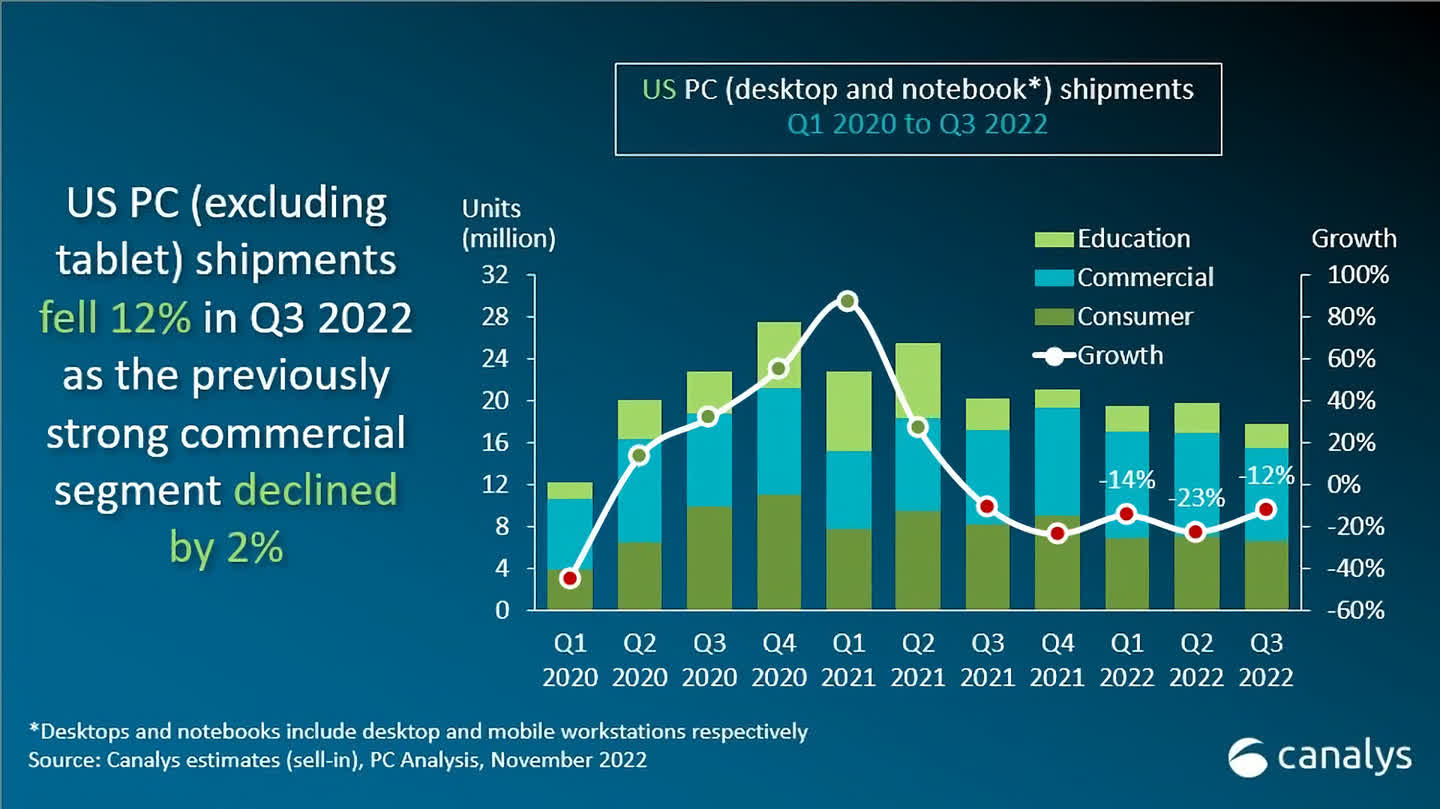

The big picture: Domestic shipments of desktops, notebooks and workstations collectively dipped 12 percent in the third quarter of 2022, from 20.3 million units in Q3 2021 to 17.8 million units in the most recent three-month period. Among them, notebooks suffered the biggest decline at 14 percent and desktops grew a modest one percent according to the latest report from market research firm Canalys.

