In context: It appears that China's crackdown on crypto mining hasn't been as effective as its government hoped. The country's share of global Bitcoin mining operations has jumped from zero to almost a quarter, putting it behind only the US as the world's top BTC-mining nation.

In October last year, the US surpassed China for the first time to become the global crypto mining leader. The Asian nation had spent months clamping down even harder on cryptocurrencies and even declared all transactions using the virtual currency illegal.

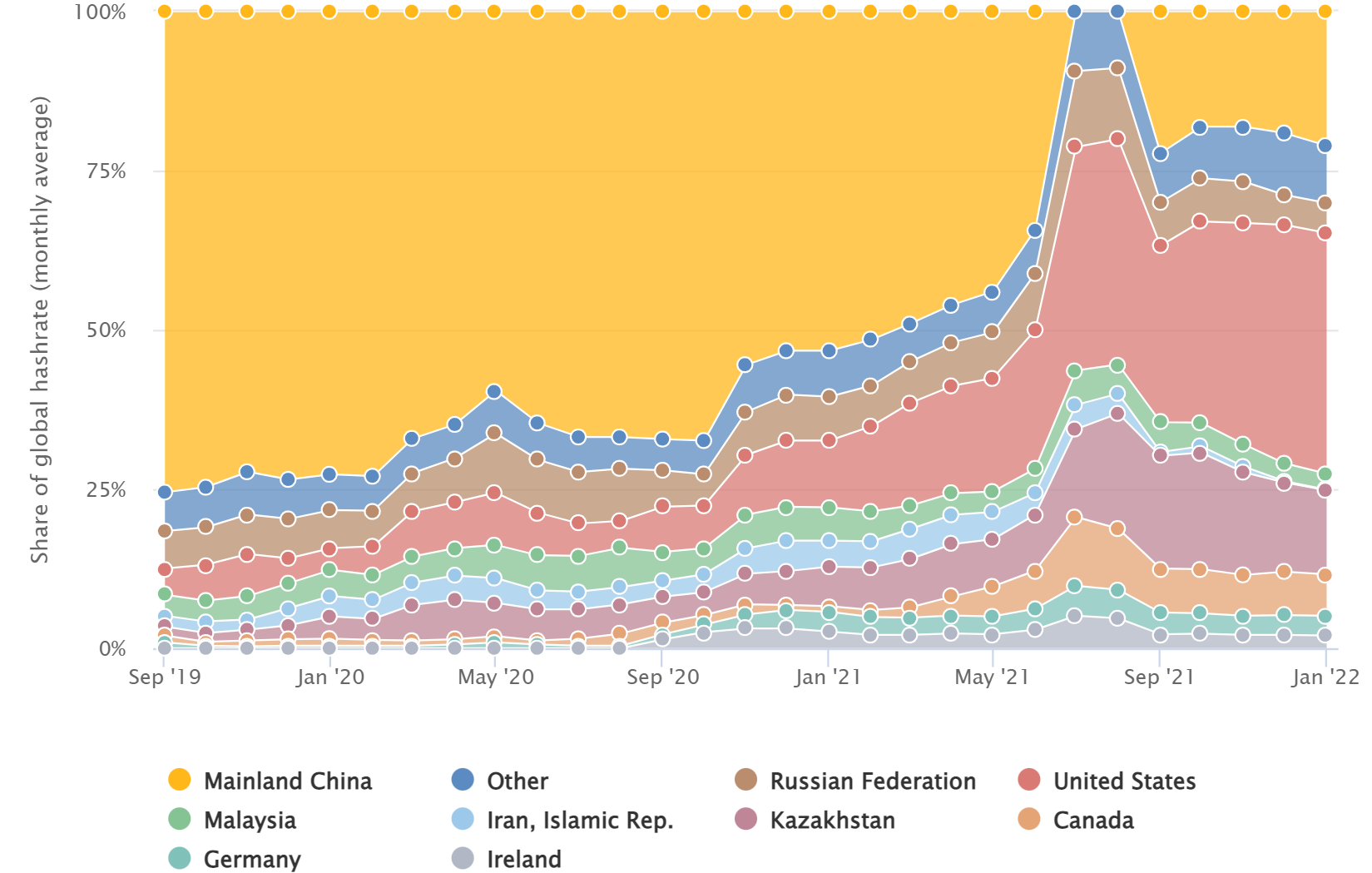

China's tightening grip on the industry saw its share of the global Bitcoin hashrate fall from 75% in September 2019 to zero. But the latest Cambridge Centre for Alternative Finance (CCAF) report shows a resurgence in the country between September 2021 and January—it now stands at 21.1%, second only to the United States' 37.8%.

The CCAF writes that China's rise is down to covert mining operations. "Access to off-grid electricity and geographically scattered small-scale operations are among the major means used by underground miners to hide their operations from authorities and circumvent the ban," the organization said in a statement.

