A hot potato: In another example of society's increasing abandonment of cash, some branches of a massive bank have stopped dealing with physical money over the counter. It comes after years of falling ATM use, a trend that drastically accelerated during Covid.

The Australia and New Zealand Banking Group (ANZ), Australia's second-largest bank by assets, recently said that a significant drop in in-branch transactions has led it to stop handling cash at some branches.

ANZ told NCA NewsWire that cash and cheque deposits and cash withdrawals would only be possible at these branches by using the onsite SmartATMs. Bank staff will be on hand to help customers who may have not previously used the machines - instead of handling cash behind the counter, presumably.

The reason behind the decision is that Australia, like the rest of the world, is using less cash. As per The Reg, Australia's Reserve Bank reports that the use of cash in day-to-day transactions has been declining since the mid-2000s.

The number and value of ATM withdrawals in Australia have declined by 60% and 40%, respectively, since 2008. Cash withdrawals took a huge nosedive during the pandemic, and have only slightly recovered since then.

Australians made 75 million ATM withdrawals in the month of December 2008. That felt to just 31 million in February 2021, a slight improvement over the 21 million withdrawals made during the Covid lockdowns.

With more people favoring digital payments over traditional physical methods, ANZ said fewer people are visiting banks, with a 50% decline in in-branch transactions over the last four years. "Only eight percent of our customers solely rely on branches for their everyday banking needs, with the majority preferring online and mobile banking methods," said an ANZ spokesperson, adding that most customers who visit are there to discuss large and complex financial transactions.

We are now at the 'give me convenience or give me death' stage of Western civilisation.

--- dystopian down under (@dystopian_DU) March 30, 2023

ANZ Bank ends cash withdrawals from its branches - as the end of paper notes looms. It's tap and go from here on in...https://t.co/Y99GQF8Vrd pic.twitter.com/p9vSCZhRVA

Despite the world moving closer to a cashless society, some Australians have expressed outrage at the bank's decision. "I'll let my 90-year-old Italian grandmother know that she can (no) longer access her own money in a supposedly first world country," one social media user wrote. "It's disgusting, what about the elderly who don't have debit cards and only have bank books?" said another.

But with just 13% of purchases in Australia now using banknotes or coins, plenty of people said they can understand why the bank is making this move.

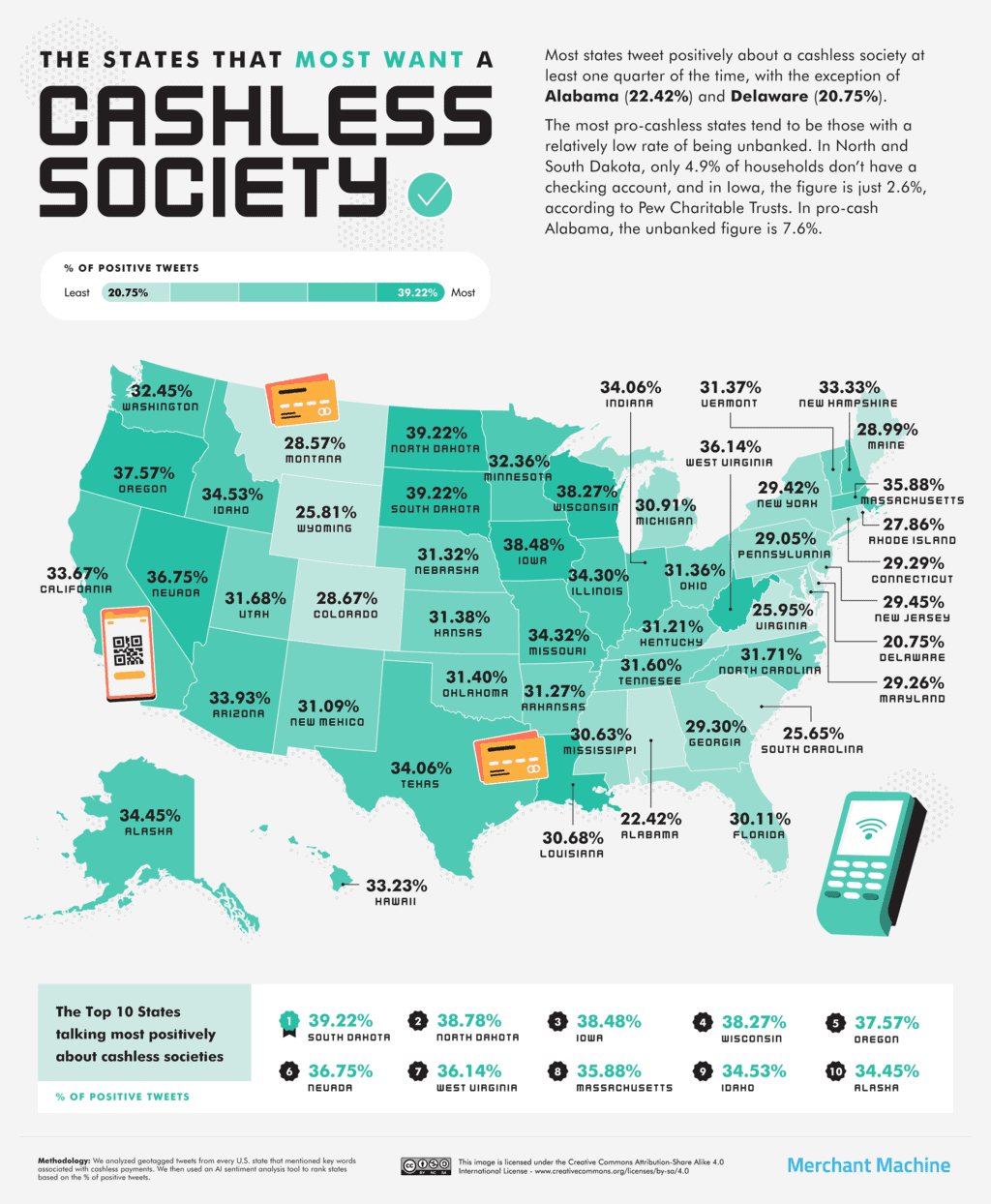

Back in November, a report suggested that only two states in the US were opposed to a cashless society: Alabama and Delaware. Despite objections, it increasingly looks as if we're rapidly heading in this direction, whether people like it or not.