Facepalm: If it's too good to be true, it probably is. MoviePass will likely go down in history as a lesson of how not to do things although with any luck, perhaps we'll get some viable new subscription models that benefit both the consumer and the theater industry.

MoviePass parent company Helios and Matheson Analytics has posted an operating loss of $126.6 million for the quarter ending June 30, 2018. In the same quarter a year ago (just before MoviePass’ subscription price was slashed to an unbelievable $9.95 per month), the company posted an operating loss of just $2.7 million.

Net loss for the quarter was $63.3 million.

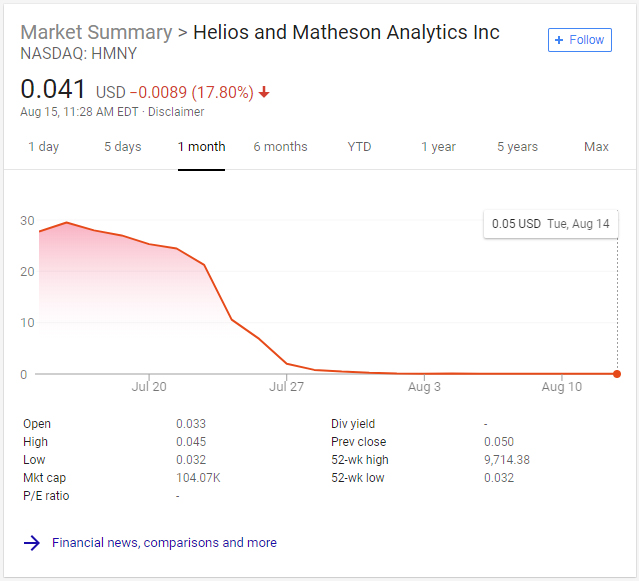

Share values in Helios and Matheson are in the dumps (and have been for a few weeks now). As of writing, shares are trading at a paltry $0.04 each.

MoviePass garnered tons of attention when it dropped its subscription rate to $9.95 per month last summer. Critics said the business model was unsustainable and, well, that’s exactly what we’ve seen as of late. The company had to take out an emergency loan last month just to keep the service up and running and it’s clear that recent changes like limiting subscribers to three movies a month and blacking out some first-run flicks wasn’t very popular.

Earlier this week, reports surfaced that MoviePass was using slimy tactics to get former members to unknowingly re-subscribe to the service and not letting them cancel again.

Shareholders are fed up with the company's actions and have filed a lawsuit against CEO Ted Farnsworth and CFO Stuart Benson, accusing them of defrauding shareholders by presenting misleading financial information.

"Defendants carried out a plan, scheme and course of conduct which was intended to and did, deceive the investing public and cause the plaintiff and other members of the class to purchase Helios common stock at artificially inflated prices," the suit reads.

Quite frankly, I’ll be surprised if MoviePass survives the current quarter.

https://www.techspot.com/news/75980-moviepass-owner-posts-massive-loss-investors-file-suit.html