In context: Intel and AMD saw their revenues drop in recent months as demand for their PC and data center processors remains low. The two companies are optimistic about a gradual recovery towards the end of this year, even as they're both lacking exposure to the current AI boom. It all hinges on inventory corrections and the belief that consumer and enterprise spending will improve by the time the supply chain stabilizes.

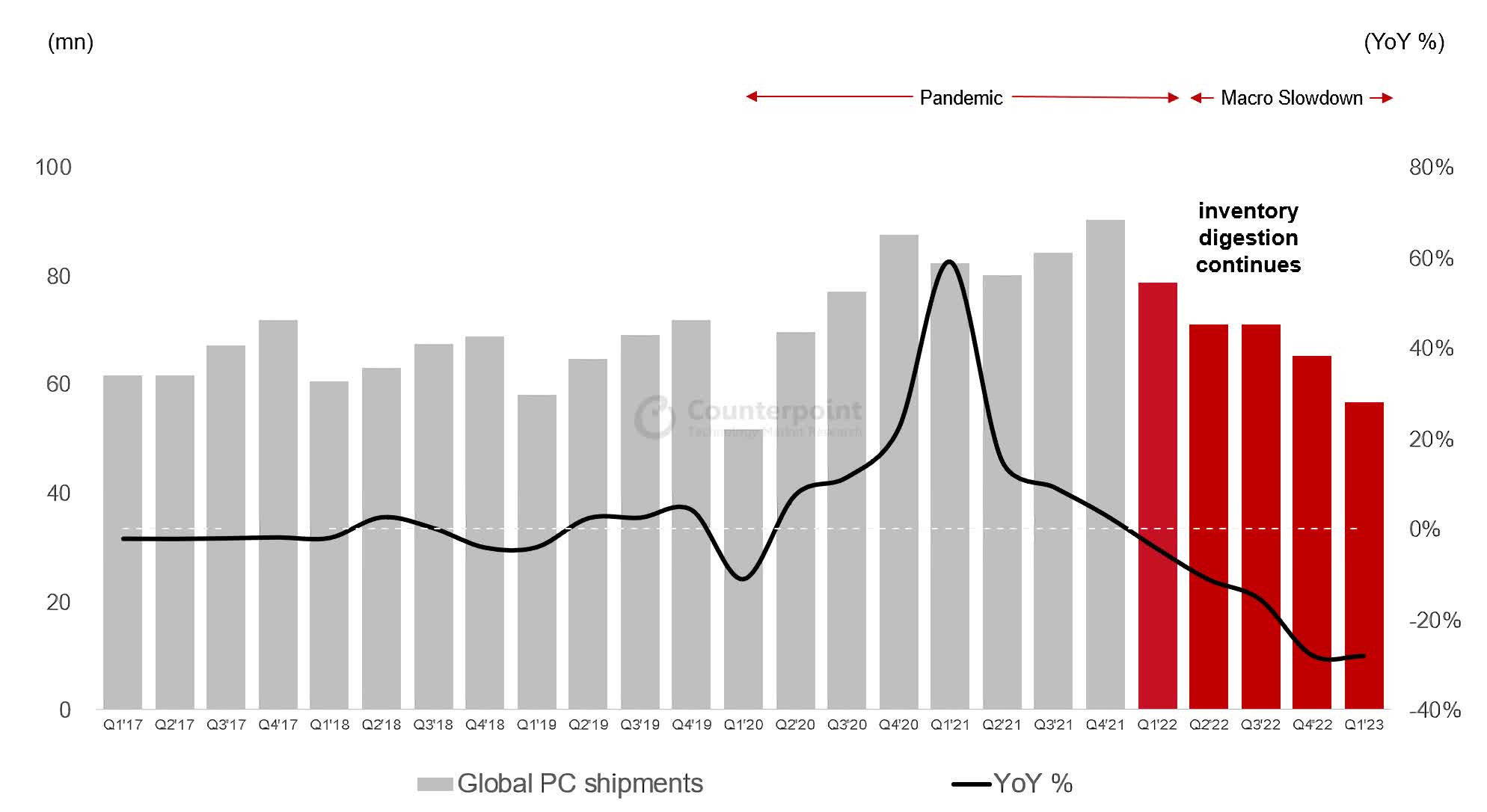

By now it's no secret the hardware industry has been struggling in recent months, mostly due to economic uncertainty and low demand for consumer electronics. People in need of a phone or PC upgrade are increasingly turning to refurbished and second-hand options, while new products gather dust on store shelves. Similarly, enterprise IT spending has seen a steady decline over the past several months, with the only products bucking the trend being data center GPUs and AI accelerators.

When in comes to CPU sales, the market decline has been so severe that Intel recently posted its biggest quarterly loss in company history. AMD, who has been eating a growing portion of Intel's lunch for the past two years, has fared better in comparison to Team Blue. Still, it too has seen a significant drop-off in processor sales in recent months, particularly when it comes to Zen 4 models.

However, analysts at Mercury Research and Counterpoint believe the market will gradually recover in the second half of this year as both Intel and AMD have been undershipping demand to help the PC market burn through existing inventory. For AMD, the decision to restrict supply was also matter of keeping CPU prices high for a while longer, as Team Red controls a rather modest 19.2 percent share of the desktop processor market and just 16.2 percent of the notebook CPU one.