The figures are based on aggregated geolocational data reported by partnering mining pools. As many miners in China are likely hiding their locations using foreign proxy services such as VPNs, the country's share of the global Bitcoin hashrate could be even higher than the report suggests.

It seems China's temporary decline was a result of miners going underground. "It takes time to find existing or build new non-traceable hosting facilities at that scale," the CCAF said. "It is probable that a non-trivial share of Chinese miners quickly adapted to the new circumstances and continued operating covertly while hiding their tracks using foreign proxy services to deflect attention and scrutiny."

"As the ban has set in and time has passed, it appears that underground miners have grown more confident and seem content with the protection offered by local proxy services," the center added.

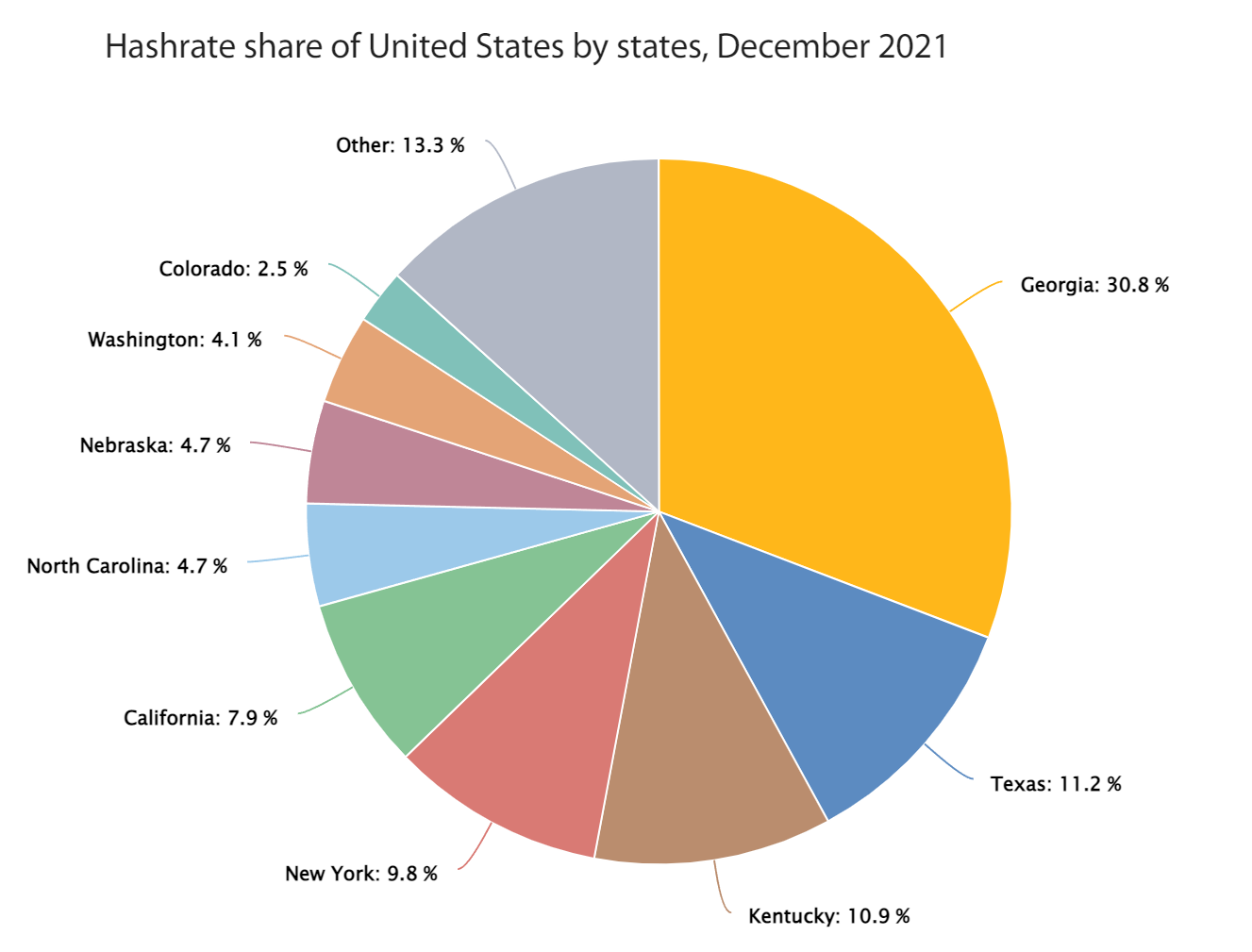

Sitting behind China on the global hashrate list is Kazakhstan with 13.22%, followed by Canada and its 6.48% share. As for individual US states, Georgia is the hashrate leader with 30.8%, followed by Texas and Kentucky.

https://www.techspot.com/news/94620-bitcoin-mining-bounces-back-china-country-takes-second.html