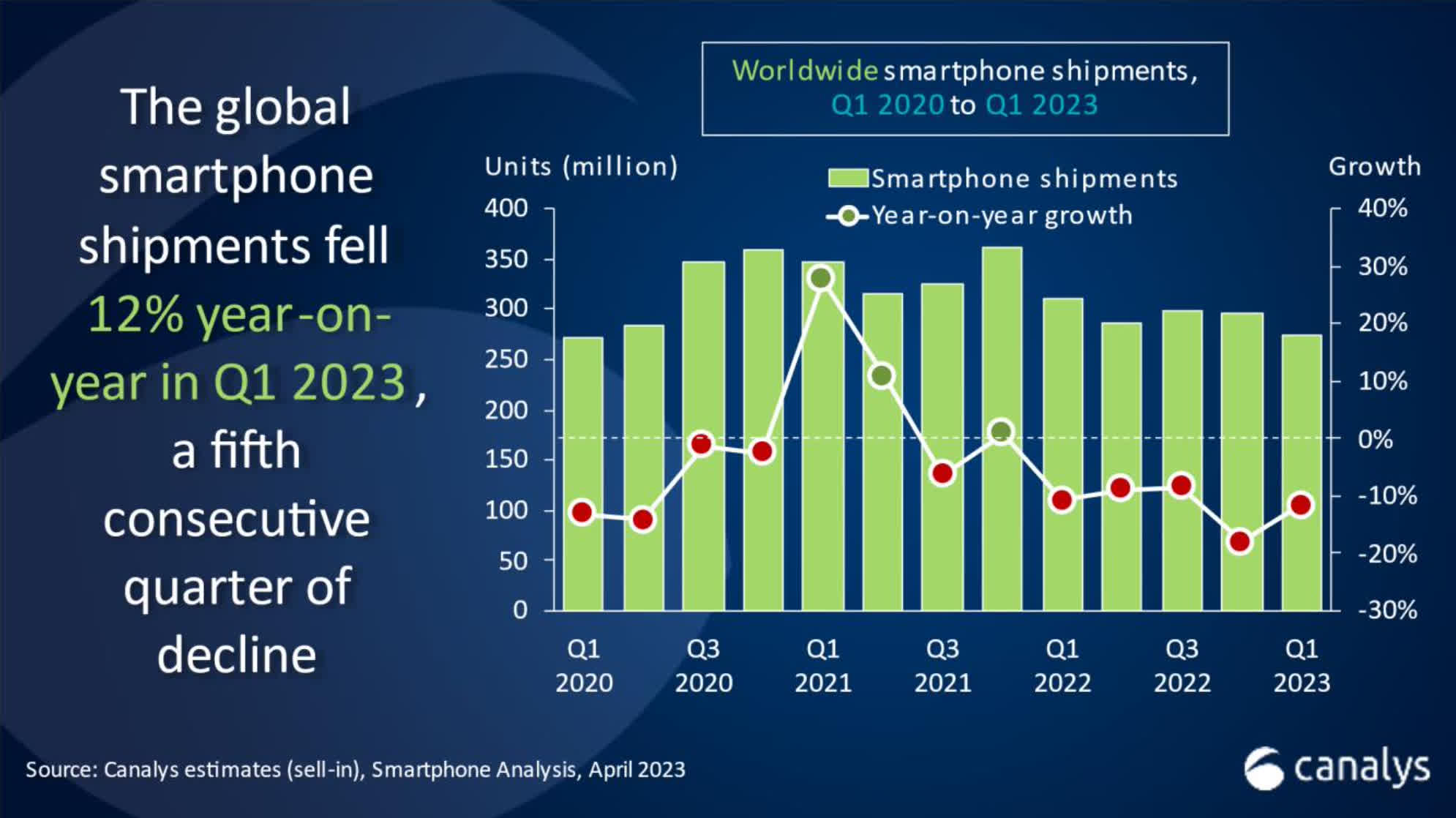

In brief: The smartphone market just saw its fifth straight quarter of decline in what has become a familiar picture of phone makers experiencing the sting of low demand for their products. Changing consumer priorities made for a horror holiday quarter, but the first three months of 2023 were hardly different.

Earlier this year, we learned that smartphone shipments had dipped to the lowest point observed in a decade. Last year was a rough one for phone makers who were expecting consumers to get tired of their aging 4G handsets and give way to a new "upgrade supercycle." Companies like Samsung saw their profits evaporate as low demand for mobile devices also translated into smaller orders for NAND, DRAM, and other components.

The trend of slowing smartphone sales continued into the first quarter of this year with a 12 percent year-over-year decline. Interestingly, Canalys analysts believe the market shows signs of stability even as they report on the fifth consecutive quarter that saw waning demand for this device category. Perhaps they are optimistic about the rough economy improving in the second half of this year like most industry watchers, but we'll have to wait and see.

The decline, they say, was the expected result of high inflation, changing consumer priorities, and general chaos along the supply chain. Despite an oversupply of chips and other components as well as aggressive marketing campaigns, people are holding onto their phones for longer and viewing them as commodities that see incremental improvements with each new generation that comes out. Still, with every passing quarter, there's an increasing chance that some consumers will need to upgrade.

When zooming in, Apple and Samsung fared better than other smartphone vendors. Samsung even managed to improve quarter-over-quarter and capture 22 percent of the global market, surpassing the Cupertino giant in the process. That said, strong sales of the iPhone 14 Pro helped Apple secure second place with a 21 percent market share. Then we have Xiaomi, Oppo, and Vivo with 11 percent, 10 percent, and eight percent of global shipments, respectively.

Canalys says most brands are taking measures to reduce existing inventories and adjust their manufacturing volume to match the lower demand. The most glaring example is Samsung, which has scaled back memory chip production until prices stabilize and demand grows again. Other suppliers will likely follow suit in the coming months.

Overall, this is a familiar picture that describes not only smartphones but the health of the entire tech industry. Worldwide IT spending is expected to take another hit in the coming months, and the most optimistic predictions point to an eventual recovery towards the end of the year.

Masthead credit: Daniel Romero