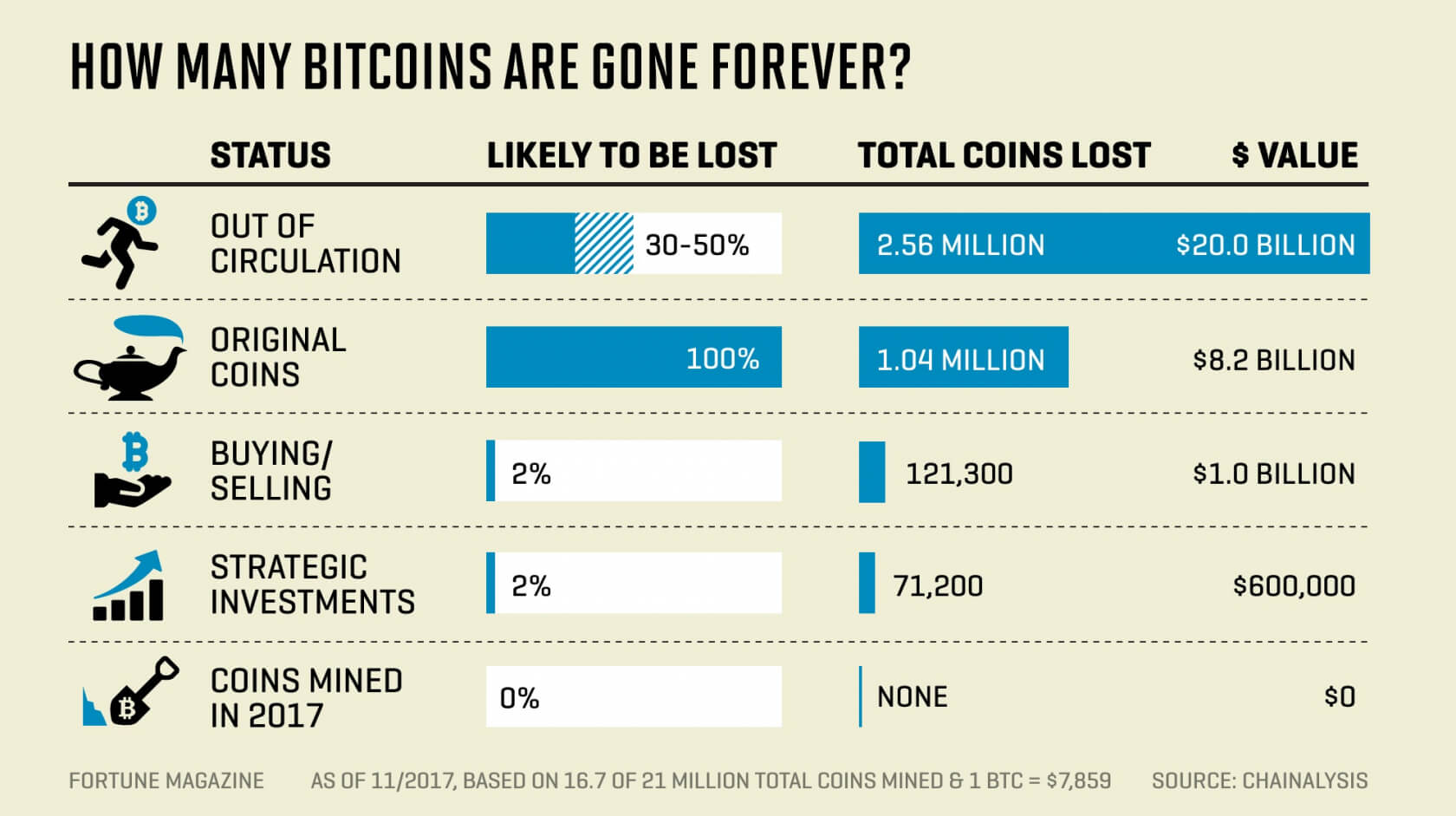

Chainalysis, a New York-based company that specializes in blockchain analysis, has uncovered some surprising information about Bitcoin. Its research shows that close to 4 million BTCs, which have a value of over $30 billion, could have disappeared forever.

As reported by Fortune, there are only 21 million Bitcoins that can be mined in total, but once they’ve all been taken by the year 2040, the actual amount available to spend or trade will be much lower than that figure. Chainalysis’ high estimate puts the number of Bitcoins gone for good at 3.79 million, while the low estimate places it at 2.78 million. That means 17 percent to 23 percent of existing Bitcoins are lost. With the price of a single coin now over $9500, that represents a lot of money.

While it wasn’t keen to reveal the exact methods behind its findings, Chainalysis used age and transaction activity to determine which Bitcoins haven’t been moved for long periods of time.

Most of these missing Bitcoins come under the ‘Out of circulation’ category, which covers those coins mined in the technology’s early days when they were almost worthless—the person who threw away a hard drive with the key to 7500 Bitcoins is cited as an example of how people were less vigilant about keeping them back then. This segment also assumes that many coins mined 2-7 years ago and belonging to long-term investors called “Holders” are gone.

Only 4 percent of Bitcoins used for strategic investments and buying/selling have been lost, while none of the coins mined this year have disappeared.

Interestingly, the second-largest number of lost Bitcoins is in the ‘Original Coins’ category. These belong to the cryptocurrency’s creator, known only by the pseudonym Satoshi. Wallets associated with the mysterious inventor, who hasn’t been heard from since 2011, represent 1 million Bitcoins. Chainalysis assumes that these coins are lost.

It's worth noting that the findings do make assumptions about some coins being gone forever, hence the inclusion of a low estimate.

Speaking to Fortune, a senior economist for Chainalysis, Kim Grauer, talked about Bitcoin scarcity and if its current value already takes into account the missing coins.

That is a very complex question. On the one hand, direct calculations about market cap do not take lost coins into consideration. Considering how highly speculative this field is, those market cap calculations may make it into economic models of the market that impact spending activity. Yet the market has adapted to the actual demand and supply available – just look at exchange behavior. Furthermore, it is well known monetary policy procedure to lower or increase fiat reserves to impact exchange rates. So the answer is yes and no.

https://www.techspot.com/news/72040-report-almost-4-million-bitcoins-could-lost-forever.html