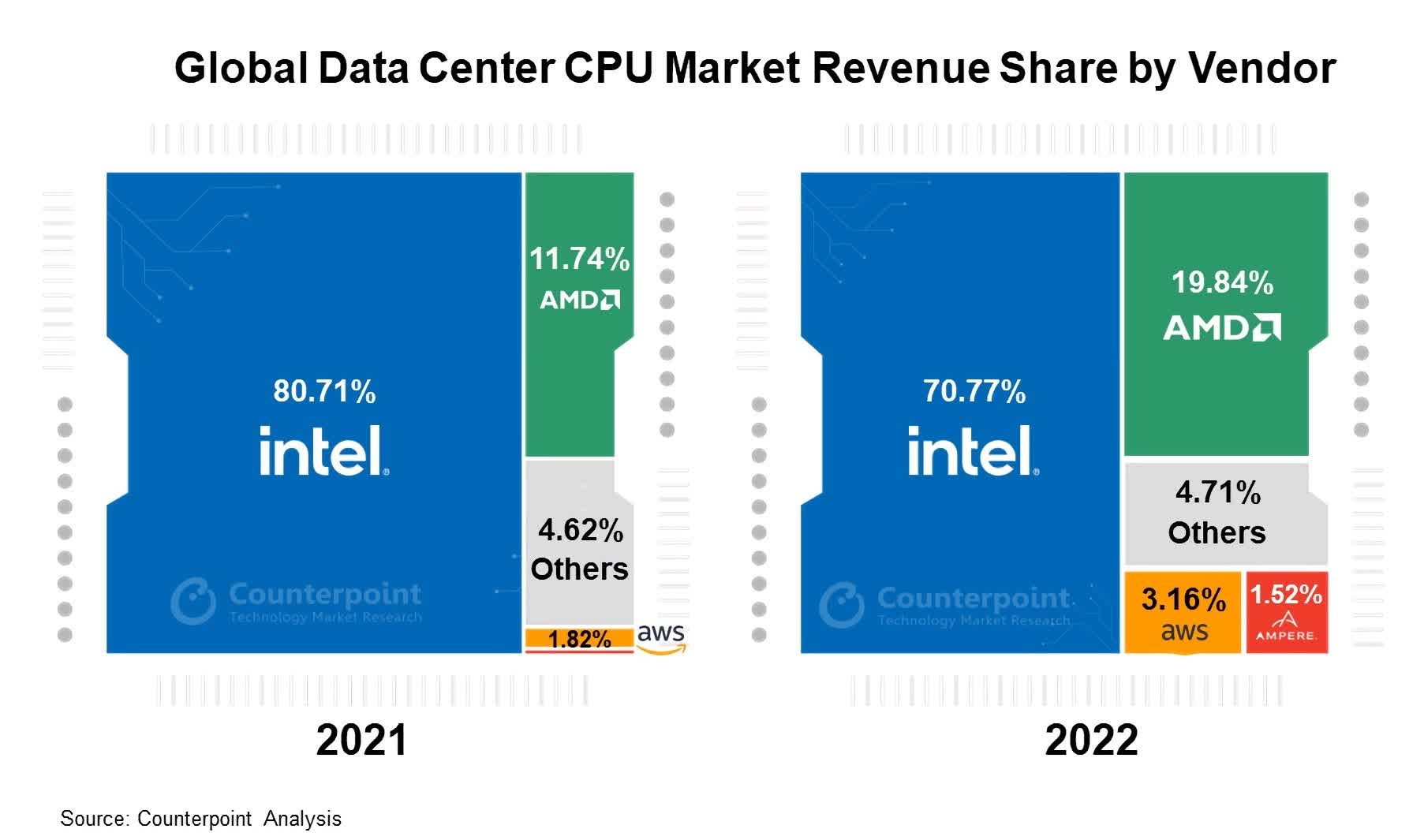

It's worth noting that firms like Mercury Research base their numbers on data from suppliers, meaning they don't accurately reflect what happens at retail. It's a similar story with server processors, where data from ODMs suggests AMD is still chipping away at Intel's market share, going from 11.6 percent in Q1 2022 to 18 percent in the first quarter of 2023.

Intel and AMD saw a sharp decline in their PC processor revenue in Q1 2023. Undershipped demand from last 4 quarters. Both will likely turn the corner in 2Q23 with sequential growth that will continue through 2023.

– Sravan Kundojjala (@SKundojjala) May 7, 2023

AMD: -65% y/y

Intel: -38% y/y $AMD $INTC pic.twitter.com/eF1FlImk7P

A separate report from semiconductor analyst Sravan Kundojjala based on Intel and AMD's financial reports paints a similar picture. When it comes to revenue share, Intel seems to have clawed back what it lost in the desktop and notebook markets in recent years, while AMD keeps making gains in the sever space.

Both companies face an increasing threat from Arm and RISC-V. Arm-based SoCs are expected to capture one quarter of the laptop market by 2027, and companies like Microsoft, Google, Amazon, and Facebook are all working on custom Arm-based silicon for their data center needs. Meanwhile, companies like Tencent and Alibaba have enlisted to help China develop homegrown chips and reduce the need for x86 and Arm products and insulate from the effects of US sanctions.

Masthead credit: David Latorre Romero