In brief: Intel finished 2022 on wobbly legs but is steadfast in its belief that greener pastures are looming. Intel reported revenue of $14.0 billion for the fourth quarter ending December 31, 2022, which is down 32 percent compared to the same period a year earlier. Gross margin slid to 39.2 percent from 53.6 percent a year earlier, and net income (loss) was $644 million. Earnings per share (loss) for the quarter checked in at $0.16.

Notably, Intel remained profitable for the full year with $63.1 billion in total revenue and net income of $8.01 billion. For comparison, Intel generated $79 billion in revenue and $19.9 billion in net income in 2021.

Intel boss Pat Gelsinger said despite the economic and market headwinds, they continued to make good progress on their strategic transformation in the fourth quarter which included advancing their product roadmap and improving operational structure and processes to further drive efficiencies.

In 2023, Gelsinger said, they will continue to work through short-term challenges. Intel CEO David Zinsner added that steps taken to right-size the organization and rationalize investments underpin cost-reduction targets of $3 billion in 2023 and puts them on the road to achieving $8 billion to $10 billion in savings by the end of 2025.

None of this is terribly surprising as Intel's results reflect what has taken place across the wider PC market in recent months.

Market analyst IDC recently said shipments of traditional PCs were down 28.1 percent over the holidays compared to the same period in 2021. Shipments of hard drives were nearly split in half last year and even peripheral maker Logitech saw sales slide around 23 percent during the holiday quarter.

Related reading: The Rise, Fall and Renaissance of AMD

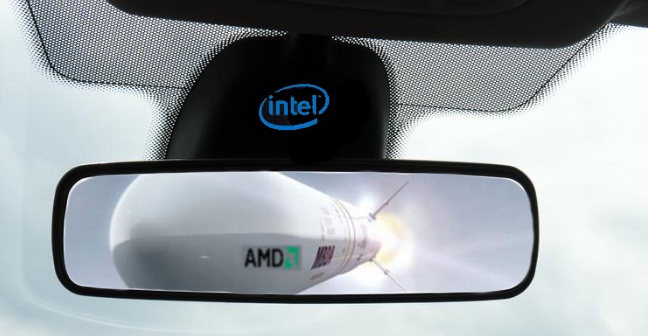

Strong competition from market rival AMD has not helped Intel's efforts either, nor has Apple's trek into in-house hardware. Apple started the transition to its own processor design in late 2020 and at this point, nearly every new Mac is offered with Apple silicon inside.

Share value in Intel is down more than seven percent as of this writing.

https://www.techspot.com/news/97413-intel-reports-massive-quarterly-loss-pc-demand-continues.html