth company coming to market to satisfy the liquidity needs of its private equity owners.

Our impression is that Arm resembles a low growth company coming to market to satisfy the liquidity needs of its private equity owners. We are certain that there is more to the story, and that Arm has some interesting technology and business model changes in the works. And their position in many market remains fundamental. That being said, our hope was that after seven years as a private company and a new management team with some big ideas, that the growth prospects would be a little more clear.

As we continued to parse the Arm IPO prospectus, we gradually came to some more conclusions. Spoiler alert – we need a thesaurus to find alternatives to the word "challenging" – however, as we work through the filing we continue to find many interesting pieces of information.

First is this gem:

"We will not receive any of the proceeds from the sale of ADSs by the selling shareholder in this offering (including any proceeds from any sale of ADSs pursuant to the underwriters' option to purchase additional ADSs). All net proceeds from the sale of ADSs in this offering will go to the selling shareholder."

Which if you think about it sums up the whole exercise. Arm gets none of the proceeds. We recall an Arm executive warning that if the Nvidia deal failed and the company had to go public it would have to significantly cut costs. Now we know what he really meant.

However, far more encouraging (sort of) the company also provided us with a market share analysis of each of their end-market segments. their total addressable market (TAM). For some reason they presented this in text form, so we put together the chart below.

Note the dollar amounts refer to the sales of their customer's chips – as we noted earlier, Arm only captures a small share of this. The portion of the market they actually sell into (the Serviceable market or SAM) is $98 billion, which means they can tap into about 50% of all logic semis revenue.

| ($ billions) | 2022 | 2025 | ARM Share | 2022 CAGR |

| Consumer Electronics | $46.9 | $53.2 | 19.0% | 4.3% |

| Industrial/Embedded | $41.5 | $50.5 | 64.5% | 6.7% |

| Mobile Processor | $29.9 | $36.0 | 99.0% | 6.4% |

| Automotive | $18.8 | $29.1 | 40.8% | 15.7% |

| Networking | $18.2 | $17.2 | 25.5% | 1.8% |

| Cloud | $17.9 | $28.4 | 10.1% | 16.6% |

| Connectivity/Other mobile | $17.6 | $17.5 | 99.0% | -0.2% |

| HPC/Other | $12.7 | $13.7 | 16.2% | 2.7% |

| Total | $202.50 | $246.60 | 48.9% | 6.8% |

Note: Arm company data above + Arm's share for Consumer Electronics and Other Mobile are based on our estimates.

This table tells us a lot about the company's prospects. Automotive and Data Center are the fastest growing segments for the company, but we consider both highly competitive. The automotive market is undergoing significant change, and while Arm is well positioned with many chip vendors here, the race has a long way to go, and Arm's position is by no means certain.

Not for nothing, we suspect that much of Arm's market share here consists of Qualcomm design wins, and they are, of course, suing Qualcomm. Data Center is also growing, and the fact that they have carved out 10% here is a big achievement. However, much of that is built on the back of just two companies - AWS Graviton and Ampere.

We also want to point out we do not believe the numbers for Industrial/Embedded – this market is growing strongly right now with Chinese chip designers piling in, and they are largely using RISC V. We think that market is growing much faster than 6.7% (at least in terms of units) but that Arm's share is significantly lower.

Overall, we see this data as the proverbial 50% glass. Glass half full – they are growing share in the fastest growing markets. Glass half empty – they are heavily reliant on some of the slowest growing markets.

Moving on, the Risk Factors section of the filing is full of interesting details.

- Arm lists RISC V as a competitive risk factor, but makes fairly few mentions of it, highlighting x86 as well as internally developed alternatives equally.

- The company cautions that US trade restrictions on semis exports to China may expand to cover Arm IP or crimp customers' sales. So far the US government has remained silent on the topic of IP, but it certainly is a risk.

- Softbank will hold all board seats at Arm, until it drops below 70% control, no independent directors required. Softbank also has full dilution protection. Add to this the fact that Arm is technically listing ADS not common shares. ADS have different voting rights, and while this is standard practice the layer does add a further wrinkle to future governance matters for the company.

- As we noted above, a Softbank affiliate has taken out an $8.5 billion loan collateralized by the 75% of Arm shares it owns. After the IPO this will be rolled into a new facility which includes covenants about margin calls in the event Arm's shares decline by an undisclosed amount. This could get messy...

- Softbank's internal valuation of Arm is $64 billion, which is a number the press has cited as the target for the IPO. This could also get messy...

- Qualcomm contributed 11% of Arm's revenue last year, roughly $300 million.

In the risks section there is a tantalizing mention of Arm designing custom chips. It has been widely rumored that Arm is going to enter the business of chip design as a way to move up the value chain. They warn that this is risky and could cause conflicts with existing customers, of course it appears in the risk section so all downside is to be expected. That said, maybe Arm has something more interesting in the works here.

One final note. Arm was an early investor in privately-held Ampere, designer of data center server CPUs. Arm owns 6.8% of Ampere, and they value that stake at $416.2 million (they have written that down to $389 million). This implies Ampere's value is $6.1 billion. Relevant in part because we are highly interested in Ampere, but also important because the fate of Arm's IPO will weigh heavily on Ampere's prospects for going public next year.

For further reading, we have one additional piece discussing Arm's rumored $64 billion valuation. Put simply, this is a suicidal figure. An old truism among investors is that good companies do not always make for good stocks. That holds true for Arm. They are a good company, but they are not a high flying tech company. They emerged from years of sleepy, private ownership with no major changes, no added excitement. They will grow, Arm processors remain important for semiconductors, but neither their growth nor their current economics merit a high-flying valuation.

https://www.techspot.com/news/99931-looking-deeper-arm-ipo-prospects-first-second-impressions.html