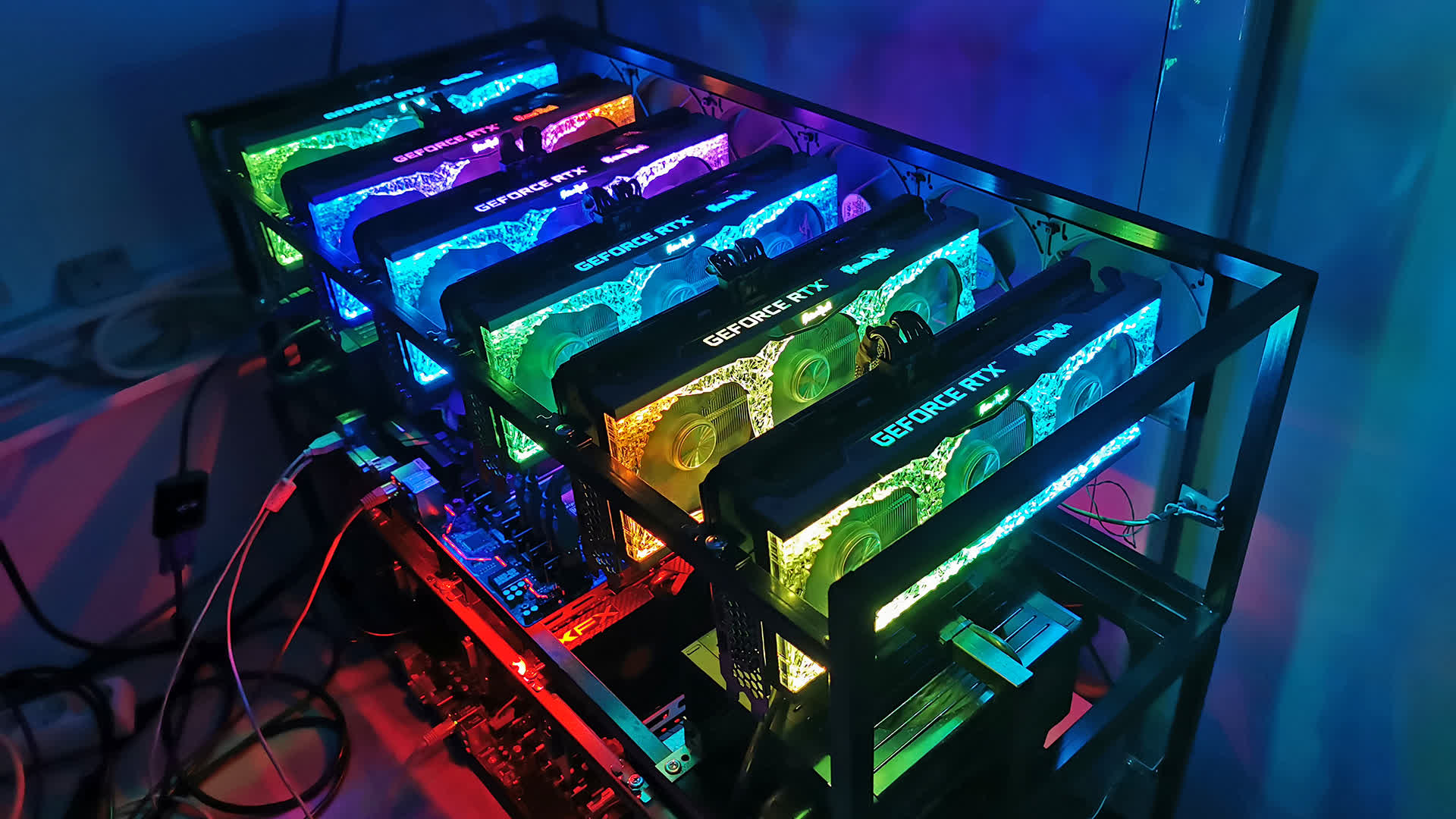

In context: Most people who wanted to buy a high-end graphics card last year had trouble acquiring one, and it doesn't look like that situation will improve anytime soon. Part of the reason why both new and second hand graphics cards are so hard to find or inexplicably overpriced is that cryptocurrency enthusiasts are snapping each and every model that can be used for mining purposes on coins that use a proof-of-work consensus algorithm to confirm transactions.

If you're looking to do some mining of your own, choosing the right hardware for the task won't be easy, and it's not just because of the GPU drought. Because of the way things work in the crypto mining space, blockchain developers introduce limitations for what you can use. The best mining GPUs need to backed up by enough VRAM, and gaming performance isn't necessarily a good indicator of mining performance. Power consumption is also a major concern, as it will directly impact how much profit you can make.

Before we take a look at the best graphics cards for mining, it should be noted that even as cryptocurrency prices have recently surged to record levels, their volatile nature makes it hard to predict what will happen in the near future. Chances are the current situation is just a repeat of what happened in 2011, 2014, and 2017, with a good probability that it will crash again. Cryptocurrency enthusiasts are used to the rollercoaster ride, but you may not be and as such it's best to temper your expectations.

We also know that not everyone is happy about the use of graphics cards to mine cryptocurrency, but the situation won't change much until at least 2022, when Ethereum's multi-phase transition from proof-of-work to proof-of-stake will be completed.

You can also think of it from a different perspective -- assuming a best case scenario, you have the possibility of recouping some or all of the cost of your graphics card and even make a small profit, by using it to mine when you're not using it for gaming.

Top performance: Nvidia RTX 3090

If you're looking for the absolute best mining hash rate per graphics card, Nvidia's Ampere architecture is a good place to look for it. In the case of the RTX 3090 graphics card, it happens to excel at both gaming performance and mining performance.

