The big picture: Job cuts in the tech industry last year were attributed to the need to economize, driven by inflation and a hiring spree during the pandemic. So, what's the explanation this year, especially when many of these firms have accumulated a significant amount of cash?

IT jobs are no longer the safe bet they once were. Since the start of the year, 209 tech companies have laid off 50,312 employees, according to Layoffs.fyi. Last year, a total of 1,191 tech companies gave 269,180 employees their walking papers.

These aren't just startups who are letting their workers go. Alphabet, Amazon, Cisco, eBay, Meta, Microsoft, SAP, and Unity Software have all downsized their staff in recent months and in sizable numbers. PayPal is yet another example: it announced in January that it planned to eliminate 2,500 jobs or nine percent of its workforce.

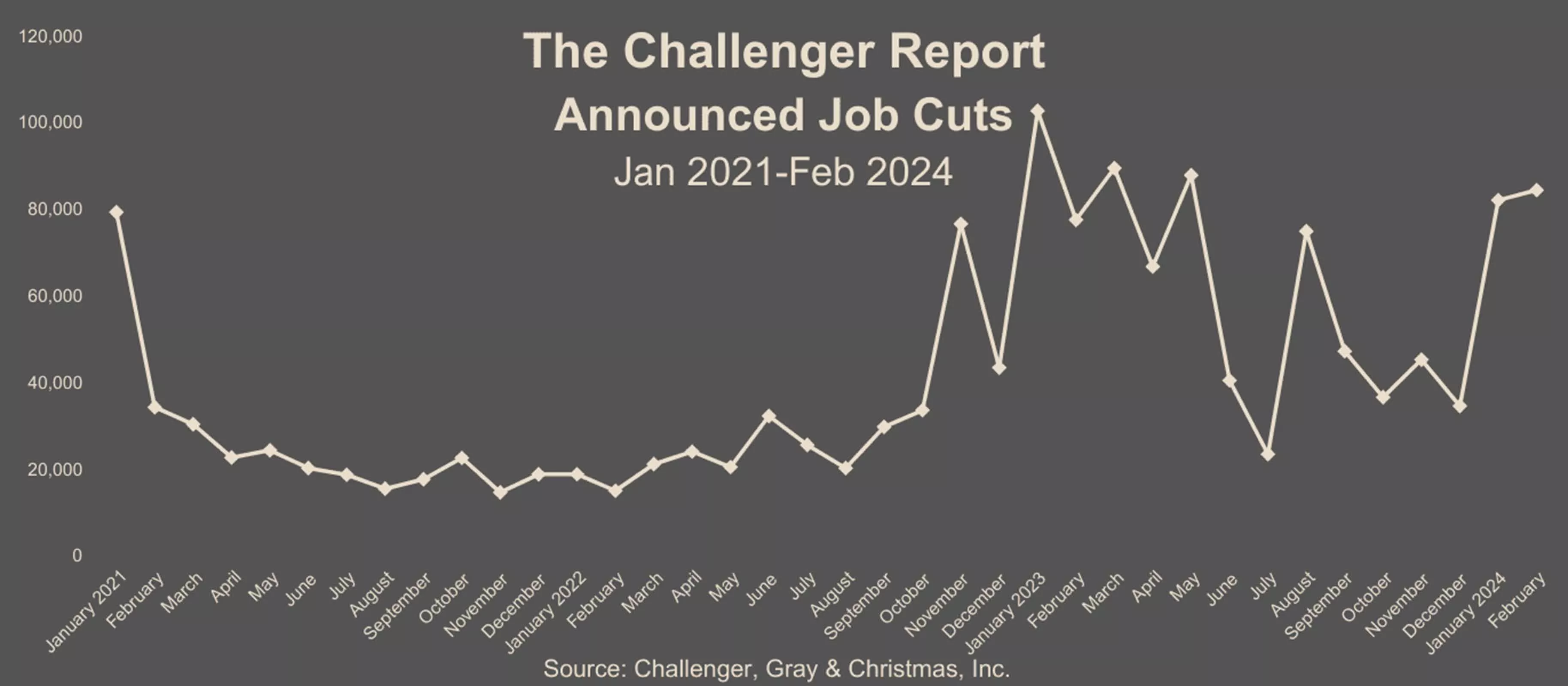

The carnage is so great that it is second only to the dot-com bust in 2001, according to Challenger, Gray & Christmas. Its latest report offers some faint relief to the sector as cuts in the sector from the January-February 2024 period have fallen 55 percent from the 63,216 cuts through February 2023.

Notably, the numbers don't perfectly align exactly with the calculations from Layoffs.fyi. The outplacement firm says that between January and February of 2024, some 28,218 cuts in tech have been made, and 12,412 occurred in February.

However you figure it, the numbers are bad for industry workers accustomed to being courted by multiple firms when job searching.

Now, many are finding the job search to be highly competitive, according to a series of interviews by CNBC. Roger Lee, creator of Layoffs.fyi, noted that many of these workers are either leaving tech entirely. "Even engineers are compromising – accepting roles with less stability, a tougher work environment, or lower pay and benefits," he said.

And the news gets worse for job seekers staying in tech. The once robust salary increases appear to be no more, as tech salaries have "largely stagnated" in the last two years, Lee said. This is not to say they don't pay well – relatively speaking – once a job is secured.

An entry-level person in the artificial intelligence field could earn anywhere from $109,500 to $138,500, according to Comprehensive.io, a compensation tracker Lee recently helped launch. On the other end of the spectrum, a senior director – someone who manages directors from various groups or is responsible for a business function – can pull down a salary that ranges between $178,500 to $310,050, according to the site.

The bottom line is the reason behind the cuts, but companies seem to have moved the goalposts this year. In 2023, tech firms claimed they needed to scale back after a hiring binge during the pandemic, and because of inflation and weak consumer demand. This year, inflation is markedly down, and many of these firms are profitable and cash flush.

Two words explain this year's trend: stock prices. Layoffs bolster shares "so these companies see no reason to stop," said Jeff Shulman, a professor at the University of Washington's Foster School of Business.

In fact, he called it the new normal. "They're getting away with it because everybody is doing it. Workers are more comfortable with it, stock investors are appreciating it, and so I think we'll see it continue for some time."

https://www.techspot.com/news/102289-tech-layoffs-becoming-new-normal.html