In the midst of the latest round of turmoil in the crypto world, Benedict Evans made a smart tweet (which is something of a superpower for him). A regular theme of Benedict's holds that many of the big-name technology companies we see today are not solving "Silicon Valley" problems, they are instead solving "Hollywood" or "Detroit" problems. And the same holds for the vast majority of crypto companies.

It is kind of entertaining (from a safest distance) to watch DeFI speed-run the last 100 years of financial services regulation in much the same way that Elon is speed-running content moderation https://t.co/qp49Ry6dqZ

— Benedict Evans (@benedictevans) November 8, 2022

Recall our view that most crypto projects today are either hopeless science projects or outright frauds, the trick is finding that small number of legitimate projects that will someday be immensely valuable. The latest drama around crypto mega-exchange FTX is just the latest example of this. We are not saying that FTX is a fraud, but it is now becoming clear that they were operating out past the frontier of regulatory oversight.

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

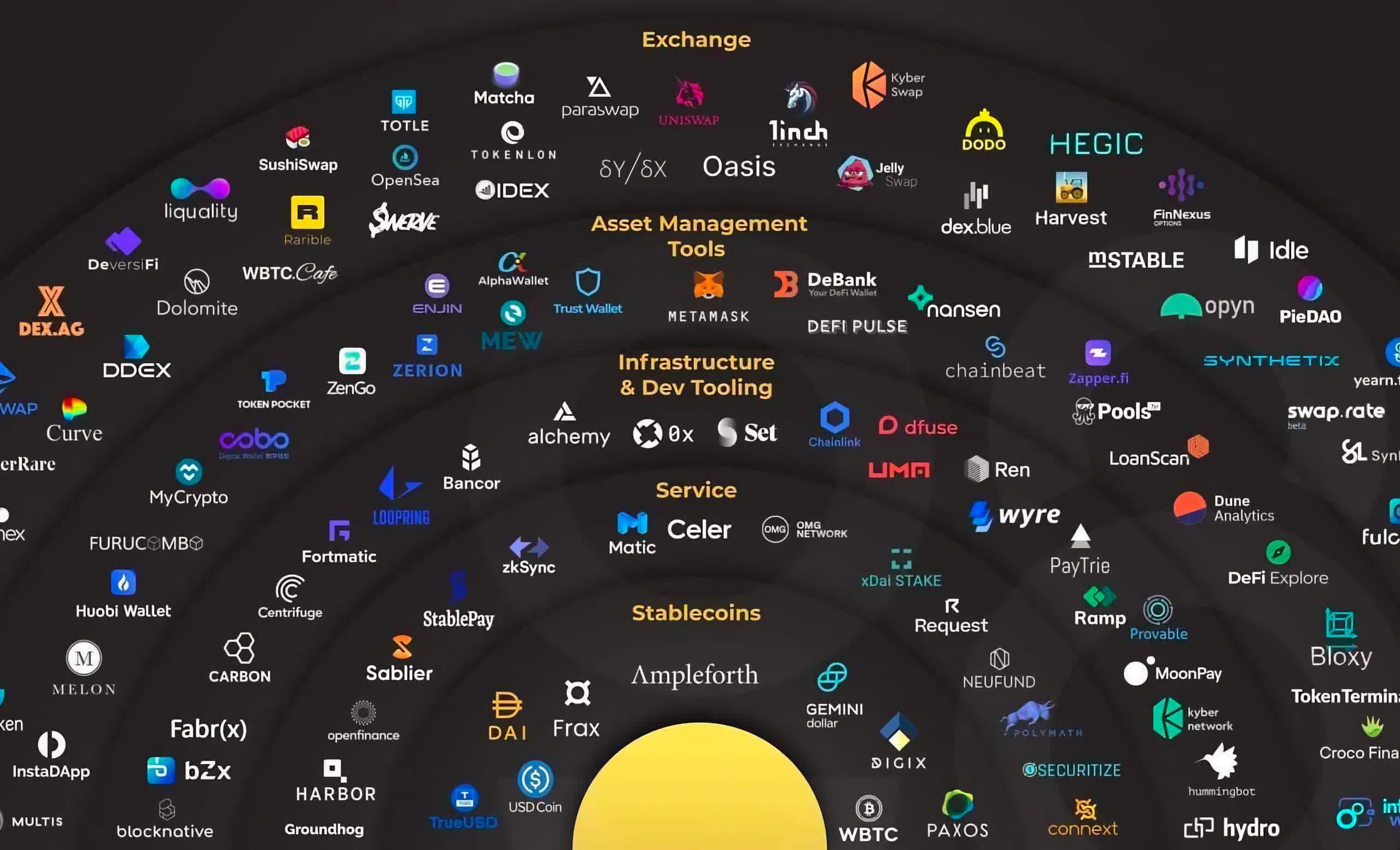

Aside from a handful of major coins (I.e. Bitcoin and Ethereum), the vast majority of revenue-generating crypto companies are financial entities – exchanges, stable coins, custodians, etc. And while all these companies are built on some solid, or at least interesting, technology, they are not technology companies.

In the case of FTX, it is just a market for trading financial instruments. Traditional financial markets have gone through hundreds of years of evolution, boom, bust and regulation. As much as everyone on the Street grumbles about the SEC, the regulators serve an important purpose. So much of the gains that crypto companies garnered over the past decade have been built on what is at heart a regulatory arbitrage, and now we are seeing the price of that. The now-teetering FTX has found out the hard way that it was supposed to be solving a Manhattan problem, not a Silicon Valley one.

In light of this, we think it is important to rethink what we think of as "technology". We are as guilty of this as anyone, and we use that word as a shorthand for all kinds of highly divergent businesses. But if we really take a look at the "Tech" companies out there, a surprisingly small portion of them are actually solving technology problems.

Take an average CRM company, of which there are hundreds. These companies use technology to differentiate themselves, but their focus is on design and User Experience, or integration with other systems. These are important problems, but they are not truly tech problems.

This is important for a few reasons. First, if we use this broad definition of technology then everything is a technology company when every company from the proverbial box factory to the street merchant is using some form of digital communications and software. Technology for these companies is a tool, it helps them solve their business problem.

By contrast, there are still many companies that look to solve technology problems because that will bring them business. We are biased toward classifying most hardware companies in this way, but it is not as simple as that. There are many interesting software companies out there that should fall in this camp as well.

Obviously, this is a highly subjective classification system, but we think this is an important framework to keep in mind. The cold reality is that for the past ten years, the capital markets have lost sight of this distinction, and the current market is the price they are paying for that.

We believe, pretty firmly, that the coming decade will see a reversal of this trend. It has to. Investors, and the market, will need to re-learn what is truly a technology problem and what is just a business model that gets better better with the application of some technology. Returns will be found in both camps, but we suspect the returns for the former will be much better.

Masthead credit: Israel Andrade

https://www.techspot.com/news/96646-opinion-what-technology-company.html