In brief: Arm chips are eating the world thanks to the company's unique business model that allows others to license its designs. Some of Arm's biggest customers hate the idea of Nvidia gatekeeping the tech through an acquisition, so they're urging regulators to take a careful look at the potential antitrust implications.

When Nvidia announced it was buying Arm for a whopping $40 billion, it understandably shocked a number of tech giants, as it's bound to change the semiconductor landscape as we know it and extend Arm's influence beyond smartphones and the Internet of Things. Even the company's co-founder, Hermann Hauser, believes it to be a bad idea, since Arm will most likely be unable to retain its neutrality as most of its licensees are competitors of Nvidia.

Nvidia told regulators in the UK, US, EU, and China that it is committed to maintaining Arm's open-licensing model and customer neutrality, but many of the companies that depend on that model aren't convinced. This includes Qualcomm, Microsoft, and Google, who have expressed their concerns to government authorities overseeing the acquisition. And others like Apple, Samsung, Intel, AMD, Amazon, NXP, MediaTek, and Huawei are also dependent on access to Arm's chip designs and software, which could get more expensive under Nvidia ownership.

According to a CNBC report, Qualcomm is the most adamant to see the acquisition blocked by regulators, as it believes it could lead to Nvidia gatekeeping important parts of Arm's intellectual property.

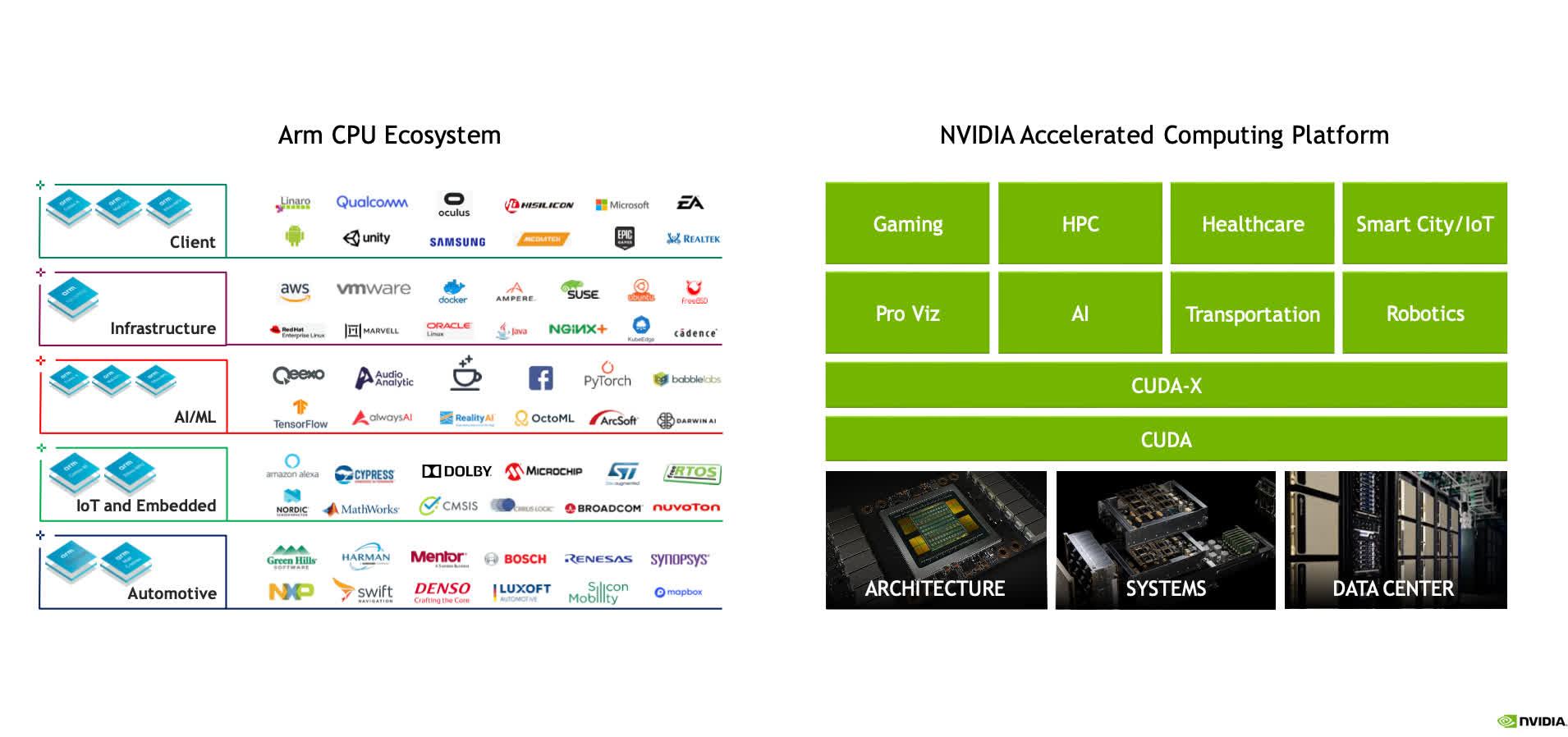

For years, Arm has been described as an "enabler of competition" thanks to its business model, which is unique in the hardware industry. The company's customers -- both big and small -- create a feedback loop that leads to continuous improvements of its chip designs and a healthy ecosystem of both standard and custom processors for a variety of applications.

Theoretically, Nvidia plans to build on that open-licensing model and add some of its own intellectual property and research and development capabilities into the mix. But more importantly, Nvidia is eyeing the "combined company's target addressable market," which it estimates at $250 billion by 2023. Essentially, it wants to dominate in pretty much every area of computing -- consumer, enterprise, and industrial.

The impact to Arm's 530 licensees could be huge, although Nvidia insists it would only help them grow their businesses. In its latest quarterly report, Arm revealed that its designs were materializing into around 842 chips per second by the end of last year, which should offer some perspective on the scale of its success. Regulators will need to go through a lengthy review process to ensure the acquisition won't affect competition, and opposition from several large tech companies spells trouble for Nvidia's ability to close the deal.

In the end, tech giants like Microsoft, Amazon, Google, and AMD are currently developing custom silicon based on Arm designs, and they don't want to see a repeat of the x86 situation where the market is closed to new entrants. This is even more important for startups, which are using free access to 75 percent of Arm's chip portfolio to spearhead hardware innovation.

https://www.techspot.com/news/88646-qualcomm-google-microsoft-arent-happy-about-nvidia-buying.html