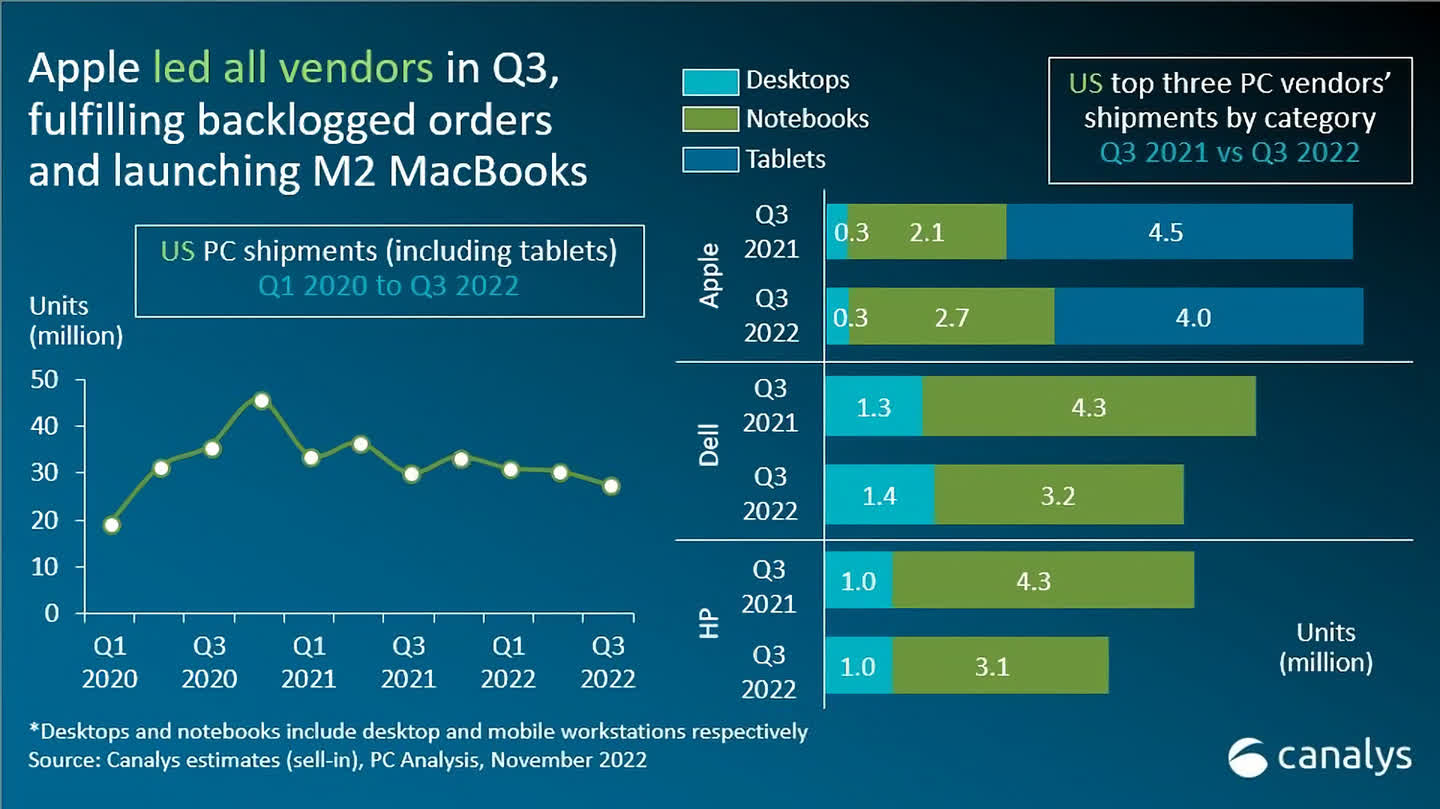

Dell led the way in the third quarter with 4.7 million systems shipped in the US followed by HP at 4.1 million and Apple at three million. Among the top five vendors by volume, only Apple and Acer experienced positive annual growth. HP saw sales slide more than 23 percent year over year and Lenovo's US shipments were down 22.2 percent.

Factoring tablets into the equation puts Apple in first place by a sizable margin. Cupertino shipped four million iPads in Q3, followed by Amazon in second place with 2.7 million Fire tablets shipped. Third place went to Samsung with 1.6 million units shipped during the same period.

Among the top five tablet manufacturers, only Amazon and TCL posted annual growth. Apple, Samsung and Microsoft all reported double-digit quarterly dips compared to the same period in 2021.

Despite the dips, manufacturers and retailers are doing everything they can to spur sales including ramping up promotions during the holidays. We saw several attractive deals on offer during Black Friday and Cyber Monday week and they're likely to keep coming right until the very last minute. Then of course, you'll have post-holiday sales because everyone will need something to spend their gift cards and newfound cash on.

Canalys research analyst Brian Lynch expects the US PC market to face further headwinds despite the Q4 holiday season. Cash-strapped consumers are expected to continue to cut spending on expensive technology products, resulting in retail inventories growing faster than sales. The education sector is forecast to begin a slow recovery next year but the majority of device refreshes are now expected to happen in 2024.

Image credit: Santeri Viinamäki

https://www.techspot.com/news/96846-pc-shipments-us-dipped-12-q3-despite-attractive.html