Mining on an RTX 3090 using the DaggerHashimoto algorithm (Ethereum mining) can yield around 120-125 MH per second, at an average power consumption of 285 watts, given some overclocking and voltage tuning.

Given the high price of the RTX 3090 that's further inflated by GPU drought and scalpers, breaking even on it may take between 237 and 278 days depending on the cost of electricity in your region (assuming $0.10 to $0.12 per kWh), and assuming the price of Ethereum doesn't dip below $1,900.

Time spent gaming on it will also eat into your potential profits, but this card will run most games out there at 4K, with the notable exception of Cyberpunk 2077, where even the magic of DLSS won't help it muster a smooth 60 frames per second at all times.

High performance: RTX 3080 and Radeon VII

Nvidia's RTX 3080 is a close second to the RTX 3090, with a hash rate of 95-100 MH per second. Again, this is what can be achieved with proper overclocking, voltage tuning, and cooling solution, and that will also depend on the silicon lottery. However, the typical power draw for that hash rate range is 220-250 watts.

Like the RTX 3090, the price is the highest disadvantage, as you would be hard pressed to find it at the MSRP of $699. Anywhere between 216 and 267 days of mining on it is what it would take to break even, but this will also make a quick profit once it reaches that point.

Some of you may not think much of the Radeon VII, and rightly so. This was AMD's second attempt at making the Vega architecture shine, and ended up underdelivering on its promise to be competitive with Nvidia's RTX 2080. But thanks to AMD's use of HBM2 memory, this is a great performer for mining Ethereum.

Careful tuning can yield 95-100 MH per second, at a power consumption of 190-200 watts. That said, the Radeon VII can be very hard to find, and eBay prices are currently hovering above $1,500.

Moderate performance: RX 6000 series, RX 5700 XT, RTX 3070, RTX 3060 Ti, RTX 3060, RTX 2080 Ti, RX Vega 64/56

AMD's Big Navi definitely doesn't disappoint when it comes to gaming performance as you've seen in our reviews of the Radeon RX 6800 and RX 6800 XT, with the RX 6900 XT being just a slightly beefed-up version of the latter. But for mining, its performance leaves some to be desired. AMD confirmed as much when they said had no plans to nerf the mining capabilities on its graphics cards, like Nvidia supposedly planned to do with some RTX 3000 series chips.

The most you can expect to get out of these cards is 60-65 MH per second with a power consumption of 160-190 watts. If you can get your hands on an RX 6800, that's the clear winner among the three in terms of price and energy efficiency, so it should yield the best mining results. Time to break even is around 180 to 236 days, assuming you can get your hands on one.

For people who are holding on to RX 5700 or RX 5700 XT, these two cards can achieve a respectable 50-56 MH per second, all with a power draw of 120-155 watts. They are certainly among the best GPUs in terms of hash rate per watt, while also being great performers in 1440p gaming.

The same can be said about Radeon Vega 64 and Vega 56, both of which can achieve a respectable 45-52 MH per second with proper tuning, which will mostly depend on how much you can overclock the HBM. Power consumption figures vary a lot with these GPUs as it will depend a lot on the silicon lottery, but typically they need 130-165 watts. Getting these cards second hand can cost more than they did at launch, but breaking even with mining on them can be done within 6 months, which makes them a less risky proposition given the volatility of crypto prices.

Nvidia's RTX 3070 and 3060 Ti are quite close in terms of both gaming and mining performance, with the latter also costing a bit less. When properly tuned, they can achieve around 60 MH per second with a power consumption of 120-130 watts. However, due to their inflated pricing, time to break even is anywhere from 225 to 242 days. These are among gamers' top choices for a gaming PC upgrade, so their availability may suffer more as a result.

The RTX 2080 Ti wasn't great value when it launched, and that hasn't changed. It was always a great 4K gaming card and it also manages to achieve a mining hash rate of 55-60 MH per second, at a power draw of 155-180 watts. Buying one at the moment requires an arm and a leg -- around $1,300 on eBay -- but you can break even on it in after mining for 180-190 days.

Honorable mentions: RTX 2070, RTX 2060 Super, GTX 1080 Ti, GTX 1060 6GB, RX 580/570/480 8GB

When looking at the most recent Steam hardware survey, we see the GeForce GTX 1060 is still powering a lot of gaming rigs out there. If you happen to have the 6GB version, you can achieve a modest, but still respectable hash rate of 25 MH per second, with a relatively low power draw of 90-100 watts. The same can be said about AMD's Radeon RX 580, RX 570, and RX 480 graphics cards -- we're talking about the 8 GB variants, of course.

Even with inflated pricing, these graphics cards allow you to break even in 4 to 5 months. It's also worth looking at the Nvidia GTX 1660 Super, which can achieve a hash rate of 26-32 MH per second at a power draw of 70-90 watts.

Better yet, AMD's Radeon RX 5600 XT can reach as high as 42 MH per second while drawing 105-115 watts. These are great 1080p gaming cards, and assuming you can find them at around $300-350, they might pay for themselves in 5 months of mining.

The RTX 2070 Super, RTX 2070, RTX 2060 Super, and GTX 1080 Ti can all achieve around the same hash rate of 40-43 MH per second. However, the 1080 Ti will draw close to 200 watts, while the other cards will draw around 110-130 watts, which is no small difference. They're grossly overpriced at over $700 on eBay, but they're capable of 1440p gaming, and it would take 6 months to recoup their cost with mining.

https://www.techspot.com/news/89151-best-mining-gpus-2021-optimist-guide.html