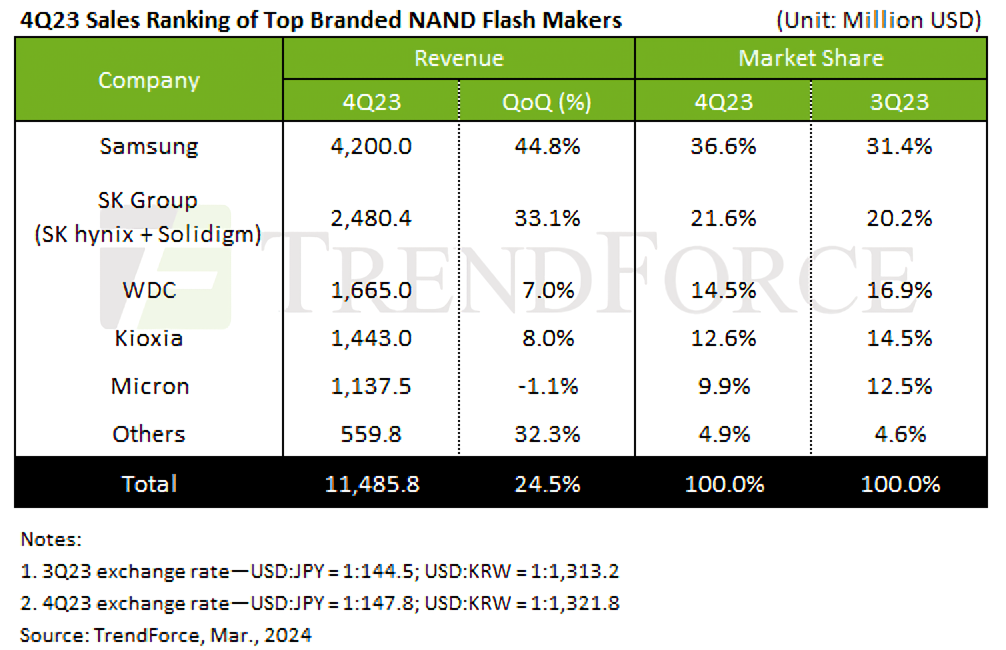

In a nutshell: The NAND flash industry was able to reverse its fortunes in the fourth quarter of 2023, and grow revenue by nearly 25 percent quarter over quarter. The latest data from TrendForce highlights a substantial 24.5 percent QoQ increase in NAND flash industry revenue to $11.49 billion.

The research firm said the growth was the result of stabilization in end user demand driven by year-end promotions "along with an expansion in component market orders driven by price chasing, leading to robust bit shipments compared to the same period last year." Production cuts in the second half of 2023 no doubt contributed to the turnaround as well, lowering operating costs while helping to correct inventory issues.

The situation is only expected to improve for industry players in the near term. TrendForce said it expects to see revenue increase by another 20 percent in the first quarter of this year, fueled by improved supply chain inventory levels and rising component prices. We can also anticipate customers ramping up orders to avoid any potential supply shortages and to lock in prices before they climb any higher.

Samsung beat out the competition with regard to overall revenue haul, generating $4.2 billion from its NAND flash business in Q4 2023 – or an increase of 44.8 percent quarter over quarter – by increasing its shipment volume by 35 percent QoQ while boosting its average selling price by 12 percent.

SK Group (made up of SK Hynix and Solidigm) combined for $2.48 billion, representing a 33.1 percent increase compared to the previous quarter. WDC came in third place with $1.66 billion in revenue but only a seven percent increase quarter over quarter. Western Digital's bit shipment volume dipped by two percent but ASP rose by 10 percent. Kioxia and Micron rounded out the top five with $1.44 billion and $1.13 billion in revenue, respectively.

As we said a few months ago, there is no better time than the present to buy a new SSD. Prices are only going to go up from here, and who knowns when or if we will see another dip that brings prices this low again.

https://www.techspot.com/news/102159-nand-flash-market-turnaround-revenue-surged-25-q4.html