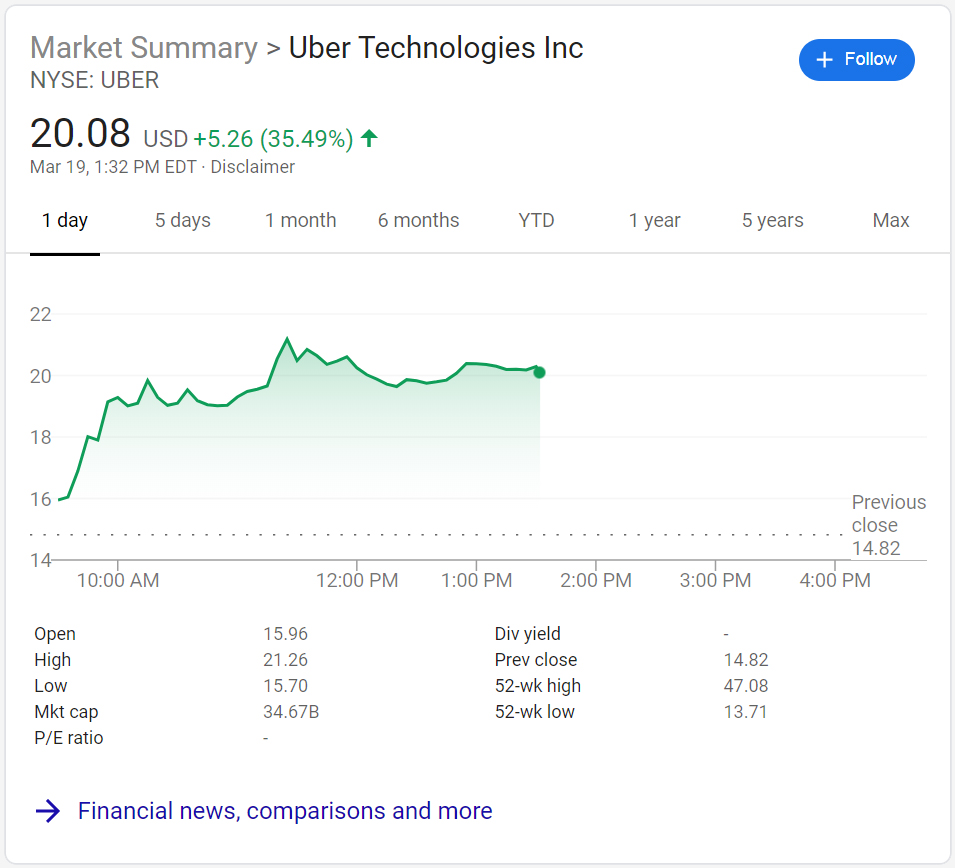

In brief: Uber CEO Dara Khosrowshahi in a conference call on Thursday said ride volume in some major cities like Seattle has dropped as much as 70 percent in recent days. Yet surprisingly, share value in the company is up more than 33 percent on the day. So what happened?

As TechCrunch recounts, Khosrowshahi said Uber has "ample liquidity." At the end of February, the company had $10 billion in unrestricted cash on hand. Even if global rides drop by 80 percent this year, the company would still be left with $4 billion in the bank.

"In any crisis, liquidity is key," the executive said.

While the majority of Uber's revenue comes from rides, the company is fortunate to be uniquely positioned to have other streams of revenue as well. Uber Eats, its food delivery arm, is doing particularly well as people shelter in place.

Uber is also considering using its network to deliver other items, like basic goods and even medicine. Grocery delivery could also be a viable option, especially considering the sharp uptick in delivery app downloads in recent days.

Earlier this week, Uber suspended its Uber Pool shared rides service and waived delivery fees for local restaurants that are new to Uber Eats.

Notably, the company didn't update its revenue guidance in today's conference call.

Share value in rival Lyft is also rebounding on Thursday. As of writing, the stock is up more than 27 percent after seeing more than half of its value disappear since the beginning of the year.

Masthead credit: Uber by InFootage.com