The big picture: The downward slide that affected most hardware markets throughout 2022 continued to stifle LCD monitor shipments in early 2023, but some vendors have started to turn the quarter. Analysts believe multiple factors emanating from China could trigger a market recovery sometime this year.

TrendForce reports that most major LCD monitor sellers saw declining shipments in the first quarter of 2023. However, positive numbers from some companies could signal an overall market recovery in the next quarter.

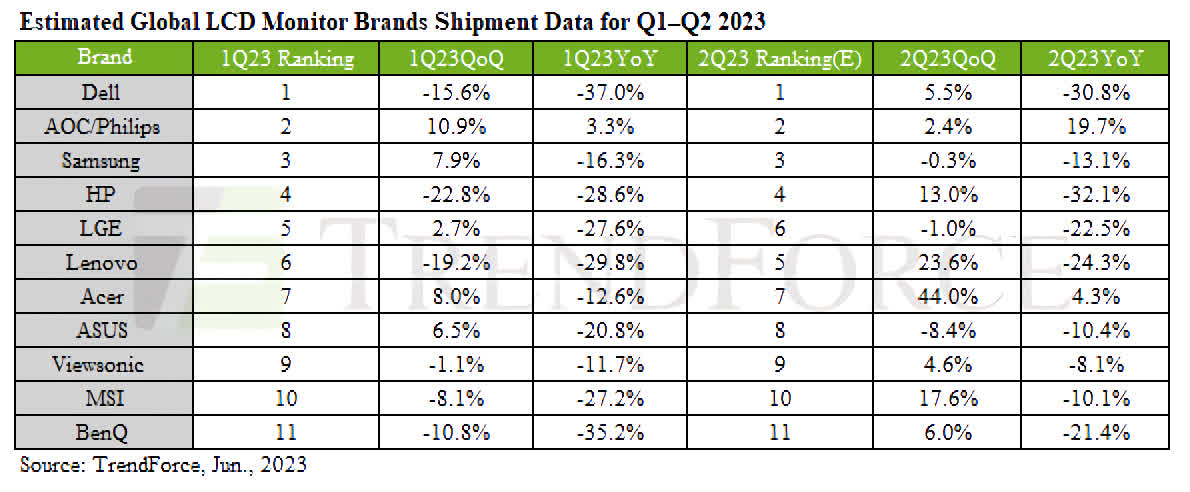

Compared to Q4 2022, the global LCD monitor market was down by 7.4 percent. Numbers from HP looked the worst, with shipments dropping by 22.8 percent. Lenovo was down 19.2 percent, and Dell declined 15.6 percent.

Year-over-year numbers were worse, with a 20.5-percent overall drop and almost all the top sellers showing double-digit declines. Asus, HP, LGE, and MSI saw shipments decrease by over 20 percent, while Dell and BenQ suffered falls exceeding 35 percent YoY.

The number-two player, AOC/Phillips, defied the negative trend, raising the curve 10.9 percent quarter-over-quarter and 3.3 percent year-over-year. TrendForce attributes the company's performance to rising consumer demand in China, which will help drive a more significant market recovery in the next quarter.

Although AOC/Philips was the only company with positive annual movement, Samsung, LEG, and Asus posted slight quarterly growth. Analysts predict Q2 global shipments could increase by 9.3 percent compared to Q1, while the year-over-year deficit could shrink to 13 percent.

A significant sales driver will be this weekend's 618 shopping day, a discount-filled event to celebrate the birthday of JD.com, one of China's primary e-commerce giants. Since the company started the occasion in 2010, it has grown into China's second-biggest day for online shopping, behind Single's Day on November 11.

Furthermore, companies like Acer and MSI are transitioning to high refresh-rate panels – part of a broader recovery in the gaming monitor market TrendForce previously projected for 2023. Displays ranging between 100 and 200Hz could see gains, partially due to the reopening of Chinese internet cafes following pandemic lockdowns. Competitive gaming events at the 2023 Asian Games this fall could also positively influence shipments.

Although TendForce expects LCD monitors, gaming monitors, and some other PC market sectors to rebound in the latter half of 2023, the overall PC monitor market could take until 2024 to regain ground lost in 2022.

https://www.techspot.com/news/99109-lcd-monitor-shipments-ugly-q1-2023-but-market.html