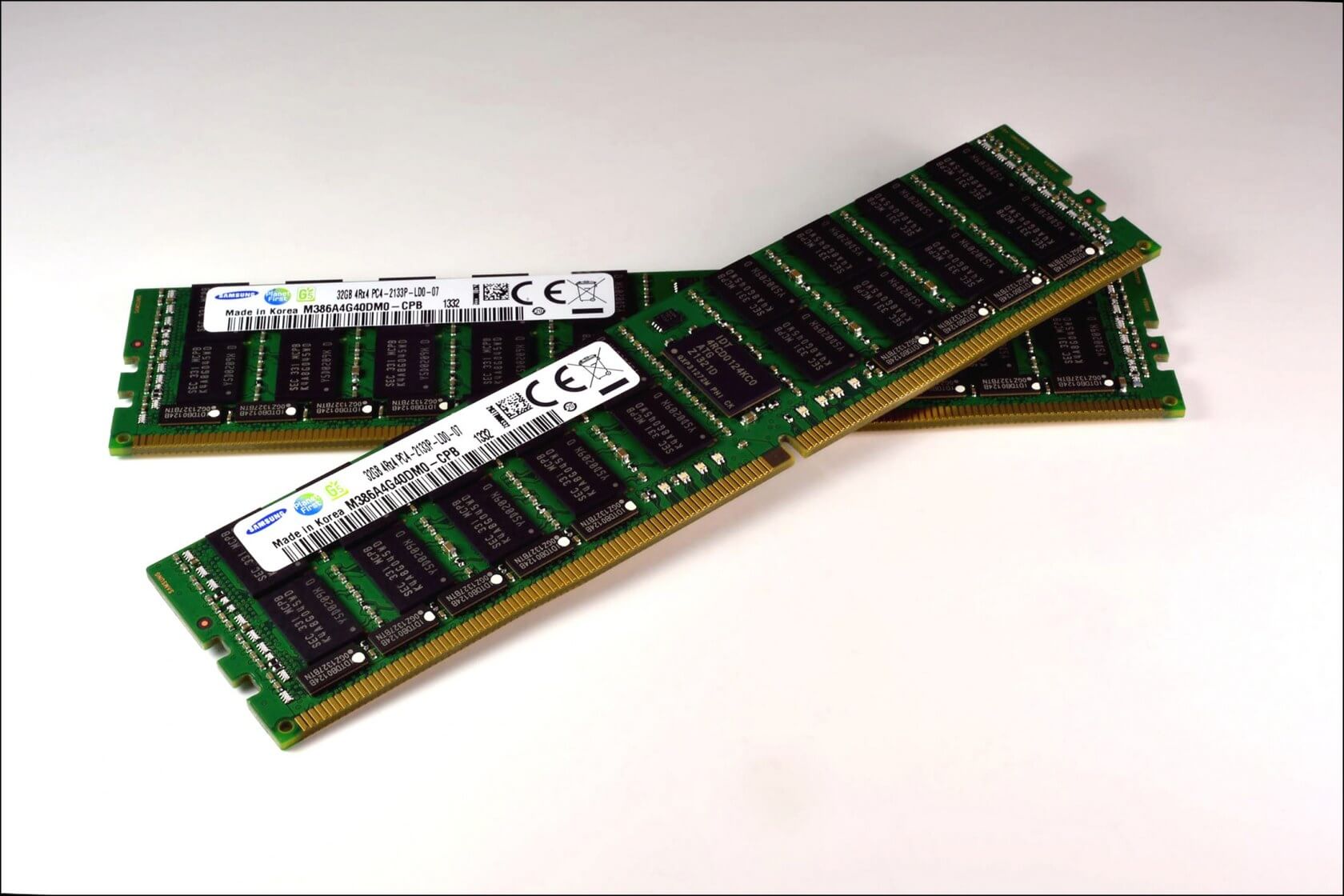

Samsung has long relied on its chip business to help the firm to record quarters, but it’s been claimed that the tech giant hasn’t always played by the rules. A class action lawsuit alleges that the company, along with two other major manufacturers, was limiting supplies of DRAM chips to inflate the prices.

The suit was filed in the US District Court for the Northern District of California by law firm Hagens Berman on behalf of US consumers who purchased smartphones and computing products that use DRAM between July 1, 2016, and February 1, 2017.

The suit cites an investigation conducted by Hagens Berman antitrust attorneys that claims to have discovered Samsung, Hynix, and Micron, who collectively make up 96 percent of the global DRAM market, colluded to limit supplies of the chips, resulting in "illegally inflated prices." It was only when the Chinese government announced an investigation into the situation in 2017 that the “conduct changed abruptly,” reads the filing.

Demand for DRAM jumped 77 percent in 2017, following an eight percent decline in 2016. The price of the chips went up 47 percent during the stated time period, according to the law firm, the highest in almost 30 years. As a result, revenue from DRAM sales more than doubled at the three companies.,

“What we’ve uncovered in the DRAM market is a classic antitrust, price-fixing scheme in which a small number of kingpin corporations hold the lion’s share of the market,” said Hagens Berman managing partner, Steve Berman. “Instead of playing by the rules, Samsung, Micron and Hynix chose to put consumers in a chokehold, wringing the market for more profit.”

Hagens Berman has been here before. The firm won a $300 million settlement against 18 DRAM manufacturers in a similar suit back in 2006. As noted by Gizmodo, the company has filed suits against Apple, Facebook, Tesla, six major hotel chains, BMW, and Harvey Weinstein, all of them since the start of the year.

If you want to find out more and are thinking about joining the suit, head on over to Hagens Berman’s website.

https://www.techspot.com/news/74369-samsung-micron-hynix-hit-class-action-suit-over.html