If you thought T-Mobile was just a mobile carrier, the company wants you to think again now. Starting today, the cellular provider is now offering its own Money checking account. The catch? The accounts are exclusive to T-Mobile's mobile customers.

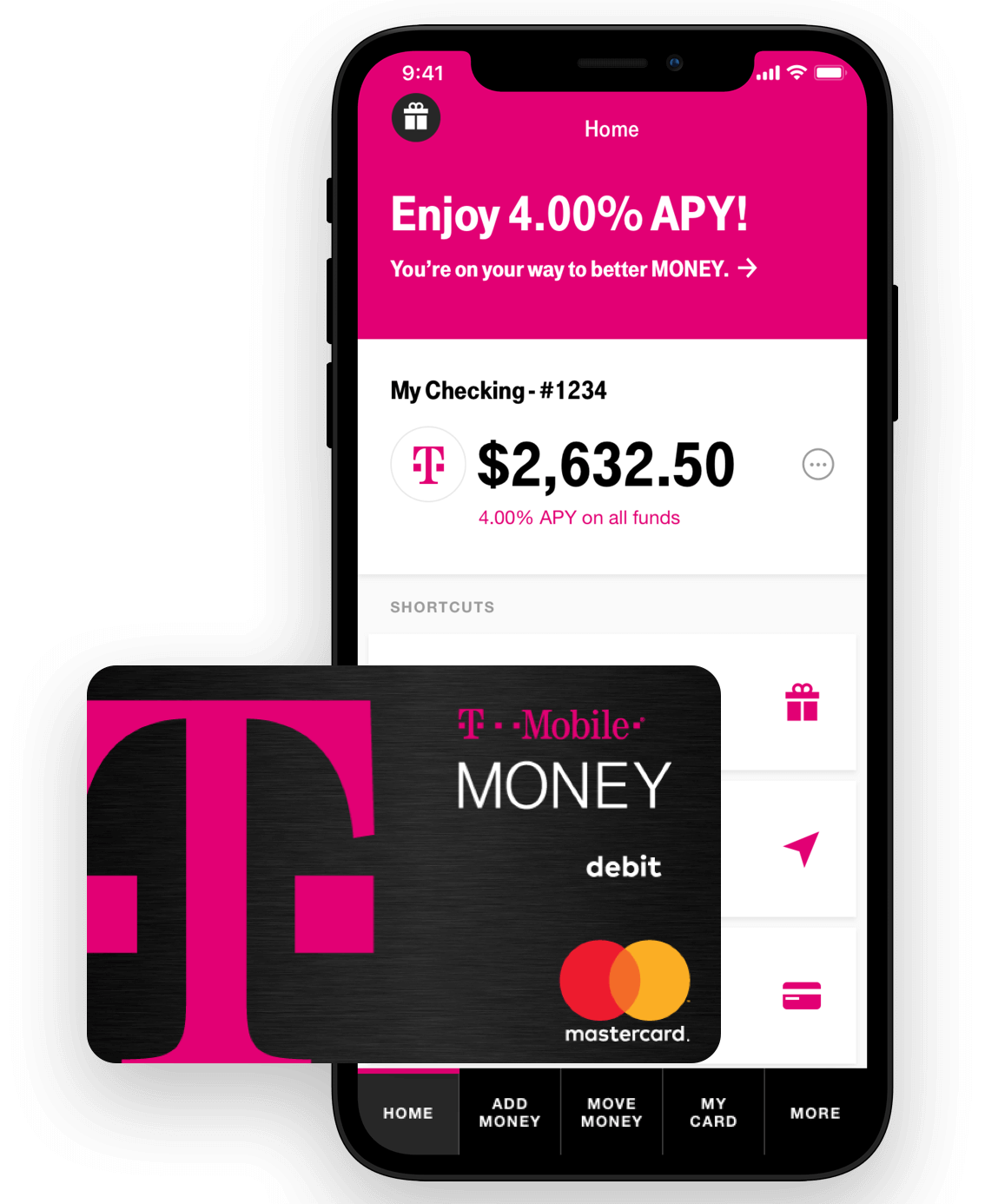

If you're wondering why you would want to sign up for a T-Mobile checking account to begin with, the company is hoping to sway you with an annual interest yield that's considerably higher than the national average at 4 percent.

However, that interest will only be available if you deposit a minimum of $200 per month into the account. That's a pretty standard requirement for most accounts of this nature, so it probably won't be an issue for most users.

There's a secondary limitation too, though: the 4 percent APY stops kicking in on balances above $3,000. Anything higher than that will reduce it to 1 percent.

Like many modern checking accounts, T-Mobile's Money accounts support most mobile payment services, like Google or Apple Pay. And, of course, you'll receive your own T-Mobile Money debit card, if you prefer to go the physical route for payments. Other perks of using T-Mobile Money include the lack of fees or minimum balance requirements, overdraft protection, FDIC insurance, and "24/7 customer support."

Unfortunately, there are two major drawbacks here, and they're the same problems you've probably faced if you've used other online-only banks in the past. First, depositing cash into your account will be a major nuisance (if not an impossibility in most cases), and withdrawing money will likely incur a fee unless you're fortunate enough to have an Allpoint ATM within easy driving distance (you can check here).

Still, if you can look past those issues and you already happen to be a T-Mobile customer, you don't have much to lose by giving their new Money account a shot. You can sign up for it right here.

https://www.techspot.com/news/79735-t-mobile-rolls-out-money-checking-account-all.html