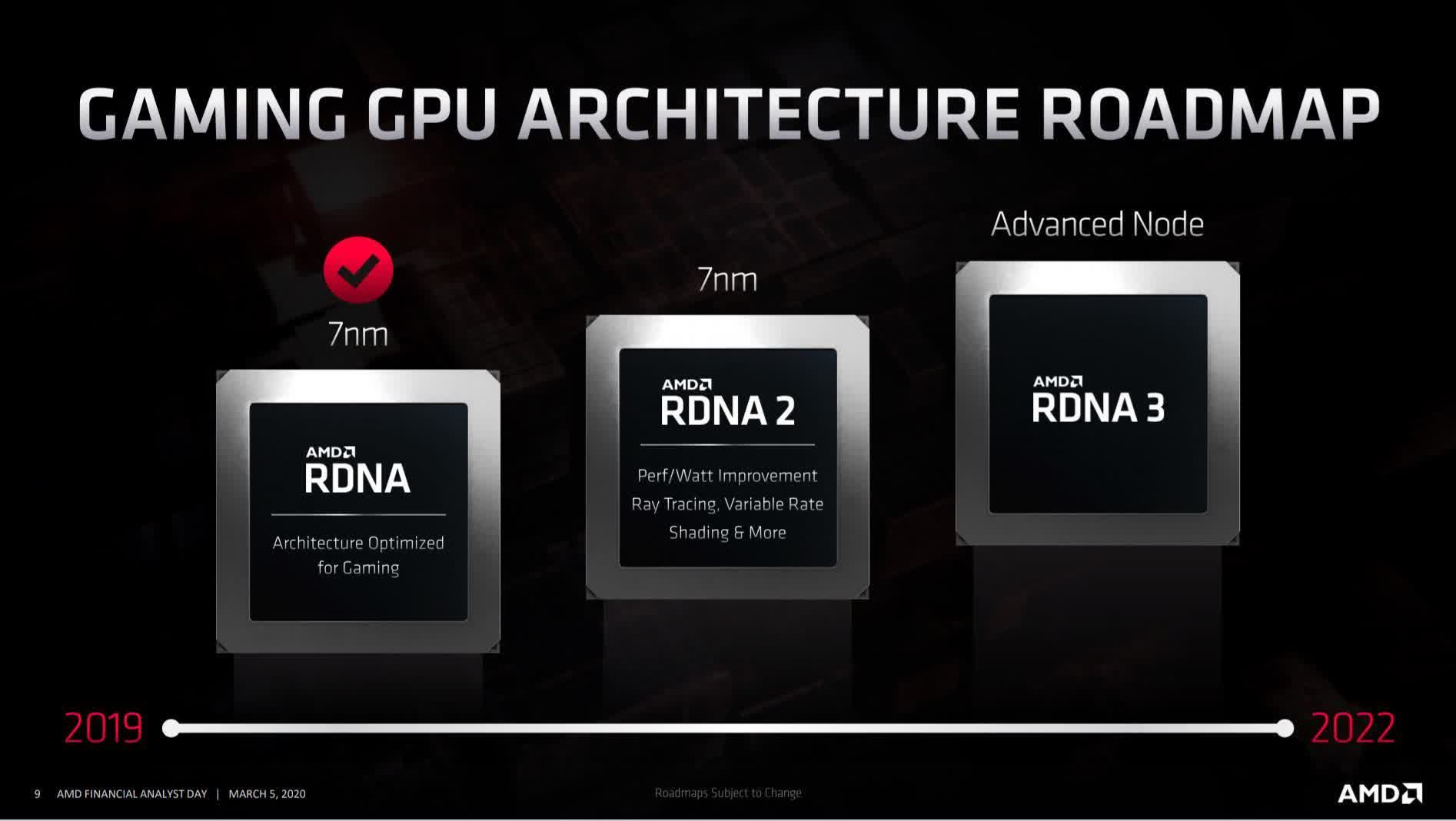

Forward-looking: Zen 3 might have only just arrived, and RDNA 2 is around the corner, but AMD is already looking toward the next generation of its GPU and CPU technologies—Zen 4 and RDNA 3—which it says will offer the same performance and efficiency gains seen in previous generational leaps.

Speaking in an interview with The Street, AMD Executive Vice President Rick Bergman said RDNA 3 would offer similar 50 percent performance-per-watt gains as its RDNA 2 predecessor.

"Let's step back and talk about the benefits of both. So why did we target, pretty aggressively, performance per watt [improvements for] our RDNA 2 [GPUs]. And then yes, we have the same commitment on RDNA 3," said Bergman.

"It just matters so much in many ways, because if your power is too high -- as we've seen from our competitors -- suddenly our potential users have to buy bigger power supplies, very advanced cooling solutions. And in a lot of ways, very importantly, it actually drives the [bill of materials] of the board up substantially. This is a desktop perspective. And invariably, that either means the retail price comes up, or your GPU cost has to come down. We focused on that for RDNA 2. It's a big focus on RDNA 3 as well."

It doesn't take Sherlock Holmes to know Bergman is taking a dig at Nvidia's RTX 30xx series and its high power demands. He also mentions the importance of AMD's Infinity Cache tech.

"On Infinity Cache, it's somewhat linked to that as well, to a certain degree. If you've been in graphics for a long time, you realize there's a pretty good correlation between memory bandwidth and performance. And so typically, the way you do it is you jack up your memory speed and widen your bus to open up performance. Unfortunately, both of those things drive up power," Bergman added.

The AMD exec said that Zen 4, which is expected to land sometime in 2022, will be another major overhaul of the company's architecture, with improvements in all areas, especially when it comes to instructions per clock (IPC). When asked if most of the gains will come from IPC improvements, rather than increased core counts or faster clock speeds, Bergman said:

"[Given] the maturity of the x86 architecture now, the answer has to be, kind of, all of the above. If you looked at our technical document on Zen 3, it was this long list of things that we did to get that 19% [IPC uplift]. Zen 4 is going to have a similar long list of things, where you look at everything from the caches, to the branch prediction, [to] the number of gates in the execution pipeline. Everything is scrutinized to squeeze more performance out."

In the area of manufacturing nodes, we already know that Zen 4 will use TSMC's 5nm process, which is also behind Apple's new M1 SoC found in the upcoming MacBook Air, MacBook Pro 13‑inch, and Mac mini. With RDNA 3, however, Bergman wasn't clear on whether it will shift from 7nm to 5nm.

"Certainly EUV is an option with that process, and there are no technical limitations holding us back. Nor are there huge technical benefits either. So that's more of a manufacturing question. There are additional nodes on 7nm that we'll take advantage of over time. But again, nothing to disclose," Bergman says.

Finally, speaking about the upcoming Radeon RX 6000-series cards, the first of which launch next week (November 18), Bergman said AMD was aiming for 1440p as the perfect resolution for a great ray tracing experience. "…that was kind of the performance level that we targeted. Now it depends on particular games and everybody's systems and so on, but I think you'll find that we have very good ray-tracing performance overall. And the game support will be strong as we go through 2021, because again, we get that great leverage. It's just built in: You support ray tracing on Microsoft or Sony [consoles], you're supporting AMD on the PC side as well."

https://www.techspot.com/news/87558-amd-looks-ahead-zen-4-rdna-3.html